Stocks have been weak lately, with the Dow recently down eight days in a row and the Russell 1000 Value Index also down 11 days in a row. In fact, the S&P 500 had more stocks down than up for 11 days in a row, the most since 1996.

Some of this weakness has been masked by strength in communication services and consumer discretionary. Just last week the Nasdaq hit 20,000 for the first time ever and only two weeks ago we were talking about the Dow at 45,000 and hitting a record eight 1,000-point milestone levels in 2024. So are things really that bad? I don’t think so.

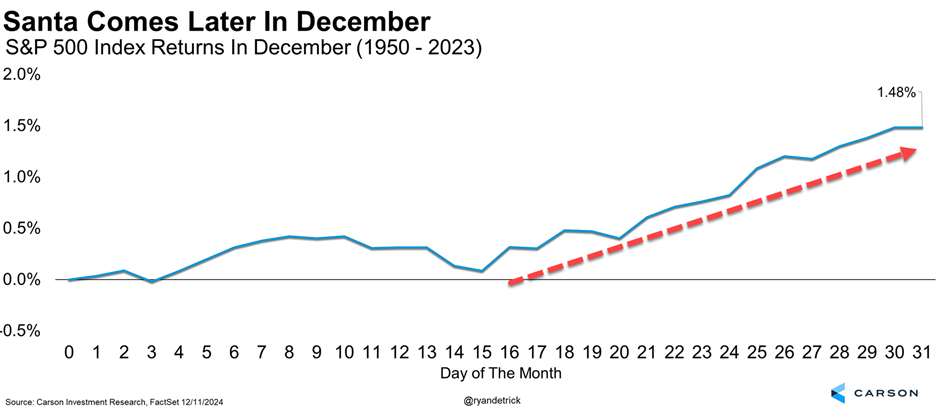

After the huge run stocks have seen this year, we aren’t overly surprised that the second week of December has seen some weakness overall. After all, this is what tends to happen in the early part of December, but there is more of the month to come and things tend to look different in December’s second half.

Here’s a nice chart that shows the second week in December tends to be a historically weak time for stocks, with nearly all of December’s gains occurring in the month’s second half. Should you still believe in Santa? We think so and continue to expect a potential year-end rally and more new highs before 2024 is officially in the books.

Eight Other Reasons to Believe

The S&P 500 is up only slightly on the month in December, but here are some other reasons we expect an end of year rally:

- No month is more likely to be higher than December (74.3% of the time).

- No month in an election year is more likely to be higher (83.3% of the time).

- When the S&P 500 has been up double digits at the midpoint of an election year (like 2024), December has never been lower.

- The Fed is expected to cut rates this Wednesday, which will be the last big event of the year, opening the door for little news the next two weeks. Remember, stocks tend to do well in the absence of news and this is why strength around holidays tends to occur.

- Only once has December been the worst month of the year for the S&P 500 (2018).

- There are signs stocks are oversold and in many cases near oversold levels that marked lows earlier this year.

- The past 10 election years saw the S&P 500 gain in December nine times.

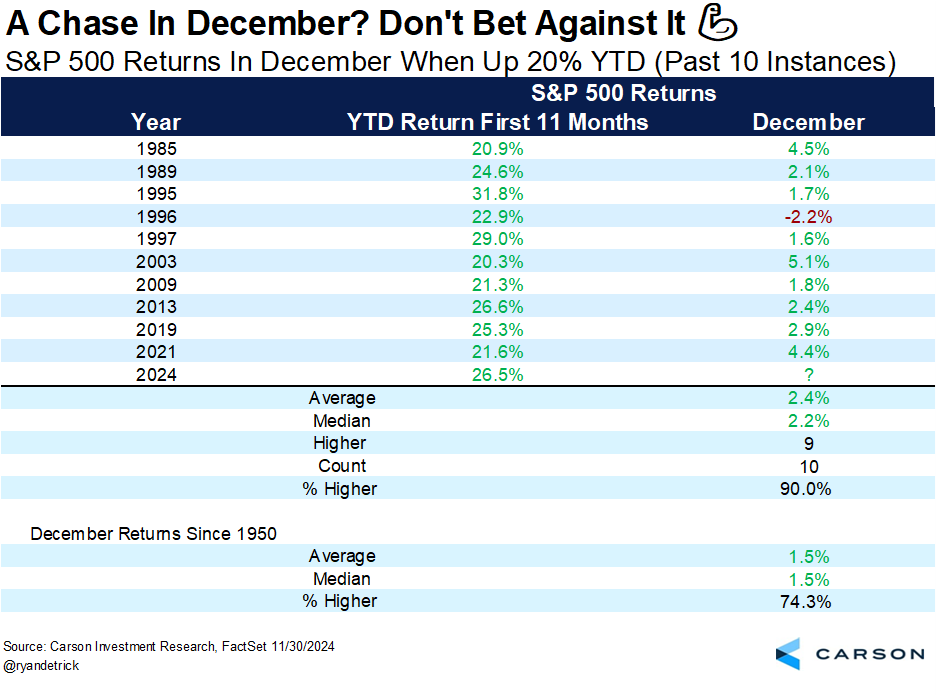

- Lastly, when stocks were up 20% or more going into December the final month has been higher nine of the past 10 times.

How do we sum it all up? Don’t stop believing in a Santa rally just yet.

For more content by Ryan Detrick, Chief Market Strategist click here.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

02555741-1224-A