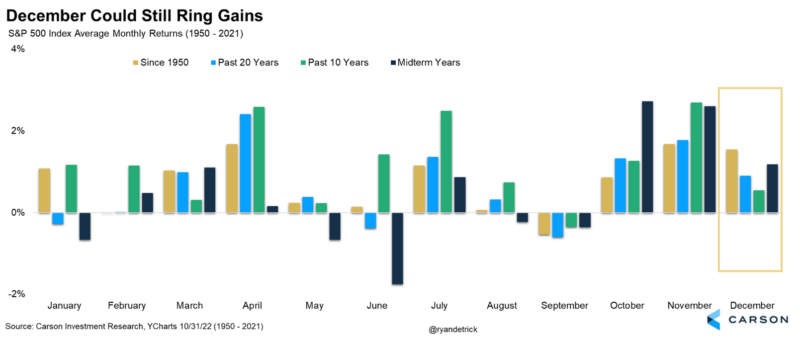

As we noted on the blog last week, December is historically a strong month for stocks, and we don’t expect 2022 to be any different. It is historically the third-best month for the S&P 500 since 1950 (April and November are stronger) and third-best during a midterm year (with October and November better).

Here are some of the major takeaways from that blog:

- When stocks are down for the year heading into this month, December has been higher eight of the past nine times.

- Stocks have finished green in December for the past three years, the longest such streak since six in a row from 2008 to 2013.

- Midterm years have been worse lately, down a record 9.1% last time (in 2018) but also down in 2014. At least we’ve never seen stocks down three Decembers in a row during midterm years.

- When stocks are up in both October and November (which could be the case this year as long as we don’t see a massive drop today), the S&P 500 doesn’t do quite as well in December, up 0.75% on average compared with the average December return of 1.54%, suggesting the prior months could be taking some of December’s historical strength.

- Lastly, only once in history has December been the worst month of the year for the S&P 500. That was in 2018 when the Fed hiked rates one more time, and it caused massive selling, but this month is usually quite calm, and big drops are rare.

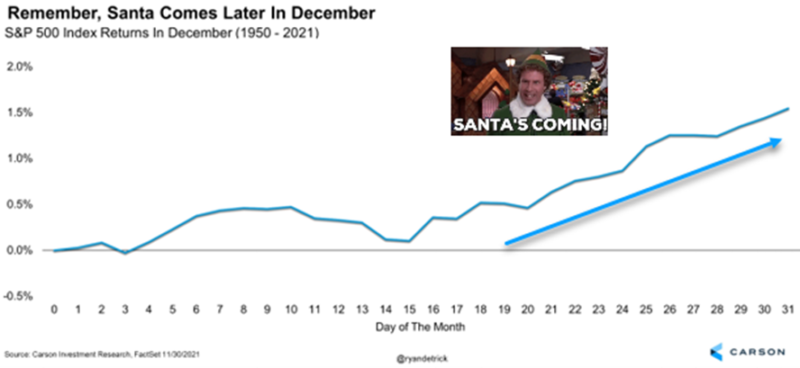

Taking things a step further, though, when does Santa come to town? One of the most well-known investment axioms is the “Santa Claus Rally,” and most investors assume it just means that stocks do well all of December, but this isn’t the case. It turns out that most of the strength in December happens in the latter half of the month. It makes sense to me, given that this is when Santa comes.

After the huge rally stocks have seen since the mid-October lows, some consolidation during this time of year would be perfectly normal. But after stocks catch their breath, we think a solid year-end rally is possible in 2022.

For more on the Santa Claus rally, be sure to read what our friends at Investopedia have to say about it here.