“Plans are useless, but planning is everything.” President Dwight D. Eisenhower

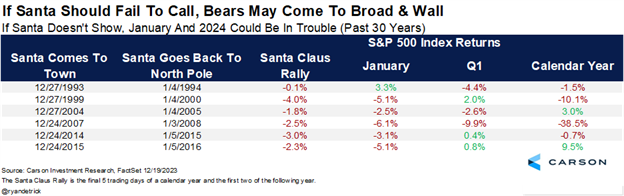

First things first, stocks fell during the historically bullish Santa Claus Rally (SCR) period. You can read all about the SCR in Here Comes The Santa Claus Rally. The absence of an SCR may be a minor warning sign stocks are due for a break. But seriously, after a nine-week win streak for the S&P 500 (longest since 2004), some weakness shouldn’t be overly surprising.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Nonetheless, looking at the past six times Santa didn’t come (going back 30 years), January has been lower the past five in a row and the first quarter was higher only three times, with modest returns overall. I’d like to stress this isn’t an end-of-the-world signal, but we shouldn’t ignore the clues markets give us when ‘stocks don’t go up when they should.’

We remain optimistic stocks will do well this year, but maybe stocks are due for a break?

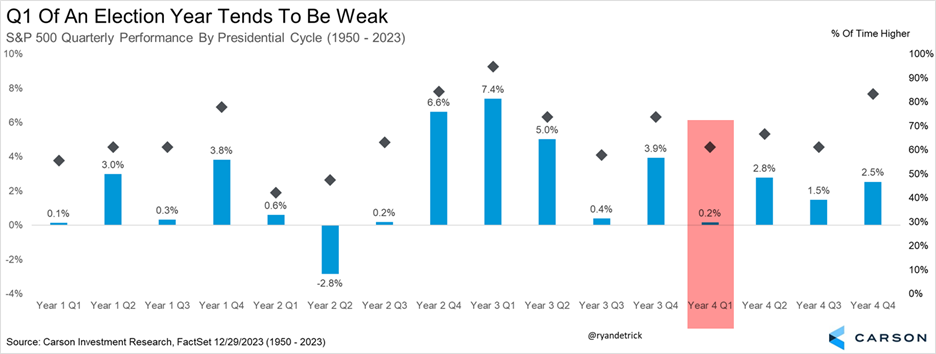

Here’s a chart I shared many times last year. It shows how stocks do on average each quarter of the four-year Presidential cycle. Sure enough, this cycle stocks rallied big time at the end of the mid-term year (2022) and then the first half of the pre-election year (2023), saw a break in Q3 of the pre-election year, before rallying hard to end the pre-election year. Now as we move into an election year, take note that Q1 tends to be a weak part of the calendar. The good news is the rest of an election year tends to be strong.

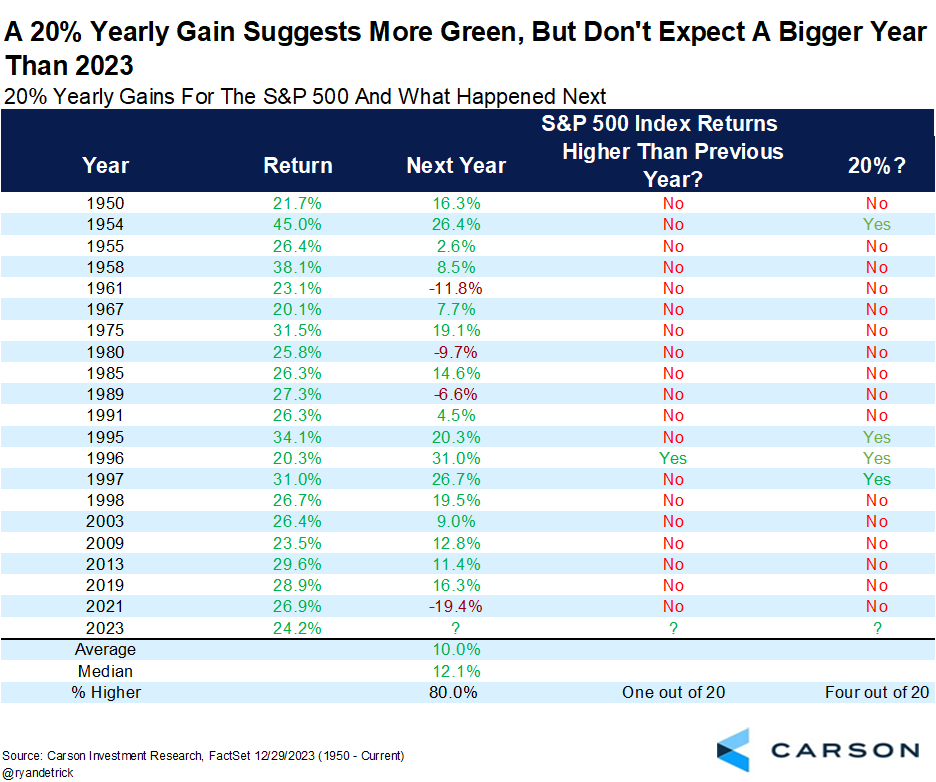

I’ve heard a lot from people asking how stocks could possibly do well in 2024 after their huge year in 2023. Well, we don’t officially release our Outlook for ’24 until next week, but I’ll just give a little bit away now. We still think this bull market has plenty of life left in it.

What happens after a 20% year you ask?

- I found there were 20 previous times the S&P 500 gained at least 20% and it was higher the following year 16 times (80%) and up a very solid median return of 12.1%.

- Last time we saw a 20% gain (’21) stocks moved into a bear market the next year (’22), but the nine years before that (and 10 of the last 11) saw gains after a 20% year.

- It would be extremely rare for stocks to actually gain more in ’24 than they did in ’23, as only once in history (’97) did the S&P 500 follow up a year that was up more than 20% with a bigger gain.

- Lastly, another 20% gain is possible, as it happened four previous years.

The bottom line is a big up year by itself isn’t a reason to become bearish, as history says it is likely to see continued strong gains.

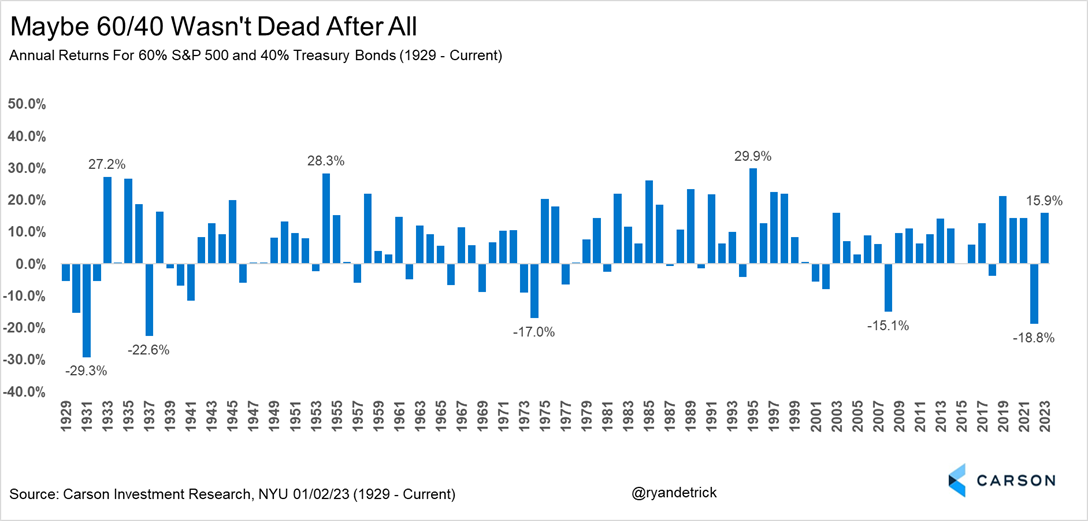

I will leave you with two charts that I think are must-knows for investors as we start the new year. First off, a balanced portfolio (60% stocks and 40% bonds) had a historically bad year in ’22, but came roaring back last year. We are optimistic that both stock and bonds should do well this year, but you’ll have to wait one more week to get our official targets.

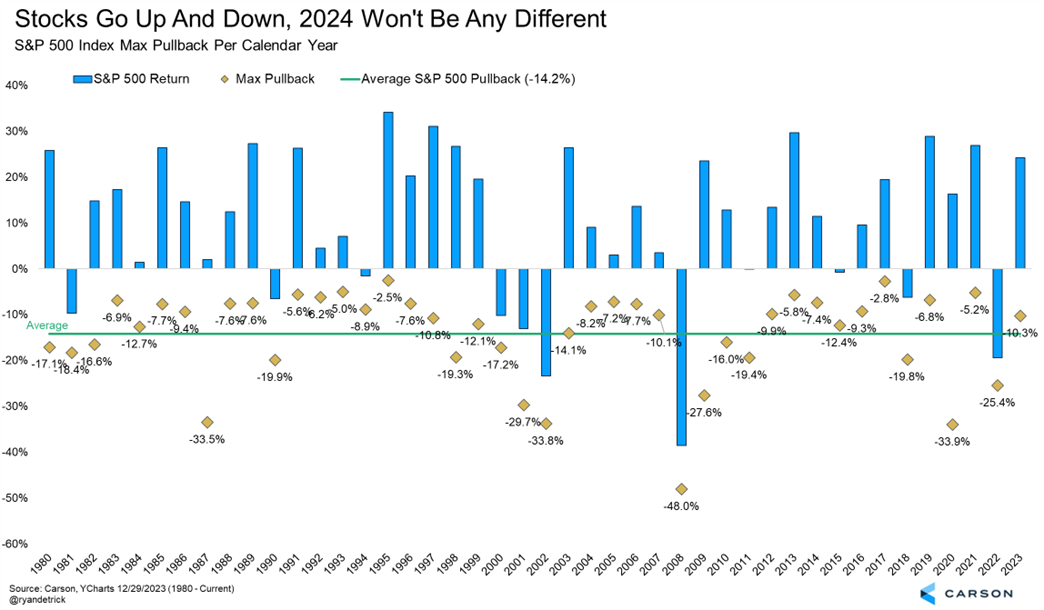

Lastly, on average stocks have seen a 14.2% peak-to-trough correction during a calendar year since 1980. Even last year, as great as it was, saw a 10.3% correction into late October. In fact, a lot of really good years have seen some scary pullbacks amid alarming headlines, so as the quote above stresses, start planning now for when you see red on the screen. Will you panic? Or use it as an opportunity?

For our latest views on the end of year rally, why this economic recovery is actually closer to early cycle, and if Die Hard is a Christmas movie, please be sure to listen to (or watch below) our latest Facts vs. Feelings podcast.

For more of Ryan’s thoughts click here.

02050254-0124-A