“The greatest danger for most of us is not that our aim is too high and we miss it, but that it is too low and we reach it.” Michelangelo

What a wild ride 2025 has been and it is only halfway over! After being down nearly 20% at the lows in April, stocks have staged one of the largest reversals ever and on Friday moved back to new highs for the first time since February 19.

We’ve been pounding the table since late April that a big rally was likely, but even we’ve been surprised at how quickly new highs are here, but we aren’t complaining. Many have what we call a fear of heights when it comes to new highs. New highs are one of those things that might seem scary but aren’t nearly as scary in reality. Kind of like getting blood drawn. I hate it and get all worked up, then it is quickly over and I wonder why I was so worried. 😱

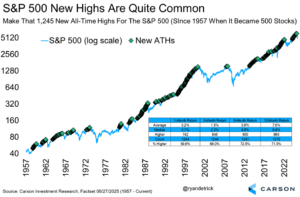

Friday marked the 1,245th new all-time high for the S&P 500 since 1957 (when it became 500 stocks). This means there’s a new high about 7.2% of all days or once every 14 trading days. That is pretty much a new high every three weeks, give or take, and they tend to come in rough clusters that can last years or even decades.

In other words, there are always worries out there and reasons to be fearful, but new highs just aren’t one of them. As we show below, new highs happen way more than you probably realize and they are perfectly normal. Yes, someday we will see a major peak in stocks and it’ll be the last new high for a long while, but the good news is we don’t think that day is today.

Historically, July Is a Strong Month

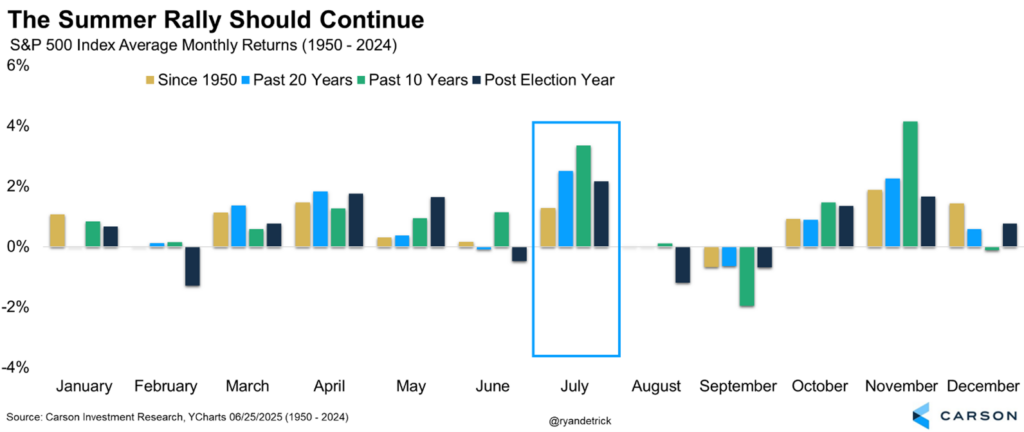

After gaining nearly 6% in May, for the best May since 1990, the S&P 500 is following it up with a very solid June (with one day to go the index is up more than 4%). The good news is July tends to be a very strong month for stocks and we don’t think this year will be any different, as this surprise summer rally continues.

In fact, July is the very best month of the year in a post-election year, the second best the past 10 years, and again the best over the past 20 years.

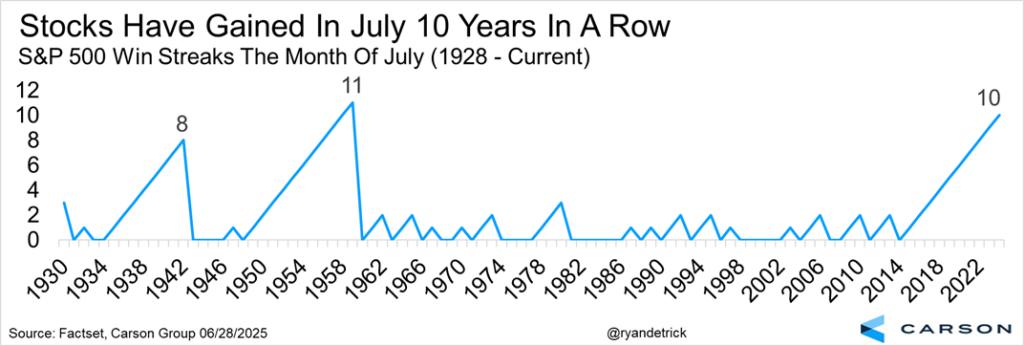

Adding to the fun, July has been higher an incredible 10 years in a row, only one away from tying the longest July win streak ever from the ‘40s and ‘50s.

What About the Rest of the Year?

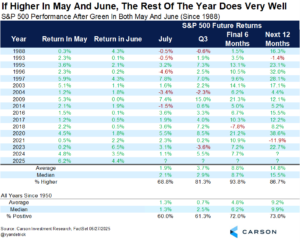

What caught our attention is the month of June historically hasn’t been very strong, but neither has May for that matter. So what has happened when both of these historically weak months are in the green (like 2025)? The answer is good things for the bulls.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

July actually does better when May and June are higher, but it is the final six months that really stand out, as these months have finished higher an incredible 15 out of the past 16 times and up nearly 9% on average (in half a year). The bottom line, we see reasons to expect this bull market to continue and the strength the last two months only further confirms this.

Thank you for reading and we want to wish everyone a happy and safe July 4th holiday week!

8121518.1.-07.01.25A

For more content by Ryan Detrick, Chief Market Strategist click here