Investors in tech stocks are walking away from this earnings season with a smile. The five major tech companies all saw a positive revision to their full year earnings estimates, according to FactSet data, and each has seen its share price rise since the start of this reporting season. Forward-looking commentary also supports a potentially bright future for these companies through the end of the year. These robust results help explain the relative outperformance of tech stocks compared to the broader market.

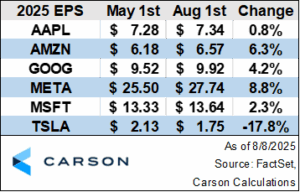

The five major tech companies to have reported in this earnings season all saw their earnings per share estimates increase. According to FactSet consensus estimates, Apple saw the smallest increase in expected earnings, with the company’s full year estimate only rising 0.8% since last earnings season concluded. Meta led the pack this reporting season with its earnings estimate increasing by a notable 8.8%. As the table below shows, the average of the five companies (excluding Tesla) saw an increase of 4.5% to their 2025 earnings estimates.

What should be further encouraging for investors in these companies is the positive reaction of stock prices to these robust results. As of July 15—before any of these companies had reported—the group’s average price change since the end of June was just +0.6%, per FactSet. By midday on August 8, their average gain since the end of June had surged to +6.5%. Clearly, investors rewarded these robust results by buying into the sector.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Forward-looking commentary from executives of these companies suggest that future results may continue to show strong underlying fundamentals. In specific, Microsoft can’t acquire data centers quickly enough. Microsoft CFO, Amy Hood, remarked on the company’s earnings call that “While we brought additional data center capacity online, demand remains higher than supply…In January, I thought we’d be in better supply/demand shape by June. And now I’m saying I hope I’m in better shape by December.” The magnitude and duration of AI-driven growth is exceeding even Microsoft’s own expectations.

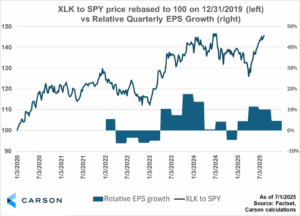

This fundamental strength is also showing up in relative price performance. As the chart below shows, XLK often outperforms SPY in advance of relative earnings strength. Investors have reversed course from earlier in the year, with recent outperformance of tech stocks pushing this ratio to be within a stone’s throw of all-time highs. Specifically, this ratio is only 0.7% away from record highs (FactSet data). A less than 1% further move higher in this ratio would make tech stocks “the most loved they’ve ever been”… again.

The main takeaways from this technology earnings season are that AI-driven growth is outpacing the expectations of both Wall Street and the companies themselves. The five largest players saw positive earnings revisions. Commentary from executives at cloud computing companies suggest demand for their data centers is exceeding prior expectations. Many industry leaders are trading near record highs. And tech’s performance relative to the broader market is also flirting with records. Tech investors are likely to exit this earnings season feeling exceptional.

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here

8268521.1.-08.11.25A