Forward earnings growth forecasts are a lagging indicator for markets. Truth be told, most data when reported is largely a lagging indicator for markets, since markets tend to be forward looking. Markets tend to respond to a combination of long-term fundamentals, which drive baseline expectations, surprises and shocks, and sentiment. However, it’s still very important to know where market expectations are and how they are changing. In fact, how they are changing can sometimes be very significant because market opinions can become entrenched and meaningful signals can be misinterpreted as noise.

Here are some things we know about earnings and what they may mean for 2024.

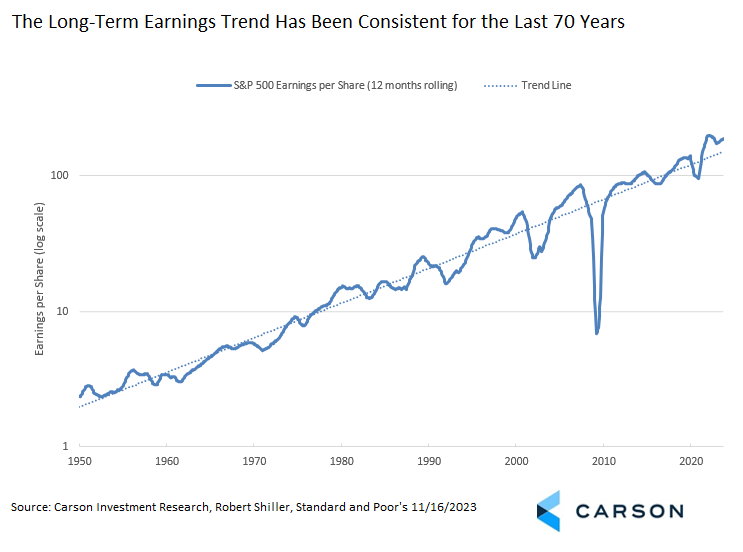

- Earnings have trended fairly steadily over the last 70 years. This is important because earnings growth over the long run is the primary driver of stock returns. There have been significant changes to the drivers of earnings. For example, as economic growth has slowed margins have improved. But the overall trend rate of growth, at about 10% per year, has been persistent. Note that the small squiggles in a long-term chart are very significant in the near term, but the highlight here is the long-term trend. This could, of course, change in the future, but the support for innovation in a free market economy supports a persistent trend even if the path should change somewhat.

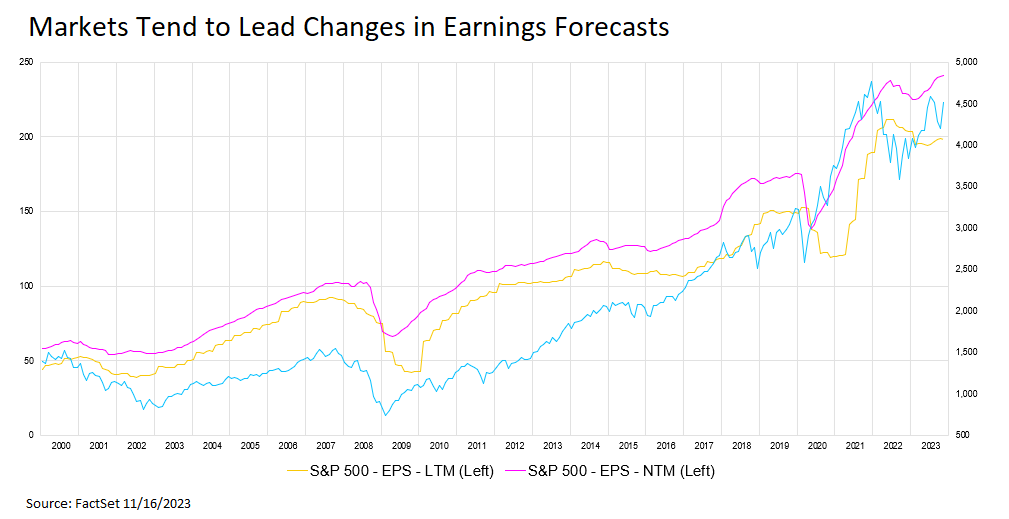

- Trailing earnings forecasts lag forward earnings forecasts. (That’s not surprising at all.) Forward earnings forecasts lag the market. As seen below, major market turning points are typically ahead of earnings, even earnings forecasts. (The next twelve months data is as of the date of the forecast—the forecast itself is for 12 months ahead.) What’s priced in?, is always the most important question when analyzing markets. Forward earnings forecasts are almost always already priced into markets. This makes sense. Analysts are generally slow to update forecasts and they partially depend on earnings coming in, which lag the quarter they are actually for. Markets are much more efficient.

As a result of this lag, rather than using earnings to forecast S&P 500 returns, we should look for cases where the macroeconomic implications of earnings may tell us something beyond the normal horizon the market prices in. What happens after major earnings breakdowns may be one of those cases. While the sample is small, a consolidation period for earnings usually sets the table for a longer period of earnings growth. This could be because an earnings “reset” is an opportunity when companies get to (or are forced to) remove inefficiencies and imbalances, with the economy often doing the same. We saw such a reset in the early 2000s, the Great Financial Crisis, and the COVID recession. There was a smaller reset in 2015-2016. The current consolidation was larger than 2015 and smaller than a typical recession, but still meaningful.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Analysts are almost always too optimistic with forward earnings twelve months ahead. The current expectation for forward year S&P 500 earnings based on analyst forecasts was $240.66 as of the end of last month, according to FactSet data. Historically, analysts have been too high 83% of the time dating back to 2000 with a median forecast 8.3% too high. (By the time earnings season starts, expectations for the coming quarter are almost always too low, so there is usually a steady process of downward revisions as a quarter approaches.) But even removing the typical bias, earnings growth would be strong enough next year to support double digit gains assuming no change in valuations. That’s currently already priced into markets but as a probability. If expectations were realized prices would be pushed higher, assuming markets didn’t start anticipating a new shock in 2025.

At Carson Investment Research, earnings expectations are largely a product of our macroeconomic forecasts. Those forecasts are what help us differentiate our expectations from what’s already priced into markets. If our base case of no recession in 2024 comes to pass, together with rate cuts starting in the first half of the year and added economic support from productivity gains, double digit returns should be attainable for the S&P 500 in 2024. What may be different in 2024 is broadening market support beyond the megacap names in the index if recession fears continue to recede.

For more of Barry’s thoughts click here: https://www.carsongroup.com/insights/blog/author/bgilbert/

1985904-1123-A