“Of all the things I’ve lost, I miss my mind the most.” Ozzy Osbourne

First off, sorry to hear the news of Ozzy passing at 76 years old. Just a couple of weeks ago he did his final show in Birmingham, England and it was so great to see him in his element one more time. But with stocks up back to new highs, the big question is could this bull market get a tad too crazy?

Remember, markets peak when euphoria takes over and everyone is excited. I’m sorry, I’m just not seeing it. Yes, we have some meme stocks coming back in the news with huge moves, but overall, there are many signs that sentiment is simply getting back to normal levels after being at historically low levels three months ago. This is bullish and says the summer rally could continue.

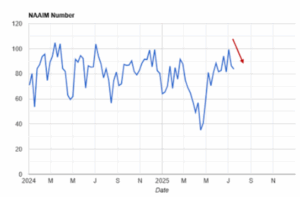

For starters, with stocks hitting new highs, the AAII Sentiment Survey is currently 39% bulls and 39% bears -not very excited in my opinion. Then on top of that, the NAAIM Exposure Index has decreased the past two weeks.

Yes, sentiment overall is higher than it was three months ago, but it is important to remember that in some ways we saw more fear in April than we did during a 100-year pandemic or at the depths of the Great Financial Crisis. I’d say we are only getting back to neutral sentiment now, which could be quite bullish from a contrarian point of view.

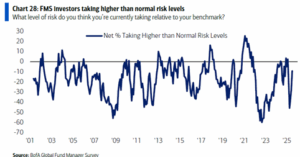

The recent Bank of America Global Fund Manager survey showed the level of risk that money managers are taking is still nowhere near past major peaks.

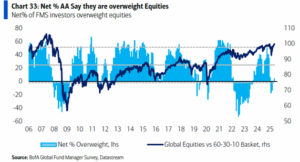

From the same survey, investors that consider themselves overweight equities are just now recovering to normal levels and still a long way from the levels of excitement we’ve seen at past peaks.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

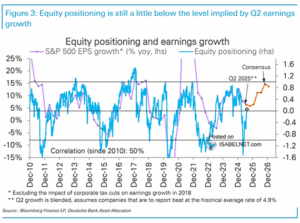

Deutsche Bank said, “There is room for equity positioning to continue rising as long as strong, resilient earnings growth persists and spreads across sectors.”

We’ve talked a lot the past few months how off base hedge funds have been this whole rally, as they keep betting against it, while retail has done really well. Well, hedge funds added to their short positions yet again last week on the S&P 500 and are now the most net short they’ve been since early April. Shoutout to Duality Research for this cool chart.

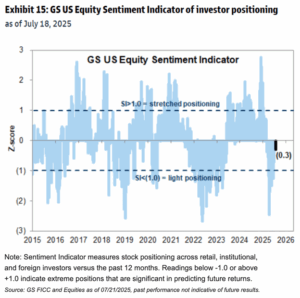

Lastly, the Goldman Sachs US Equity Sentiment Indicator showed clients turned more cautious and hedge funds sold US equities three weeks in a row, not consistent with what you’d expect if we were near a major peak in equities.

Let’s put a bow on this, I simply don’t see signs this bull market is nearing a major peak due to too many bulls. Thanks for reading and be sure to watch our latest Facts vs Feelings, as we discussed this and so much more. Oh, and right at the beginning Sonu breaks out his guitar to honor Ozzy.

8203856.1.-07.23.25A

For more content by Ryan Detrick, Chief Market Strategist click here