“I’m involved in the stock market, which is fun and, sometimes, very painful.” Regis Philbin

In case you hadn’t heard yet, last week, we released our Midyear Market Outlook 2025: Uncharted Waters! We discuss why we remain optimistic on both the economy and stock market the remainder of this year, similar to what we said at the start of the year, but we didn’t change our tune in April like so many other places. Remember the cover below at the beginning of May? The Barron’s Big Money Poll had the least amount of bulls in 30 years, which made our view for a big summer rally quite the contrarian call.

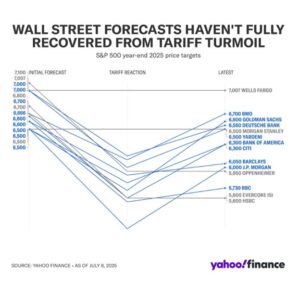

Here’s another nice way of showing how it works via Yahoo! Finance. Many strategists (even the bearish ones in 2023 and 2024) turned bullish at the start of the year, then capitulated in April, and more recently increased their targets again. Wish this wasn’t how it worked, but it is.

If you are reading this then you know we’ve been overweight equities all year and never wavered, even during the crash after Liberation Day. The good news is we continue to expect higher prices the second half of 2025 and today I will share three more reasons to remain optimistic.

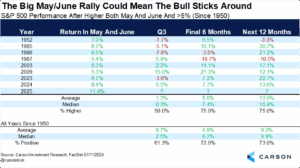

A Big May and June

So after money managers in the Big Money Poll were less bullish in late April 2025 than they were during the Great Financial Crisis or a once in a100 year pandemic, all stocks did was soar 11% in May and June for the best return those two months ever. If that didn’t sum up the great Regis quote above I don’t know what does.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

We found eight other times the S&P 500 gained more than 5% during these historically weak months, while also being higher each month. Yes, 1987 is in there, but the rest of the year still saw a higher-than-average performance, with a median return of a solid 7.4%. Then going out 12 months stronger performance was perfectly common.

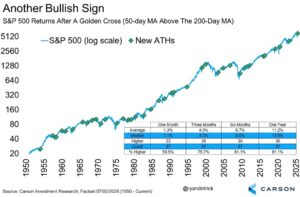

The Golden Cross

Another potential positive driver is the S&P 500 had a golden cross two weeks ago. This happens when the faster 50-day moving average crosses above the slower trending 200-day moving average. Historically, the large part of bull markets take place under this scenario and it is another reason to expect higher prices the next six months, with the S&P 500 up more than 81% of the time, and once again, better-than-average returns.

What Goes Up, Stays Up?

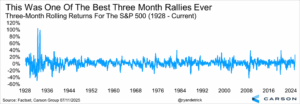

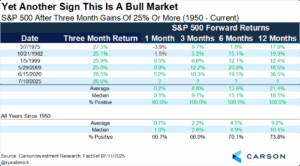

After one of the most vicious selloffs we’ve seen in years, stocks have come soaring back. As we noted time and time again in April, historically the worst days happen right near the best days, so if you sell because of a few bad days, you’ll inevitably miss out on the pending rebound. In fact, stocks gained more than 26% off the April 8 closing lows, one of the best three-month rallies ever.

What does that mean? On the surface you’d think a big three-month rally would mean some weakness and give back, but that isn’t the case at all. The five other times stocks were up at least 25% in three months saw more green returns three, six, and 12 months later every single time.

Then look at some of those dates: off the 1975 lows, the 1982 lows, early 1999, off the 2009 lows, and off the COVID lows in 2020. Those times all might have felt like stocks went ‘too far, too fast, but continued gains happened each time. In fact, the S&P 500 was up more than 21% on average a year later with each time up at least double digits, another reason to remain bullish right here and now.

For more thoughts, Sonu Varghese, VP Global Macro Strategist, and I were honored to join The Compound and Friends podcast last week. This is one of the largest financial podcasts in the world and it was so much fun to join Josh Brown and Michael Batnick of Ritholtz Wealth Management to discuss why the rest of 2025 should be a good one.

For more content by Ryan Detrick, Chief Market Strategist click here

8174503.1-07.15.25A