2025 was a great year for investors, as stocks made new highs across the globe, bonds had their best year since 2020, and commodities gained overall with gold and silver soaring. Here are three timeless investment lessons from 2025 that we believe investors should pay close attention to in 2026.

Beware When Everyone Agrees

“If everyone is thinking alike, somebody isn’t thinking.” -General George Patton

Above is one of my favorite quotes and I use it often. When it comes to investing, we are always looking for what is (and isn’t) already priced in. Back in April, I heard from so many people I hadn’t heard from for decades. They were worried after hearing on the morning talk shows how bad tariffs would be and how we were headed straight for economic Armageddon. Well, we all know that didn’t happen and I think much of the reason for the historic rise in equities the final eight months of the year was because of how much negativity had already been priced into things.

And let’s go a little further back. This time a year ago all we heard was how the US would lead the globe in economic growth and equity returns. Listen, we didn’t totally disagree, as we had strong conviction all year that this bull market would continue and the US would see solid returns yet again. But looking back on 2025 what really stands out is just how well the rest of the world did relative to the US. Emerging markets and developed international each gained more than 30% on the year according to MSCI indexes, much better than the very solid 19% return for the S&P 500 in the US.

Were there clues? Yes, nearly everywhere I looked heading into 2025 I saw agreement that the US economy and stock market would do great, along with the US Dollar remaining strong. I openly started to discuss a lower US Dollar early in 2025 and got a lot of odds looks. I’ve done this long enough to know that once you see that, you are probably on to something. As a result, early in 2025 we moved to a neutral allocation to developed international equities and it greatly helped our models overall, and the potential for a lower US Dollar was a big reason for that decision.

Other clues? The Economist had this cover in October 2024. It is literally a roll of $100 bills shooting into outer space like rocket ship. Yeah, this one will go down in history as a major contrarian signal that the rest of the world was about to do much, much better.

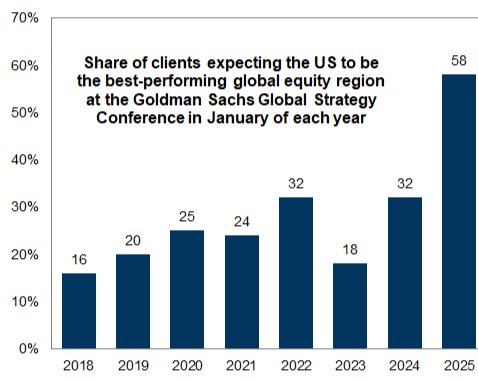

Another clue came from Goldman Sachs’ Global Strategy Conference. This annual conference, which takes place near the beginning of the year, includes a bunch of polling of the attendees. Well, this conference saw a historically high number expecting the US to be the best equity region in 2025; instead, it was one of the weaker ones in a good year for stocks across the globe.

Source: Goldman Sachs, 1/31/2025

When most people all agree on something it doesn’t mean it can’t work, as US markets did great all things considered last year, but be open to the real alpha opportunity (a geeky word we use for outperformance) coming for going against the crowd. This is way easier said than done, but it’s one of the key places where alpha comes from.

Politics and Investing Don’t Mix

“If the opposite of pro is con, then the opposite of progress must be Congress.” Sam Stovall

The other timeless investment lesson that was a big part of 2025 that you shouldn’t forget about in 2026 was don’t mix politics with investing. We have repeated this again and again no matter who has been in power in Washington. I’m old enough to remember when some people didn’t like President Obama and missed out on eight solid years of returns. Others didn’t like Trump 1.0 and missed out on more solid gains, and then there were those who didn’t like President Biden and although markets were rocky early, the last two years were spectacular. You would think everyone would have learned their lesson at this point. But along come Trump 2.0 and once again, so many investors let politics get in the way of their investing decisions.

I heard from so many people earlier this year that they didn’t trust (or like) President Trump and they were going to sell their equities. Unfortunately, many did just that back in April and missed out on the nearly 40% rally the rest of the year.

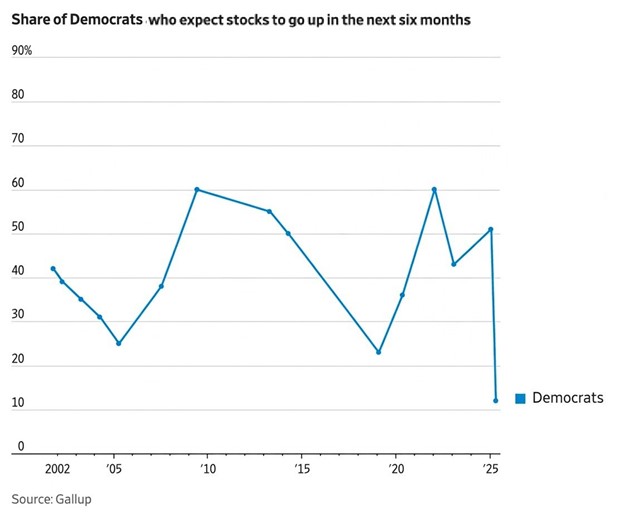

In June, Gallup had a poll that showed just over 10% of Democrats expected higher stock prices the next six months. Another way to put that was 90% of Democrats were looking for lower stocks prices the next six months. I’m not picking on Democrats here, as Republicans were the same under Biden, but I will say when I saw that I had a pretty good clue where stocks might be headed the next six months.

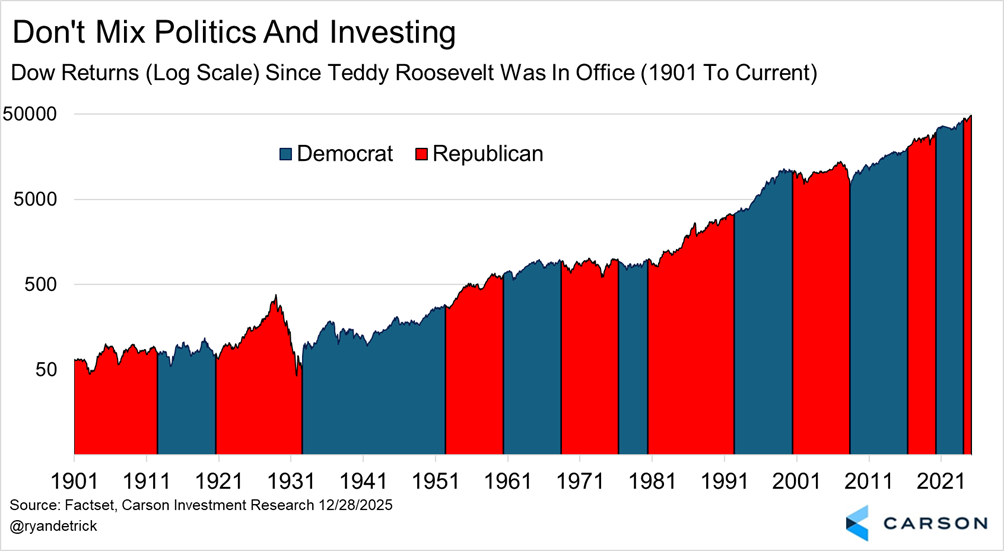

Date: 6/15/2025

Here’s one of my favorite big picture charts I’ve shared over the years. Technically, stocks have done a tad better when we’ve had a Democratic president, but the flipside is stocks have done much better under a Republican led Congress than when both chambers of Congress were blue. End of the day though, if the economy is on firm footing, the Fed isn’t aggressively hiking, inflation is mostly under control, and earnings and profits margins are trending higher (and don’t forget to take politics out of all these assessments), it will matter way more for your investments than who is sitting in the White House.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Beware the Wall Street Strategist

“Life is 10% what happens to you and 90% how you respond to it.” Lou Holtz

Want to know a secret? No one knows what is going to happen in 2026. We have clues and use our best processes to figure it all out, but never blindly follow anyone when it comes to what the market is going to do. I’d put what we’ve done here at the Carson Investment Research team up against anyone the past three years, but I’ll be the first to admit we’ve missed many calls and we will miss many more.

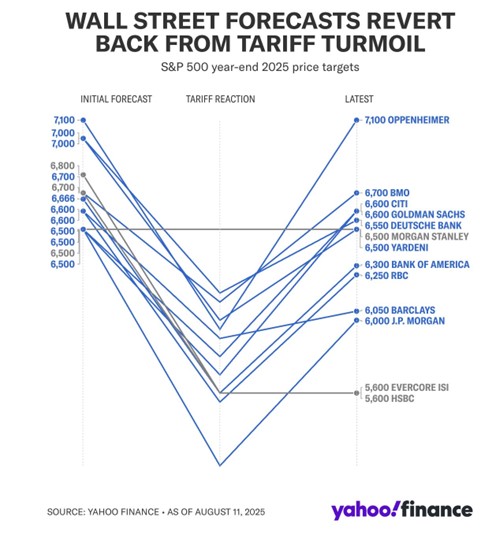

One chart that sums up 2025 is this one from our friends at Yahoo! Finance with strategist forecasts for the S&P 500. All those strategists in the chart below were bullish coming into the year. Then we had the near bear market around Liberation Day, and they cut their forecasts. And then once stocks started to soar back, they upped their targets again. It’s almost as if they were telling us what has already happened in the market rather than forecasting what would happen.

We never cut our S&P 500 2025 target of a gain between 12-15% in April as we continued to share our view. Even when stocks were down 15% for the year and our target felt like an eternity away, we held firm that a huge rebound was likely coming, and fortunately (but not to our surprise) that’s the way things turned out. Still, we sure didn’t see a 10.5% drop the two days after Liberation Day, nor did we see a near bear market.

It is an honor you read what our team has to say and it is a privilege to manage billions of dollars for our Carson Partners and their clients. We don’t have all the answers, but sometimes just knowing that can be an advantage.

As we move into 2026, know that there will be bad days and scary headlines. Even yours truly will probably have a miss or two. But I can say this about our team—we won’t always be right, we won’t always be wrong, but we’ll be honest and always be out there explaining what we are seeing in a way that is clear, concise, and that puts facts above feelings. And you’ll be happy to hear that we plan on releasing our Outlook for 2026 next week, so stay tuned!

For more thoughts on 2026, I was honored to be joined by two great friends of mine in our latest Facts vs Feelings, as Chris Kimble, founder of Kimble Charting Solutions, and Scott Brown, founder of Brown Technical Insights, joined me to talk about the charts. Enjoy!

Geeking Out On Charts with Chris Kimble and Scott Brown

For more content by Ryan Detrick, Chief Market Strategist click here.

8688358.1. – 1Jan26A