Technology stocks have come under pressure in recent weeks owing to macroeconomic concerns, including the risk of a potential recession caused by rising tariffs that could hinder the free flow of trade. In this environment, active equity investors are likely to focus more on forward-looking commentary from companies – if any is provided – to assess whether forward earnings estimates are attainable. Given the current divergence between price action and forecasts, this earnings season may hold surprises for investors.

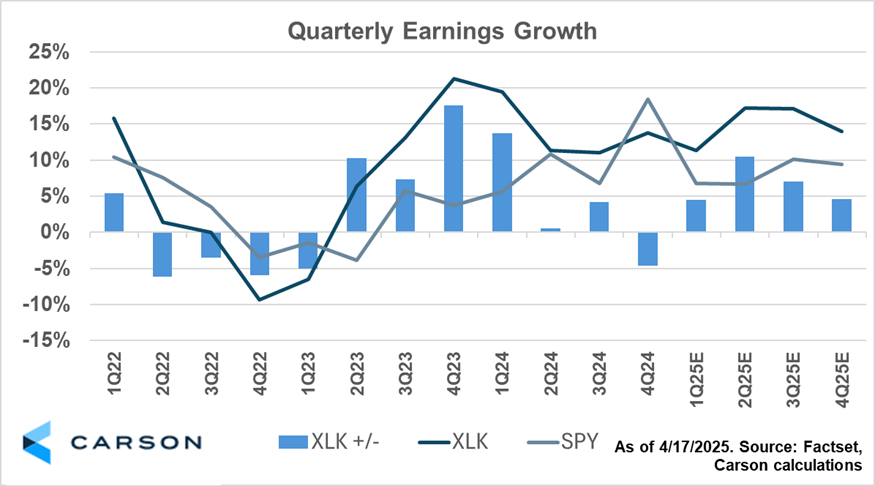

The technology sector, as proxied by XLK (the iShares Technology Select Sector Fund), has historically delivered earnings per share (“EPS”) growth that outpaces the broader S&P 500, tracked by SPY. As shown below, EPS growth outperformance for XLK peaked in the fourth quarter of 2023, when tech earnings grew 21.3% year over year compared to 3.7% for the S&P 500 – a notable 17.6% outperformance (FactSet data). After last quarter’s disappointing results, which showed a slower growth rate than the broader market, tech stocks are expected to fundamentally lead once again, with projected outperformance of 4.5%.

Forward guidance will likely prove critical for technology investors. While tech stocks are expected to outgrow the market this quarter, next quarter’s expectations call for higher growth outperformance, and for that to continue through the remainder of the year. Due to their higher mix of recurring revenue compared to other sectors, tech companies often provide some of the most detailed and reliable guidance. If companies are unable to offer visibility into next quarter’s results, that would mark a sharp departure from the norm—though recent price declines may already reflect this uncertainty.

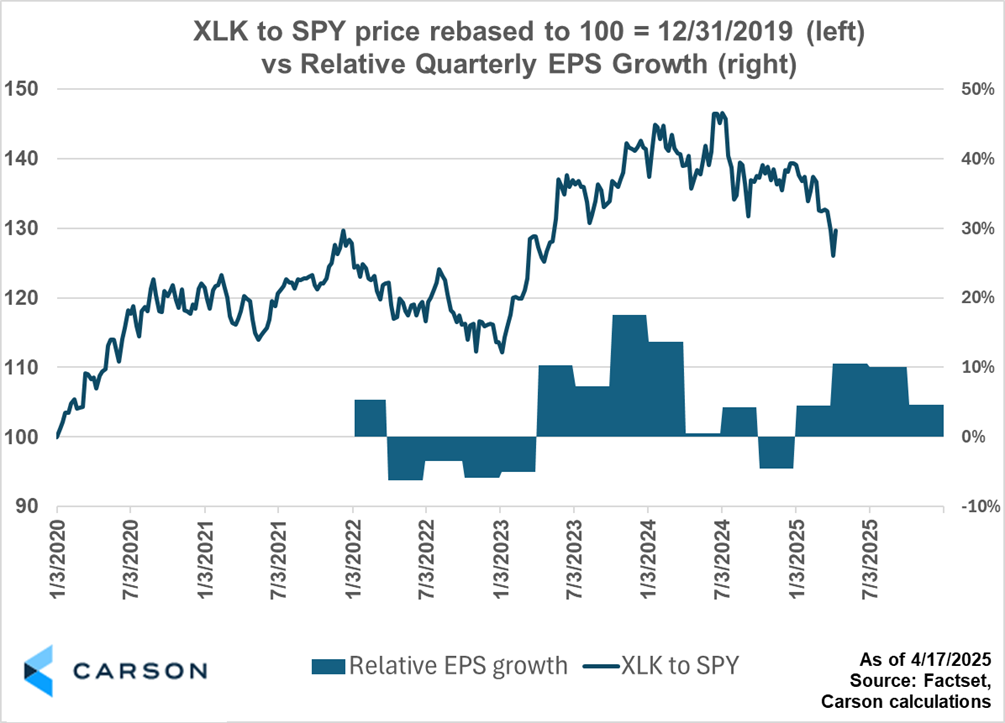

The resumption in expected earnings outperformance does not appear to be priced into these stocks, however. As shown below, comparing the price of XLK to SPY – rebased to 100 as of December 31,2019 – reveals that tech stocks have materially outperformed over the past five-plus years by roughly 30%. Overlaying relative EPS growth shows a loose and lagged correlation between relative price and EPS performance, with relative price trends often leading EPS differentials by 3 to 6 months. Said differently, tech’s price outperformance often is predictive of earnings growth outperformance.

Tech investors now find themselves at a crossroads. The sector’s recent price underperformance relative to the broader market may indicate that future EPS growth is set to underperform. Yet, FactSet consensus estimates still call for tech earnings to outperform both this quarter and for the rest of the year by a meaningful amount. This disconnect suggests one of two things: either buyers of tech stocks have gone on strike owing to uncertainty, or forward growth estimates are due for a downward revision. Investors will need to sharpen their pencils as—and if—forward guidance begins to roll in.

Technology investors are heading into one of the most uncertain earnings seasons in recent years. While tech companies typically provide clear forward-looking guidance, thanks to superior revenue visibility, this quarter may be different – clouded by trade policy uncertainty and its ripple effects. Expectations are high, with the tech sector projected to resume EPS growth outperformance when compared against the broader market. However, recent price underperformance may indicate that the market is already discounting some of this optimism. If investors exit this earnings season confident that tech growth will indeed outperform, it may lead to some positive surprises.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.

7876137.1-0425-A