“It is uncertainty, far more than disaster, that unnerves and weakens markets.” -John Steele Gordon, American writer

After serious consideration, we’ve decided to move all of our portfolios into Godiva Chocolate Cheesecake at The Cheesecake Factory, because if you’ve ever had one then you know. Now that I have your attention, April Fool’s Day!

Now to your regularly scheduled blog.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

After what began as a nice start to the year with a green January, the S&P 500 fell in both February and March. In fact, it lost 5.8% in March for the worst March since 2020 and second worst March the past 24 years. Dominating the weakness was continued worries over tariffs and potential uncertainty surrounding trade policy. Remember, markets can go up on good or bad news—it is uncertainty they don’t like and we saw that in a big way last month. The quote above from John Steele Gordon is one of my favorites on this topic.

Was This Really a Surprise?

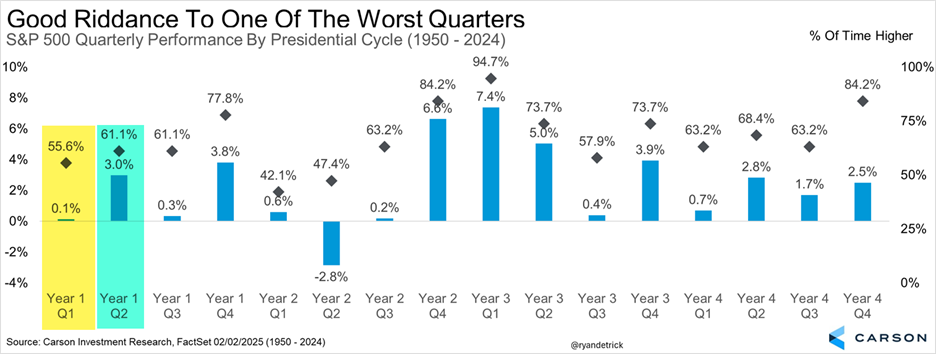

No, we didn’t expect stocks to be this weak to start the year, but below is a chart we’ve shared many times and it shows that the first quarter of a post-election year tends to be quite weak historically. In fact, it is one of the worst quarters during the entire four-year Presidential cycle. Add in the facts (as we’ve discussed before) that early after a 20% year has been weak historically and so has the first quarter in general the past 20 years, and maybe this weakness isn’t as surprising as it might seem. The good news is the second quarter tends to do better in a post-election year.

The Decline Isn’t as Broad Based as You Might Think

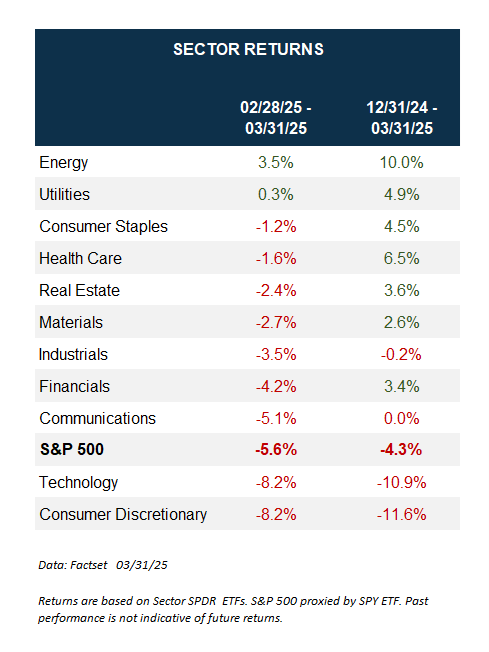

Yes, the S&P 500 is down close to 5% after the first quarter, but this is greatly skewed by weakness in the technology and consumer discretionary sectors. In fact, seven sectors are up on the year, two are virtually flat, and only two are down. In total, nine of them are outperforming the S&P 500 so far this year. Toss in the fact that bonds are up a little bit, gold is soaring, and many stock markets around the globe are firmly in the green this year and it has been a nice year for a diversified portfolio. Of course, if you were heavily in the Mag 7 then this year hasn’t been very fun.

Some Good News for April

March wasn’t a good month and we clearly didn’t expect the second worst month of March over the past 24 years this time a month ago. But some good news is that after the worst ten Marches ever, April bounced back with gains in eight of them with some very solid returns.

Speaking of April, it was lower last year, but it hasn’t been lower in back-to-back years in 20 years. Since 1950 it is the second best month, the past 20 years the third best month, the past decade the fourth best month, and the second best month in post-election years. No, you should never blindly invest in seasonality, but this could bode well for the bulls.

Now the Bad News

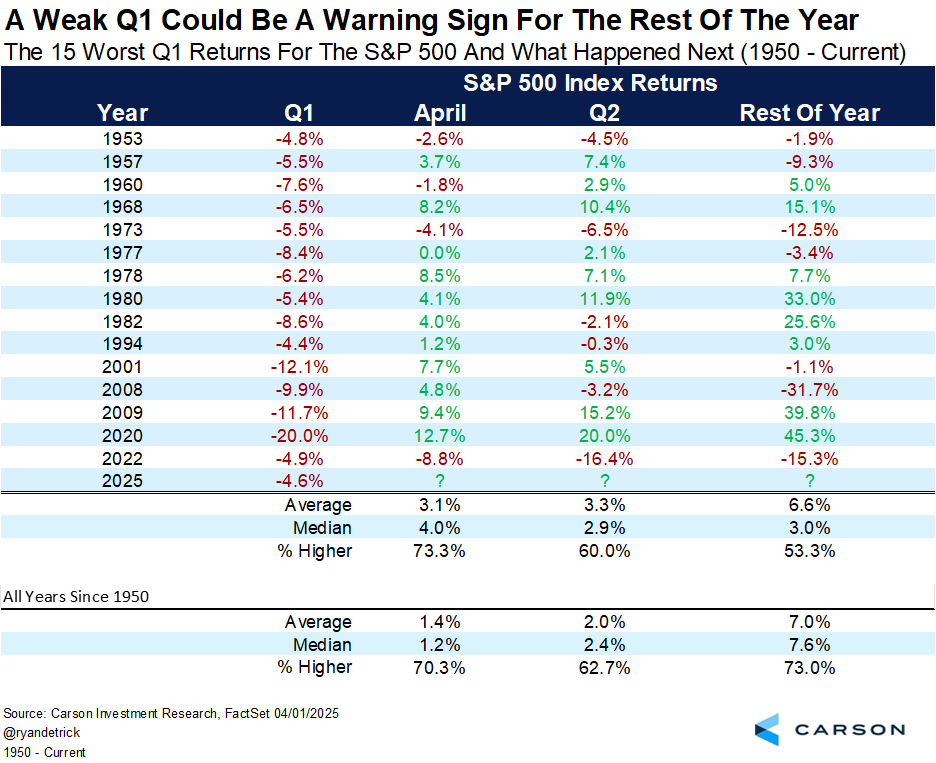

A weak first quarter could be a warning sign for more weakness over the rest of the year. Looking at the 15 worst first quarters ever we found that the rest of the year was up only a median of 3.0% and up about a coin flip, much worse than all years since 1950. It isn’t all bad though, as April does better after a weak first quarter at least. Still, we’d put this in the potential worries camp.

Yes, the worries are growing and uncertainty is high, but we remain optimistic the economy will avoid a recession and stocks can come back nicely before this year is over. But enough about that. I’m writing this from beautiful Bryce Canyon in Utah while on Spring Break with my family. All I can say is you need to come here once in your life. It is unlike anywhere else in the world. Here’s me in front of the iconic Thor’s Hammer. Thanks for reading!

For more content by Ryan Detrick, Chief Market Strategist click here.

7805831-0425-A