“No pressure, no diamonds.” – Thomas Carlyle, 19th century Scottish historian

Well, it was due to happen and last Wednesday it did, as the S&P 500 finally fell more than 2% on the day. Disappointing earnings from Tesla and Alphabet sparked it, but the reality is you can’t go forever without a bad day and it could have been darn near anything to spur it.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

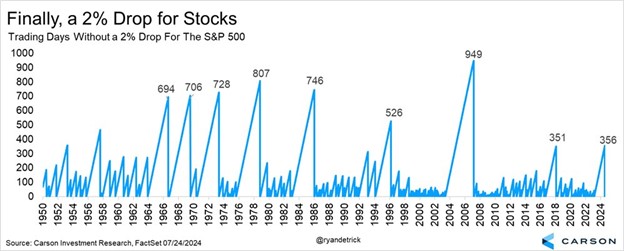

In the end, it was an amazing 356 trading days without a 2% drop (since February 2023), the longest such streak since the record 949 days before the Great Financial Crisis. As you can see below, this was one of the longest streaks ever without a big down day.

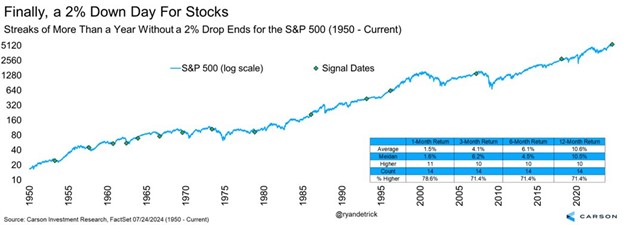

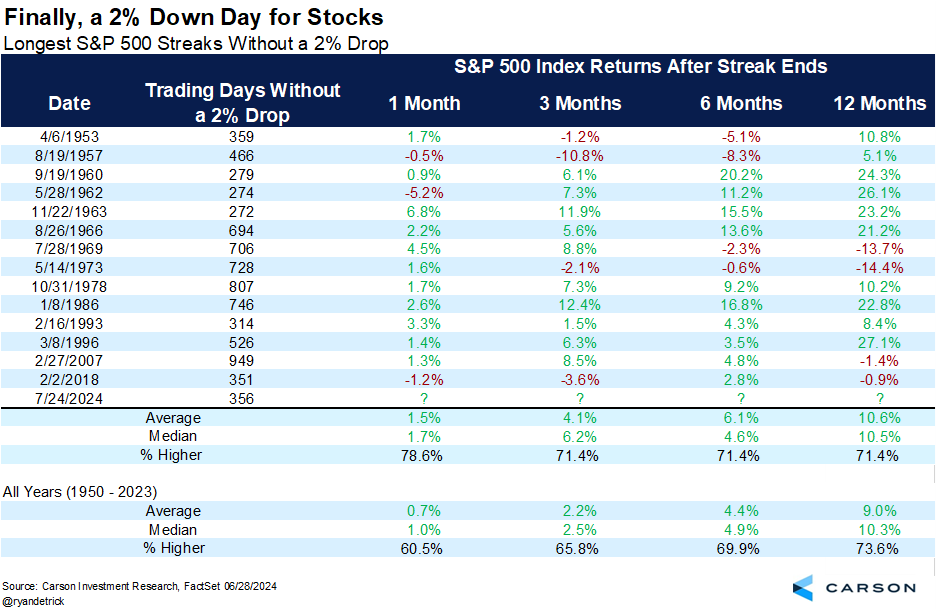

What could be on tap now? Some more volatility would be perfectly normal, so don’t be surprised if we see larger moves, as most of this year so far has been historically calm. But what does history tell us could be next? When you go at least a full year without a 2% drop and then finally have one, the bull tends to remain. In fact, up a median of more than six percent three months later and up more than 10% on average a year later don’t sound all too bearish to me.

Here’s a list of the 14 other times stocks went a full year without a 2% drop and then finally had one. It is worth noting the past two times this happened (Feb 2007 and Feb 2018) saw stocks lower a year later. But it has never been lower three in a row, so we’d side with the odds in favor of potential double-digit returns over the coming year.

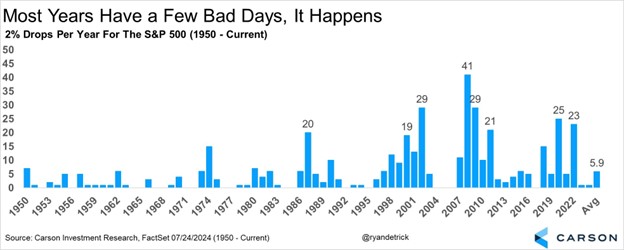

Lastly, it is important to realize that even some of the best years ever saw multiple 2% drops. Sure, some years didn’t see any (like 1995, 2005, 2006, and 2017), but then we see years like 1989 and 2013 which saw two separate 2% declines each and those years gained an impressive 27.3% and 29.6%, respectively. In fact, 1998 had 12 big drops, but still managed to gain more than 26% on the year, while 2009 had 29 big drops and added close to 24%. To put a bow on this, the past 14 times a year had five or fewer 2% declines saw the year higher all 14 times and up 19.3% on average. In other words, some bad days are normal, even in some of the best years. Or as the timeless quote above tells us, to have some diamonds, you need some pressure.

In conclusion, I joined Dominic Chu on CNBC to discuss many of these ideas, you can watch the full interview below. And can you believe summer is ending soon with many kids going back to school over the coming weeks? Here’s to getting in that last minute vacation!

For more content by Ryan Detrick, Chief Market Strategist click here.

02341394-0724-A