“Big opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.” Warren Buffett, Chairperson at Berkshire Hathaway

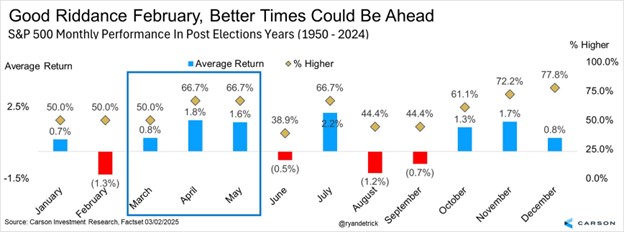

Welcome to March and good riddance to February! In the end, February was a choppy and frustrating month, but this wasn’t a big surprise, as we wrote about and discussed all month. Are better times ahead? We think so, and March is the month of St. Patrick’s Day so maybe we should expect some green. Let’s get into it.

Not a Surprise, Don’t Panic

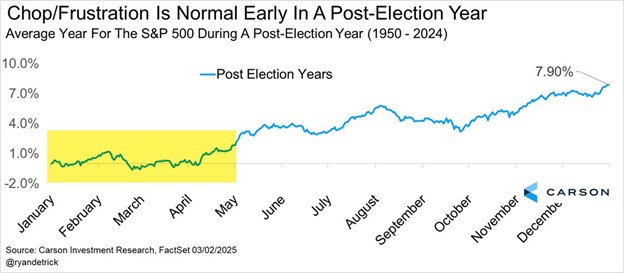

The second half of February was rough, as worries over the economy, tariffs, Washington drama and geopolitical concerns, and big cap tech weakness dominated the conversation. Here’s the thing. Yes, the year-to-date gains we saw in January might have mostly vanished, but as we’ve noted before, early in a post-election years things tend to be choppy. Not to mention February is a weak month historically, especially in a post-election year. So in a way, this is normal and not a reason to panic. Here’s one way of showing this.

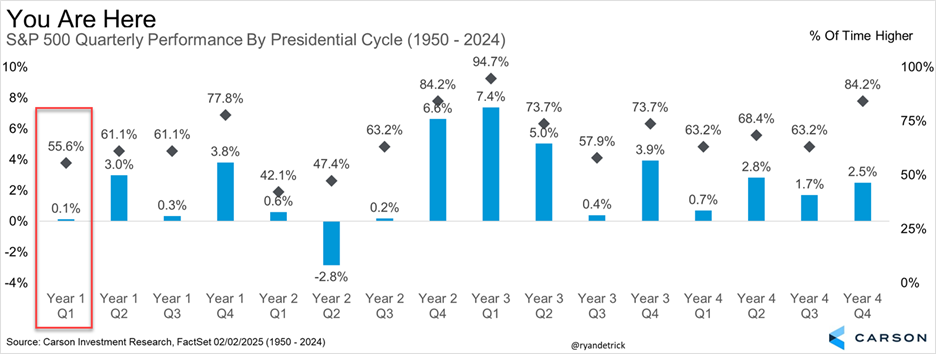

Here’s another angle on the same thing that shows the first quarter of a post-election year is the second weakest quarter out of the entire four-year presidential cycle. In other words, after back-to-back 20% gains the past two years, maybe a well deserved break to kick off 2025 is perfectly normal.

Here Comes March

In the end, the S&P 500 fell 1.4% in February, but not before a 1.6% jump on the last day of the month, which checked in at the best last day of February since Leap Day in 1988. If things feel choppy, that’s because they have been. The S&P 500 was up in September, down in October, up in November, down in December, up in January, and now down in February. That is the first time in history we’ve seen those six months alternate between green and red and it is the longest such streak of alternating up and down months since seven in a row from February through August back in 2022.

We continue to think the bull market is alive and well and the economy is on solid footing, but that doesn’t mean we won’t have scary headlines or worries. Just two weeks ago we were writing about new highs. That may feel like a long time ago, but really it just happened.

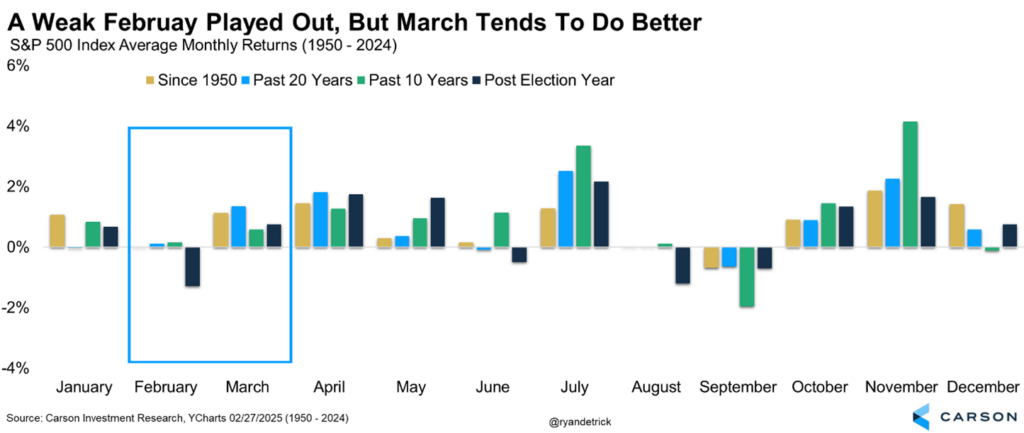

As poor as February is historically (and that played out), it is worth noting that March and April are two of the better months of the year. The past two decades March is the fourth best month and April is the third best month. You should never blindly invest in seasonality, but just as February was ripe for potential trouble, be open to the possibility of a nice Spring bounce.

Looking at March the past four years, the S&P 500 has gained more than 4%, 3%, 3%, and 3%. Of course, in 2020 it lost more than 12% for the worst March ever and worst month since October 2008. Here’s another closer look at election years, which shows February is weak (check), but these next three months tend to be strong.

Panic Is in the Air

How are you feeling about markets right now? Hopefully because you’ve been reading our blog you know that even the best years have scary headlines and volatility and that volatility is the toll we pay to invest. But we’ve seen historic levels of fear in various investor sentiment polls over the past week, even with stocks less than 5% away from all-time highs.

The American Association of Individual Investors (AAII) Sentiment Survey showed more than 60% bears for only the seventh time in history (going back to when the poll started in 1987). Here’s the catch—those other times we saw this level of fear were times like the 1990 recession and accompanying near bear market; October 2008 and March 2009 during the Great Financial Crisis; and the end of the bear market in 2022. In other words, stocks were down substantially before fear truly spiked, making what we are seeing now truly rare and uncharacteristic.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

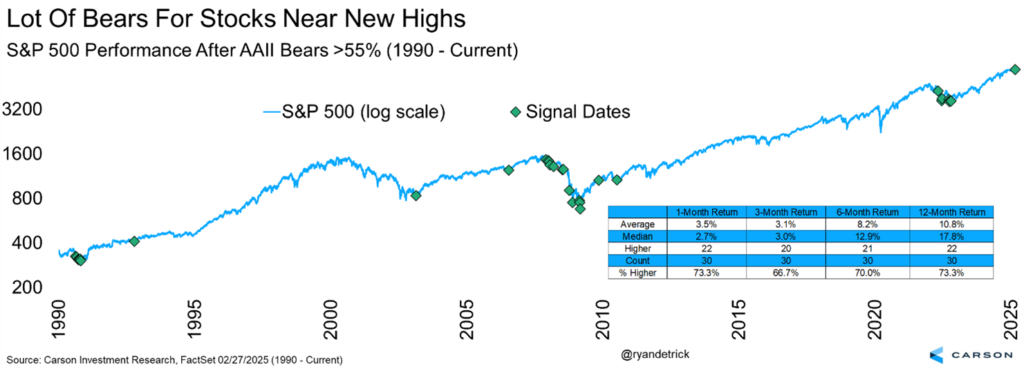

Stocks were up about 28% on average a year after previous times bears were above 60% (and higher every time), so contrarian bells are ringing right now. To get a larger sample size, we looked at all the times bears spiked above 55% in the AAII survey. Once again, the returns going out a year were quite strong overall, but we did notice fear spiked in early 2008 and many of those returns were significantly lower a year later.

But assuming we aren’t heading into another financial crisis (we don’t think we are), the other times we saw this was quite bullish for investors willing to stay strong and not panic sell. The S&P 500 was up a median of nearly 13% six months later and 18% a year later.

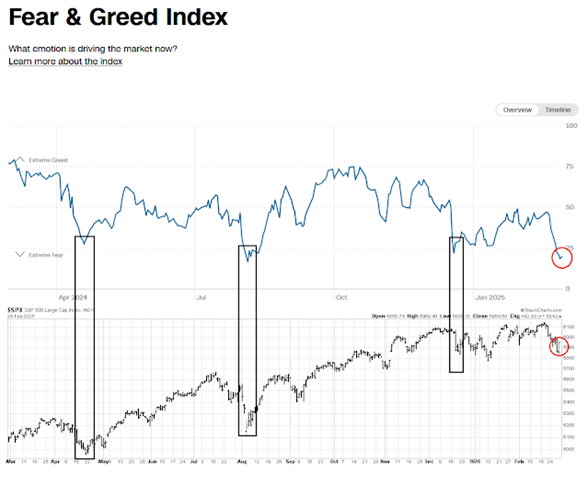

The CNN Fear & Greed Index was recently beneath 20, consistent with levels of fear last seen near major market lows.

Why does sentiment matter? Because the market is all about what is (or isn’t) priced in. For example, large cap tech stocks reported strong earnings across the board, yet many sold off hard when earnings were announced. This was because the bar was set quite high, maybe too high looking back. When worry is in the air and uncertainty is high, this tends to be a bullish contrarian signal, as better news eventually comes and clears that lowered bar. Given our overall still positive economic backdrop, we think seeing this much worry in the air is actually rather bullish, which is why we don’t expect the recent weakness to spiral out of control.

I joined the crew on CNBC’s Squawk Box last Friday to discuss many of these concepts and you can watch the full interview here. Thanks for reading!

For more content by Ryan Detrick, Chief Market Strategist click here.

7694919.1-0325-A