I’ve been in Omaha at the Carson Group home office the past few days and I’ll just say that the things we’ve got coming out over the coming months are going to be awesome. Stay tuned, as we have so many ways to help investors understand what is really happening, while also helping our Carson Partners however we can. Stay tuned!

Today I’ll show three charts that caught my attention recently.

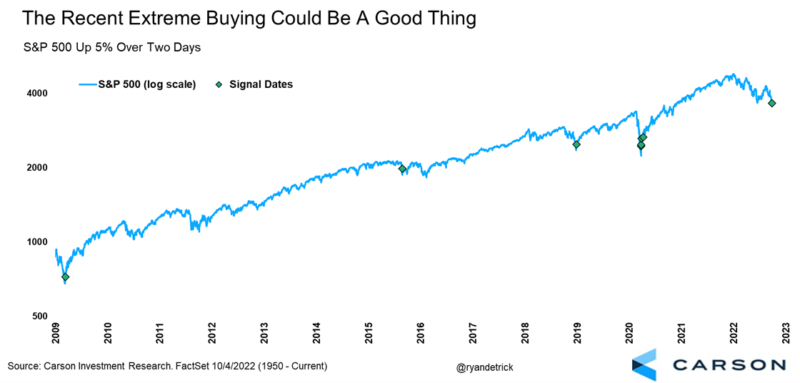

First, the S&P 500 gained 5.7% the first two days of October, for the best two-day start to any quarter since the second quarter of 1938. Be aware, the S&P 500 added more than 40% after that bounce into the end of the year back then. But what about other 5% gains that spanned two days? Simply put, they are rare but also have taken place near some major lows in recent memory. As the chart below shows, most recently we saw this rare show of strength in March/April 2020, December 2018, August 2015, August 2011, and March 2009. In other words, those weren’t the worst time to accumulate stocks, and this strength more often than not marked the end of weakness and stronger price action was up next.

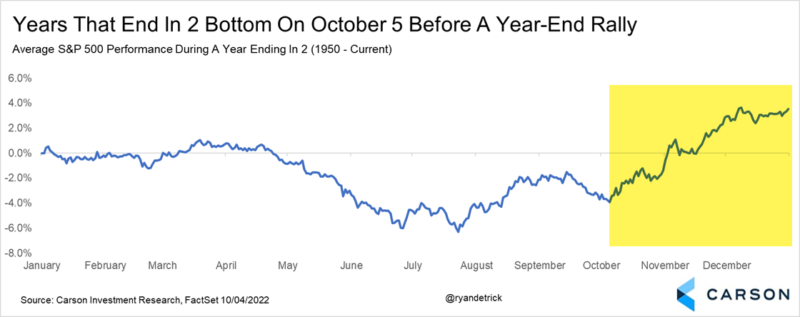

Second, the calendar could be a major tailwind for investors going forward. Looking at years that ended in “2” showed the S&P 500 bottomed on October 5 historically and opened the door to a big rally. Years like 1962, 1972, 1982, 2002, and 2012 all saw big year-end rallies and we wouldn’t bet against 2022 joining this list.

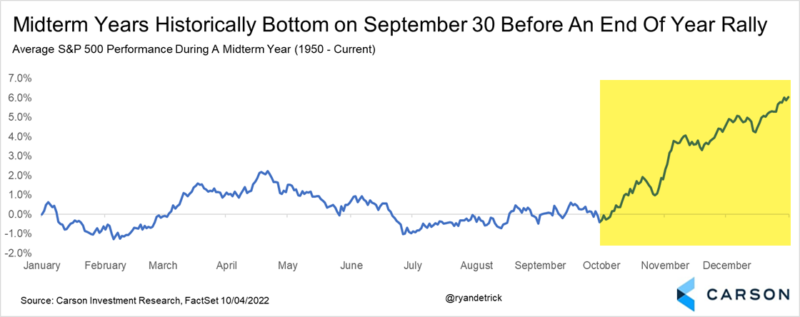

Third, midterm years historically bottom on September 30 before a strong end-of-year rally. Wouldn’t you know it, the S&P 500 bottomed on September 30 before the huge early October surge. Could history be repeating? Speaking of seasonality, be sure to read this blog on fourth-quarter seasonality.

I’ll leave you with these two points:

I discussed many of these concepts with Michael Santoli on CNBC’s Overtime earlier this week and you can watch the full interview below:

Finally, the Facts Vs. Feelings Podcast with Sonu Varghese and myself is up and running! This brand new weekly podcast is a great way to hear the latest views from the Carson Investment Research team and you can get it wherever you get your favorite podcast or go here.