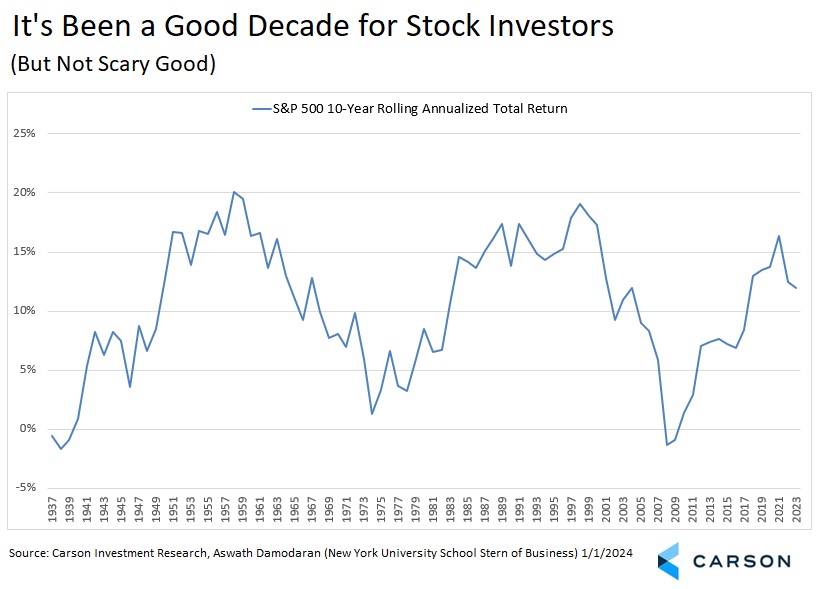

2023 is now in the books. It was a year that no-one expected, but to the upside, which is the way we would all have it. The anticipated recession that didn’t come was overpriced into the market with 2022’s S&P 500 decline of 18%. Those declines helped the index power ahead to a 26.3% gain on a total return basis in 2023. That left the S&P 500 with a modest 3.5% gain over the last two years and an annualized growth rate of 11.9% over the last 10 years, which is good but not scary good compared to the 50-year annualized growth rate of 11.1%. In fact, it ranks as only the 41st best of the 87 10-year rolling periods going back to 1937. (For the curious, the best 10-year period was 1947-1958 with an annualized 20.1% gain.)

Bonds came roaring back in the fourth quarter, giving the Bloomberg U.S. Aggregate Bond Index (“Agg”) a return of 5.5% for the year, just ahead of the Bloomberg US Short Treasury (1-3 month) Index at 5.1%. This was the first year of gains for the broad U.S. benchmark after two years of declines, which had marked only the fourth and fifth year of declines in the index’s history.

But if you only paid attention to full year returns, you missed the story. The Agg was down for the year through three quarters and then posted its best quarter in over 20 years, with a gain of 6.8%, providing solid benefits for those who had lengthened the maturity of bond holdings over the year. The Bloomberg US Aggregate Securitized – MBS Index and the Bloomberg Municipal Bond Index also both had their best quarter in over 20 years, finishing the year with total returns of 5.0% and 6.4% respectively. The broad decline in yields was so sharp in the fourth quarter it likely pulled forward some potential 2024 gains, but we expect bonds to have another solid if unspectacular year ahead as the Federal Reserve starts to lower interest rates, while also continuing to return to their traditional role of portfolio diversifiers as inflation continues to move towards the Fed’s target 2%.

One of the biggest stories of the year was the run for large cap growth stocks, anchored by the technology-oriented mega caps and the chipmakers most closely associated with artificial intelligence. The Russell 1000 Growth Index climbed 42.7%, its best year on record (going back to 1979), surpassing even the best years of the “dot com” bubble. Some of this was make-up for underperformance in 2022 when the index lost 29.1%. After such strong separation from value, we expect performance between growth and value to be more aligned in 2024.

Finally, the fourth quarter saw the Russell 2000 Index of small cap stocks outpace the Russell 1000 Index for only the second time since the first quarter of 2020. Small caps were hit hard by the regional banking crisis early in the year, compounded by their greater sensitivity to higher interest rates due to funding costs. Those losses had pushed valuations to historical extremes compared to large caps. Small caps have come very far very fast, with one of their best rallies ever since bottoming compared to the Russell 1000 on November 10. Nevertheless, the Russell 2000 only returned 16.9% for the year compared to 26.5% for the Russell 1000.

Small cap valuations have moved more in line with historical averages with the recent rally, but the Russell 1000 still trades at a substantial premium to history so the separation between them is historically meaningful. It may require some patience, since valuations are a poor timing mechanism, but we believe there is still scope for small cap outperformance over a strategic time frame.

There you have it. A surprisingly strong year for stocks and a solid year for bonds, considering where they were after three quarters. Growth stocks had a stellar performance with a boost from the AI frenzy. Small caps were spectacular late in the year but still lagged behind large caps over the year by a wide margin. All setting up an interesting 2024, with recession calls somewhat lighter than a year ago, but still quite a bit of gloom out there with some large shops still holding onto their recession call. (Stick to a call long enough and you’ll never be wrong, only early.)

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For a deeper dive on our views for what lies ahead in 2024, watch for Carson Investment Research’s 2024 Outlook, to be released next week.

For more of Barry’s thoughts click here.

2046045-0124-A