It’s now Day 43 of the shutdown and a resolution seems imminent. We know that the shutdown has been very challenging for a lot of people, but one small way it has impacted us is we haven’t received any official economic data for over five weeks, including payrolls, consumer spending, income, and production data. A lot of these are inputs that go into our own Carson Leading Economic Index (LEI) for the US, but fortunately, it makes up only about half the inputs. The remaining inputs are private market data and so we’re still able to get a reasonable picture of how the economy is doing (one advantage of having our own index).

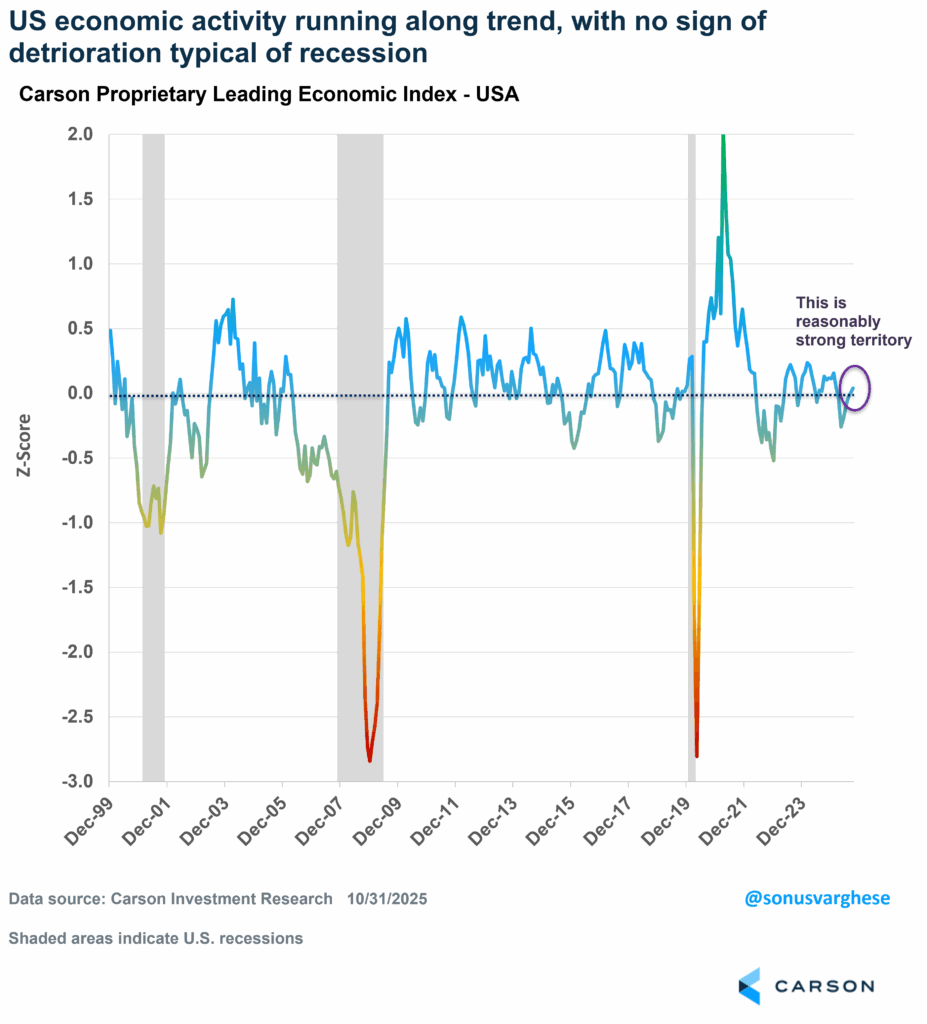

Our proprietary US LEI has been on bit of a rebound since May, and it currently says the economy is growing close to trend. Note that even during the worst of the downturn (April–May), levels were well above what we would normally associate with a recession, or even levels we’ve historically seen in advance of a recession (like in 2000 or 2007). As you can see below, the LEI’s current level is actually in pretty solid territory and that’s good news. Current levels are even better than what we saw in mid-2022, when recession risks were elevated but the economy never plunged into an actual recession. This was a big reason why we didn’t call for a recession anytime between 2022 and 2024. This was in sharp contrast to all the recession calls you saw in 2022 and 2023, including signals from other popular leading economic indicators. You can also see that the LEI deteriorated sharply back in 2018, amid the trade war and Fed tightening, but the economy avoided a recession back then.

The LEI tells us what’s happening now. Looking ahead is another thing but we do have a few tailwinds for the economy, and markets.

Tailwind #1: A Pickup in Global Activity

The dearth of economic data has put more focus on the macro picture coming out of earnings. And things look quite good on that front. S&P 500 earnings are expected to grow over 10% in Q3 (the 4th straight quarter of double-digit earnings growth). Revenue growth is estimated around 8%, which is the highest quarterly growth rate in three years (since Q3 2022). A big part of this is the rebound in international revenue, and that matters because about 40% of S&P 500 revenue comes from abroad. That also corroborates a broader story that we’re seeing in our LEIs for the rest of the world.

Developed markets (ex US) are now growing quite a bit above trend. And it’s not being driven by any one country—countries across Europe (especially Germany, Spain, Italy, Netherlands) are seeing activity running above trend, as well as Japan and Australia outside of Europe. Of course, keep in mind that trend growth in these countries is lower than what it has been in the US over the last 25 years. Still, there’s a global fiscal reflation story here, plus the tailwind of central banks across the developed world cutting rates. Activity in emerging markets is also rebounding after running below trend for over three years. This is mostly on the back of activity recovering in China, Taiwan, and South Korea. This is likely a function of the worst of the trade chaos now behind us, with China especially getting a big reprieve. We’re likely to see more fiscal spending next year in countries like Germany and China, which would be positive for those countries and the regions.

The rebound in global economic activity is a tailwind for US companies, but also the US economy. It’s hard to picture a significant slowdown (let alone a recession) in the US when growth in the rest of the world is rebounding. Contrary to the narrative of de-globalization, globalization is alive and well, especially for US companies, which are benefitting from it now just as they have over the last 25 years. The message: In our opinion, “Don’t fight a potential global recovery and companies’ ability to benefit from that.”

POLICY TAILWINDS (AND RISKS)

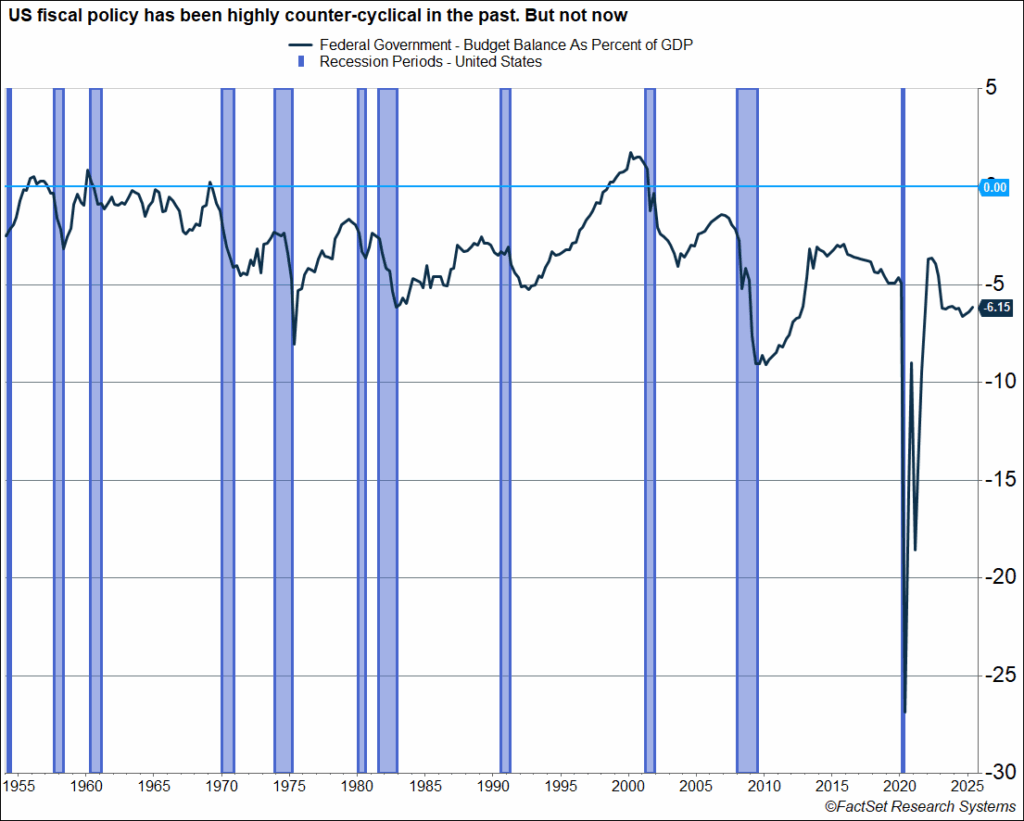

Tailwind #2: Tax Cuts

Did you know that Congress passed a massive deficit-financed tax bill this summer? The One Big Beautiful Bill (OBBB) hasn’t gotten much news since it passed but it’s going to increase deficits by about $4 trillion over the next decade, including interest costs (the cost will rise to $5.5 trillion if tax cuts are extended beyond 2028, which is likely). That means the deficit is going to run at a whopping 6-8% of GDP for a few more years. The US government has never run this level of deficits (as a percent of GDP) in the middle of an economic expansion. Historically, the budget balance heads towards a surplus as expansion continues, but not now. That’s not great for the government’s balance sheet (more than half the deficit is interest costs), BUT the other side is that deficits flow into corporate profits. That’s good for markets in the near term, especially since a lot of the tax cuts will be front-loaded. Tariff revenue will offset some of this but not all (assuming that the tariffs even stick around).

An immediate positive impact of the tax bill, for the economy and even markets, is that a lot of tax cuts were made retroactive to 2025. This includes new deductions on tips and for seniors’ income, and much larger deductions for state and local taxes (income and property taxes). That means a lot of households are going to see outsized tax refunds in the first half of 2026, which is likely to boost consumption (and markets, if households use some of the money to buy stocks).

The message: In our opinion, “Don’t fight loose fiscal policy.”

The risk here is obvious—households spending all that money could boost inflation further from already elevated levels, which creates a problem for the Fed.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Tailwind #3: End of Tariff Uncertainty and Chaos

We’ve been in the camp since at least July that the trade war was behind us (though the market seemed to think that was the case all the way back in May). The current level of tariffs is around 11%-points higher than where they were at the start of the year, but with all the workarounds and exemptions (especially for items crucial to the AI build-up), tariffs are in a much better spot than the worst-case scenario expected around Liberation Day. Companies have obviously figured out how to deal with tariffs as well, which is why earnings growth is strong. Moreover, the latest “deal” with the Chinese puts the trade war further in the rearview mirror. That means there’s a lot less uncertainty in 2026 (at least until the fall of 2026 when the terms of the deal with China have to be re-upped).

The president has also floated a few trial balloons of sending “tariff refunds” back to households. While the president will need Congress to sign off on this, it speaks to intent. The White House is very tuned in to markets, and the administration is likely to try and mitigate as much volatility as possible, especially in an election year. The message here: In our opinion, “Don’t fight the White House.”

The only wrinkle here is that the Supreme Court could rule against a chunk of the administration’s tariffs imposed under IEEPA (International Emergency Economic Powers Act). The obvious positive there is that companies could request refunds, bolstering their balance sheets/cash-flow in 2026. However, the administration is likely to use other tariff powers to re-impose the tariffs, especially on large trading partners, but that’s going to take time – so the cloud of tariffs, and associated uncertainty, could hang over companies next year as well.

Tailwind #4: Interest Rate Cuts

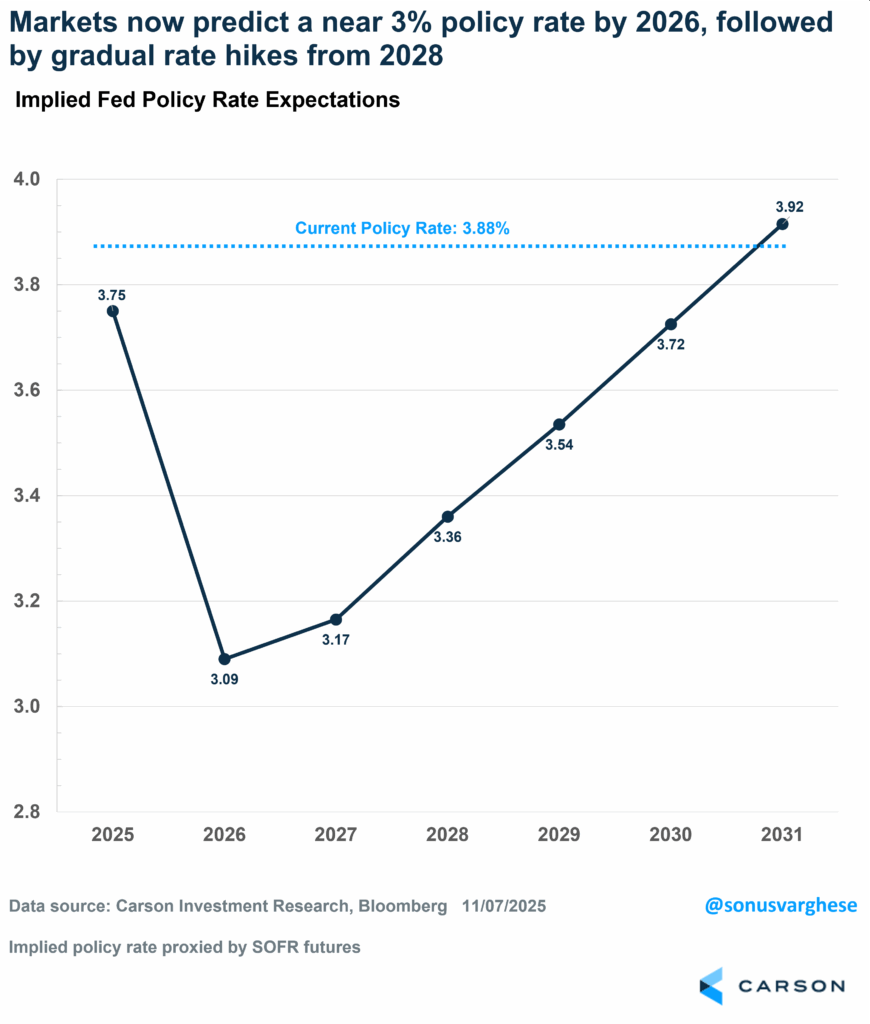

There’s some uncertainty around a rate cut in December, with Powell refusing to commit to a cut after the Fed’s October meeting. The Fed’s caught between the two sides of their mandate, stable inflation and maximum employment. Inflation is running around 3% currently, well above the Fed’s target of 2% (as it has for four and half years now). On the other hand, there’s elevated risk on the labor market side, with hiring weak. In the Fed’s view, the risks to both sides of their mandate are balanced, and that suggests policy rates ought to be “neutral” (neither too loose nor too accommodative), which is around 3% based on the Fed’s own projections. Policy rates are just shy of 4% right now, which means we’re likely to see more rate cuts that take us closer to that 3%, whether that starts in December or next year. And if not by a Powell-led Fed, then under a new chair appointed by President Trump next year (and one likely to be much more amenable to rate cuts). That’s why markets are pricing in a dovish Fed over the next year or two, followed by gradual tightening after 2028 as the Fed refocuses on the inflation fight.

A dovish Fed that is cutting in the face of elevated inflation is yet another near-term tailwind for markets. The Fed has already cut 0.5%-points in 2025, on top of 1%-point in 2024. That cumulative 1.5%-points of cuts is now the largest mid-cycle adjustment since the mid-1980s (granted after very aggressive hikes). The impact of recent cuts will likely flow through into the economy in 2026, with cyclical, rate-sensitive areas of the economy benefiting. The message: In our opinion, “Don’t fight the Fed.”

The risk here is that the Fed pulls back from the expected rate cut trajectory, perhaps because the labor market picks up steam again (which would not be a bad thing for the economy) or inflation shows no sign of abating and rises even further amid tax-cut fueled spending (more worrying).

MARKET TAILWINDS

Tailwind #5: Momentum

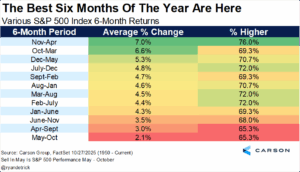

The May-October period is “supposed” to be weak for markets, at least relative to other six-month periods. As Ryan shows in his table below, the next six months (November–April) is historically the strongest six-month period for markets.

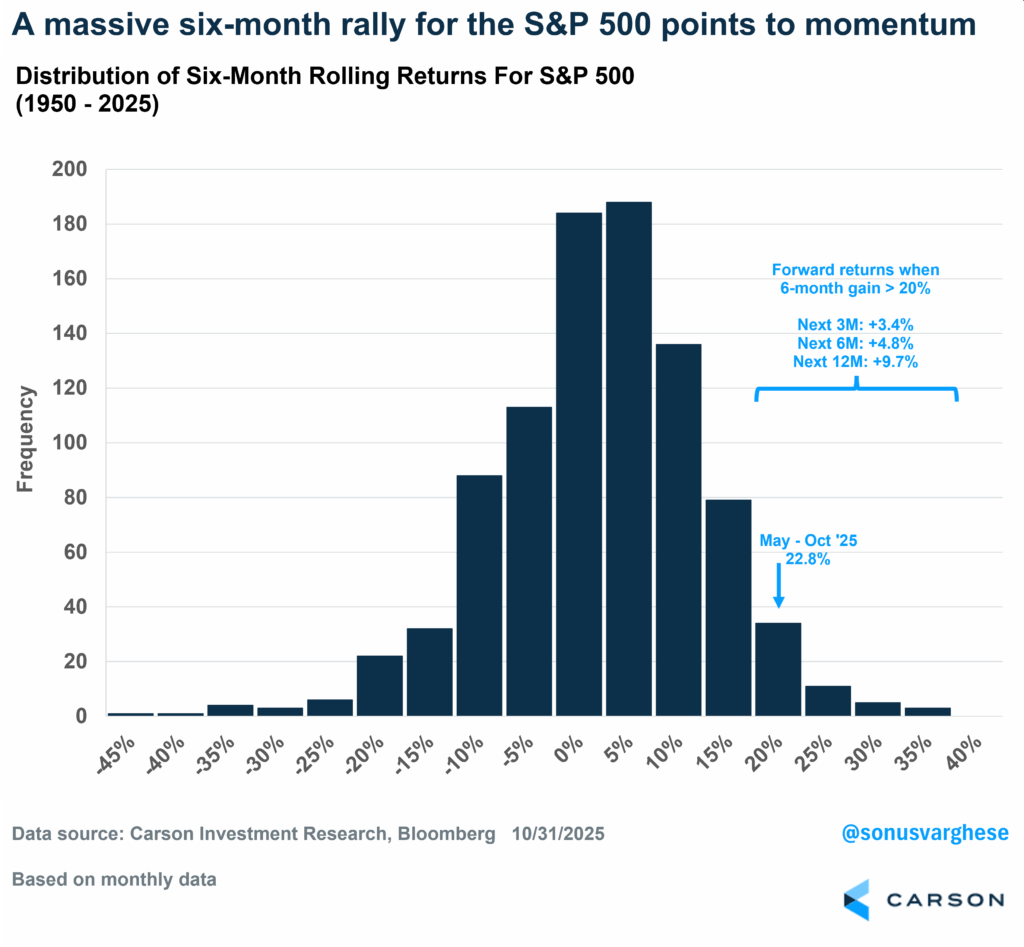

Yet, the S&P 500 just had a massive 22.8% rally over the last six months (+23.6% in total return terms). You would think this was just a rebound after Liberation Day, but not quite. The market did rebound from post-Liberation Day lows but most of that happened in April—the S&P 500 index was down “only” 9% from its February peak by the end of April, so the May–October rally was not simply a “rebound from the lows.” I looked at all historical six-month returns for the S&P 500 since 1950, and this recent 6-month rally of 22.8% ranks in the top 4%. In fact, looking at median forward returns after 6-month rallies of at least 20%:

- 3 months ahead: +3.4% versus 2.3% for all periods (positive 75% of the time)

- 6 months ahead: +4.8% versus 4.6% for all periods (positive 73% of the time)

- 12 months ahead: +9.7% versus 9.3% for all periods (positive 79% of the time)

Moreover, as Ryan pointed out in a recent blog, 2025 is likely shaping up to be a historic year for markets, closing up double digits after being down over 15% during the year. That’s happened only three times in the past (1982, 2009, and 2020) and the average return over the following calendar year was 19%.

The message: In our opinion, “Don’t fight momentum,” as momentum begets momentum.

All said and done, 2026 looks to be shaping up nicely for the economy, and markets. A lot of the uncertainty over policy may be behind us, and in fact, some headwinds have turned into tailwinds. To summarize:

- Don’t fight a potential global recovery (and companies’ ability to benefit from that).

- Don’t fight loose fiscal policy (and there may be more to come in an election year).

- Don’t fight the White House (and their desire to boost markets).

- Don’t fight the Fed (and their current emphasis on supporting the labor market).

- Don’t fight momentum.

Ryan and I talked about a lot of this in our latest Facts vs Feelings episode. Take a listen.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

8599404.1.-12NOV25A