We’ve been getting good news about the labor market in recent months – job growth has been strong, and the unemployment rate has been below 4% for 26 straight months (the longest streak since the late 1960s). However, there were some concerns at the edges if you looked hard enough. The March payroll report set aside a lot of these worries, as it was positive across the board.

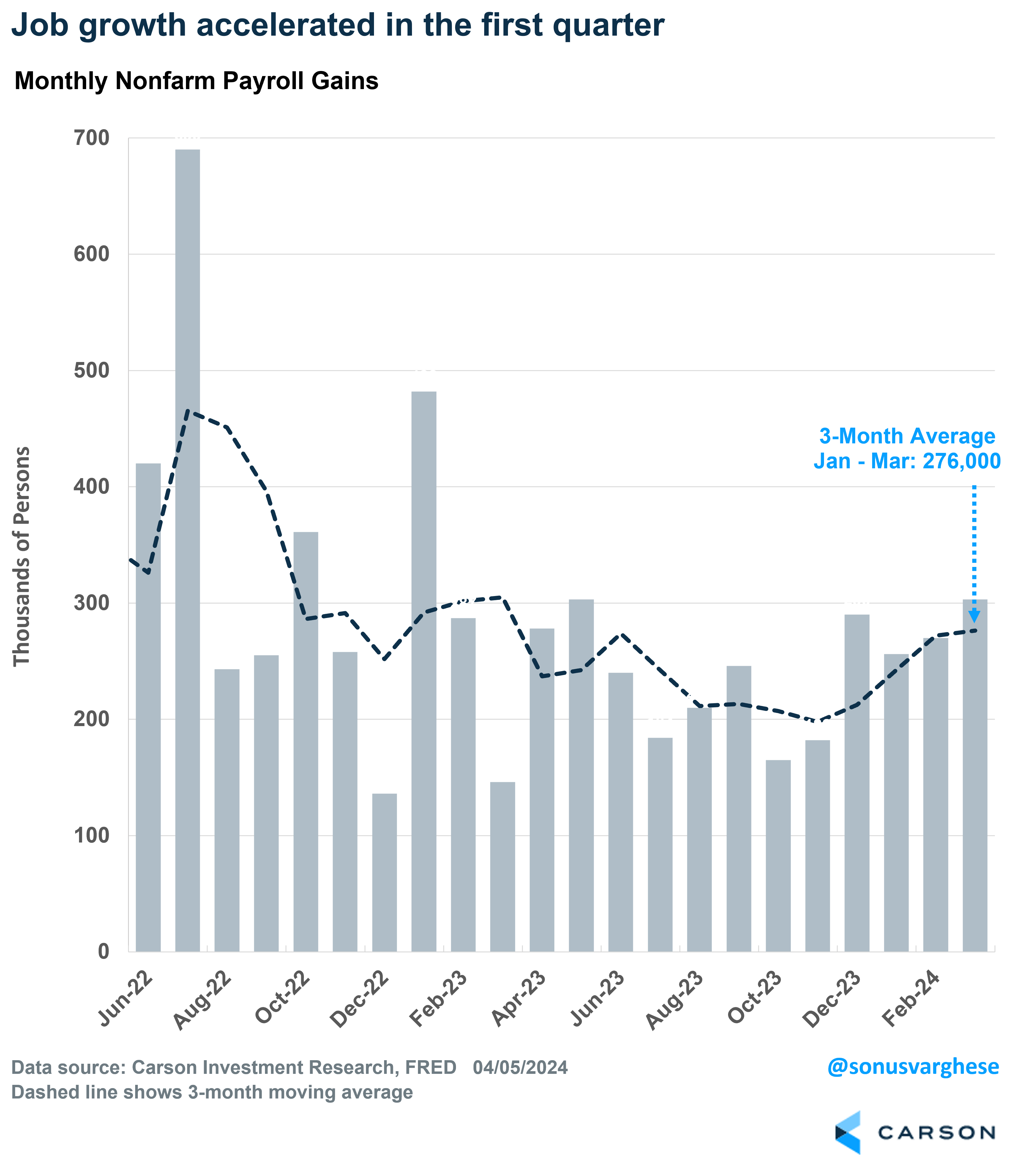

Payroll growth actually picked up in recent months. The economy created 303,000 net new jobs in March (well above expectations for a 214,000 increase), and with positive revisions to January and February, payroll growth averaged 276,000 a month in the first quarter. Payroll growth averaged 212,000 in Q4 2023, and for further perspective, it averaged 166,000 in 2019.

A lot of the employment growth over the past year has come from non-cyclical sectors like health care, education, and government – but only because these sectors lagged the initial recovery in 2021-2022. However, cyclical areas are bouncing back. Payroll growth in the goods-producing sector, along with retail trade and leisure and hospitality, saw 109,000 jobs created in March. That by itself is almost enough to keep up with population growth.

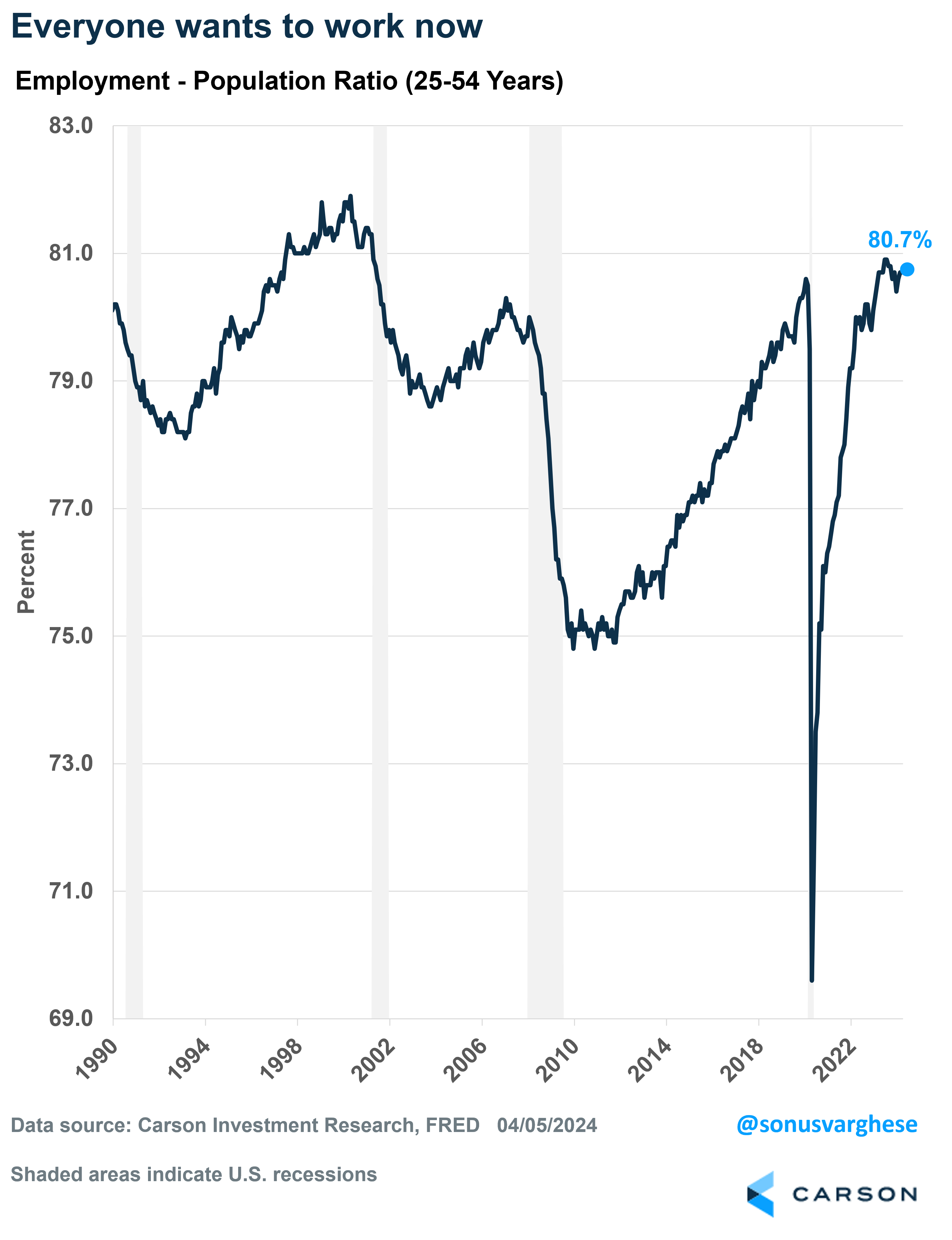

The unemployment rate had risen from 3.4% last April to 3.9% in February, raising concerns. The unemployment rate comes out of the Bureau of Labor Statistics’ “Household Survey”, which is smaller and more noisier than the “establishment Survey”, which is where the payroll data comes from. Employment gains had lagged in the household survey in recent months, but March saw a reversal. As a result there was a welcome pullback in the unemployment rate to 3.8%. That’s still higher than a year ago, but not by much. Moreover, higher immigration is increasing the supply of workers and there’s a lag between when new immigrants enter the workforce and how quickly they find jobs (higher immigration has also a key reason why real economic growth has exceeded expectations). In any case, I prefer to look at the “prime-age” employment-population ratio, which tells you how many people in their prime working years (25-54) are employed relative to the population. The measure is at 80.7%, exactly where it was a year ago and higher than at any point between July 2001 and February 2020. That by itself tells you how strong the labor market and economy is, with a higher proportion of prime-age adults working now than we saw over the last two expansions.

But does a strong labor market raise concerns over inflation?

A strong labor market would typically raise the prospect of higher inflation. The logic is that a hot labor market would result in higher wage growth, which would push demand for goods and services higher, resulting in higher inflation. However, wage growth has been easing since 2022, and the story hasn’t change despite the recent acceleration in hiring.

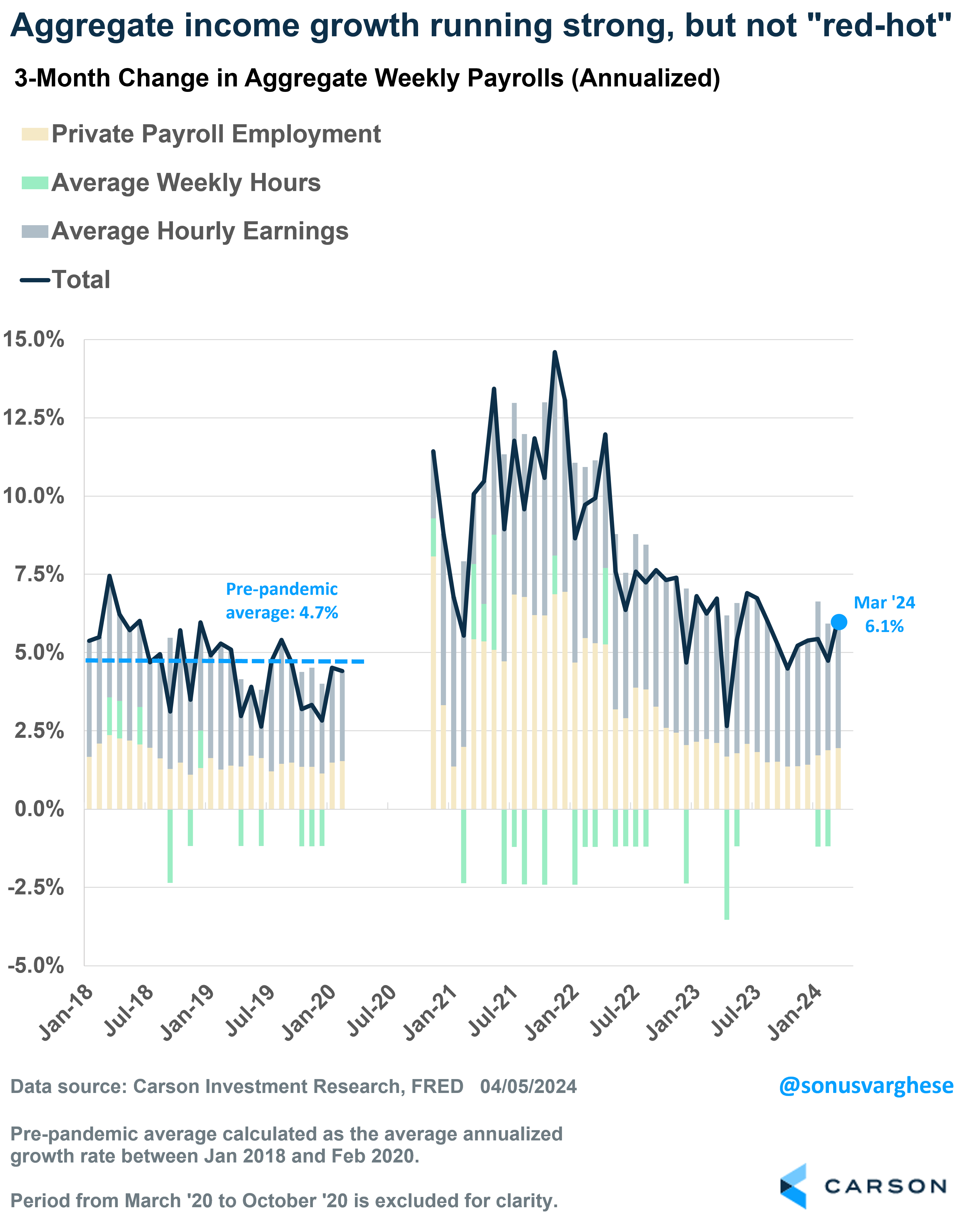

If you look at overall income growth across all workers in the economy (a product of employment growth, hourly wage growth, and hours worked), that’s running at a 6.1% annualized pace over the last three months. That’s stronger than what we saw pre-pandemic, when aggregate income growth averaged about 4.7% annualized, but well off the red-hot levels of 10%+ in 2021-2022 (when inflation surged).

Moreover, there are two notable things that pop out when looking at aggregate income.

One, income growth is running ahead of inflation. After adjusting for inflation, aggregate income rose at an annualized pace of about 2% in the first quarter (assuming the Fed’s preferred inflation metric, the personal consumption expenditures index, rose at a 4.1% annualized pace in Q1). That’s positive for consumption, and the economy.

Two, hours worked has been running flat recently (the green bars in the chart above). At the same time, GDP growth in the first quarter is estimated to clock in around 2.5% (using the Atlanta Fed GDP Nowcast). That means labor productivity continues to run strong, as workers are producing above-trend output while working the same amount of hours.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Higher productivity was a key theme in our 2024 Outlook, and it’s encouraging to see signs of that continuing, mostly thanks to a strong labor market that is drawing more workers in (including immigration). As we’ve written in the past, productivity growth allows for strong wage growth with muted inflation. Which is positive in two ways:

- Some of the productivity growth is taken by firms in the form of margin growth. (Firms don’t pass all the productivity gains to workers, much as we’d all like our employers to do that.)

- Muted inflation even in the face of a strong labor market means the Fed can start to ease rates, which will potentially fuel investment and provide a further boost to productivity.

With respect to potential interest rate cuts by the Federal Reserve, the strong labor market and economy doesn’t preclude cuts. Of course, the inflation data needs to cooperate, but we do expect inflation to pull back in March and April, reversing the firming we saw in the first two months of the year. The good news is that there’s nothing in the economic data that suggests we’re on the verge of a labor-market induced inflation surge. Yes, some commodity prices are rising amid Middle East tensions, but as we’ve seen in the recent past, these are volatile and prices can reverse just as quickly.

Speaking of strong productivity growth, and its potential to boost the economy and profits, Ryan and I chatted with Ark Investment Management’s Chief Investment Officer, Cathie Wood, recently. She and her team are very positive on the outlook for AI and its potential to boost productivity, much more so than most other Wall Street forecasters. Take a listen to the whole conversation or our latest Facts vs Feelings episode:

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02188788-0424-A