“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” —Mark Twain

What a Month and Quarter

“Wow” is about all you can say for what just happened. Yes, historically August and September tend to be weak and the third quarter is the worst quarter on average, but 2025 didn’t follow the script at all.

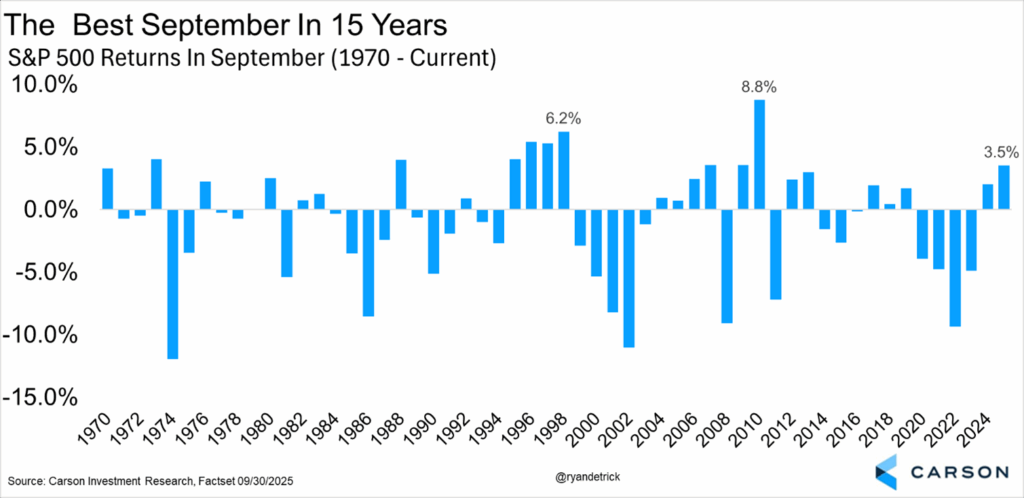

In the end, it was the best September in 15 years and second best going back 27 years, as the S&P 500 added 3.5%. Also, not a single day closed up or down more than 1%, making it a historically calm month to boot.

Taking things a step further, stocks gained all three months in the third quarter and are now up five months in a row. The S&P added 7.8% in the quarter, for the best third quarter since 2020 and before that the best all the way back to 2010.

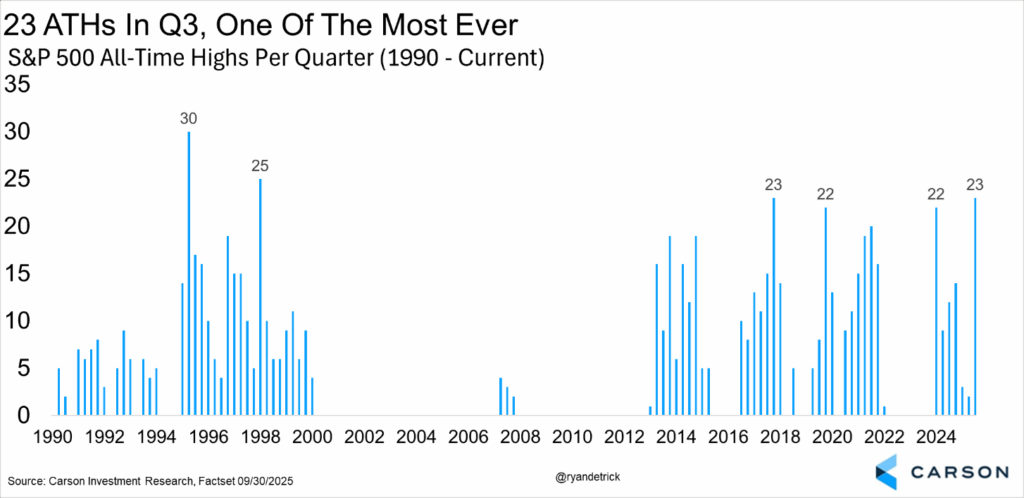

And on virtually no one’s bingo card, the S&P 500 made 23 new all-time highs in the third quarter, tying the most for any quarter since 1998.

Now What? Let’s Start with October

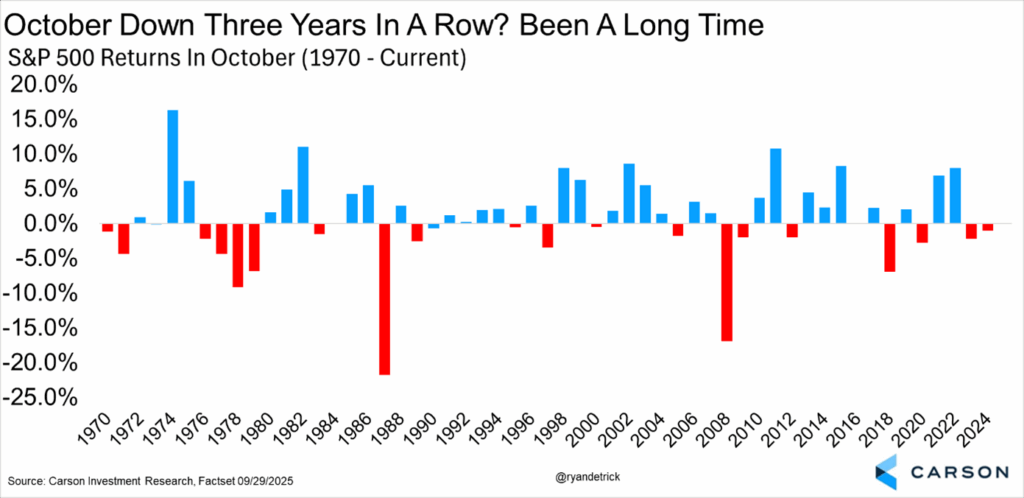

For starters October has been down the past two years, even though the S&P 500 gained more than 20% each of those years. But you have to go back to the late 1970s for the last time October was down three years in a row.

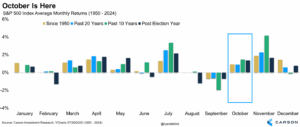

October is historically the most volatile month, including some of the largest drops in history in 1929, 1987, and 2008. But all in all, October isn’t all that bad, even considering some historic crashes. The past 10 years it is the third best month on average and since 1950, over the past 20 years, and in post-election years it tends to be right in the middle of the pack.

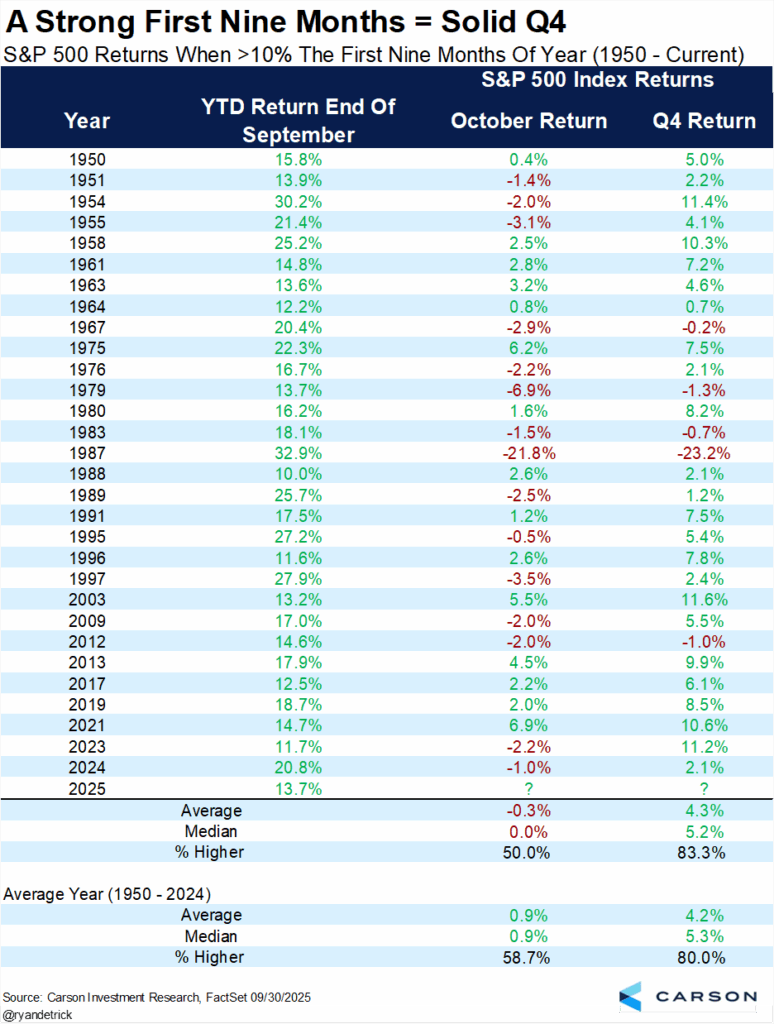

The S&P 500 is up five months in a row and can’t go up forever. Also be aware that years up 10% or more heading into the fourth quarter have tended to see weakness in October, including a negative average return with gains only a coin flip of the time. But the good news is the fourth quarter has been higher 14 out of the past 15 times after a good first three quarters despite October weakness.

More About the Fourth Quarter

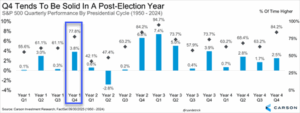

The fourth quarter historically has been the best quarter of the year, higher 80% of the time and up 3.8% on average. It hasn’t even really been close.

Breaking things down by the four-year Presidential cycle shows once again this quarter tends to be quite solid in Year 1 of the cycle.

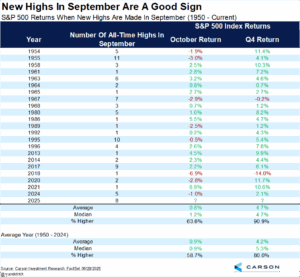

Lastly, the S&P 500 made eight new all-time highs in September, the most since 2017. We found the fourth quarter has been higher more than 90% of the time (20 out of 22) when stocks hit a new high in the historically weak month of September.

Let’s Wrap It Up

The bottom line is while we’ve been bullish, even we are surprised by the market strength we’ve seen the past few months. Then again, surprises happen to the upside in a bull market and as we’ve been saying for a long time now, this is a bull market.

We expect to see more gains in the fourth quarter of 2025, but after being up five months in a row, the chances for a little pause in October are rather high. But we’d expect any weakness to be fairly contained, and possibly even an opportunity before a potential end-of-year push higher.

If you’ve read this far, I thank you. For more of our thoughts on the latest, we were honored to be joined by Jan van Eck, CEO and President of Van Eck. He is a titan in our industry and you’ll enjoy this conversation, I know we did.

8451380.1.-01OCT2025

For more content by Ryan Detrick, Chief Market Strategist click here.