“October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.” -Mark Twain

October is known for many things, from sweaters, to leaves on the ground, to the World Series, to pumpkins, and yes, to market crashes. It is also my birthday month, but for today’s blog, we will focus on why we believe there won’t be another October market crash.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Stocks have had a rough go of things since the late July peak. As we’ve noted many times, the past few months shouldn’t have come as much of a surprise, given the third quarter tends to be a time investors pause to catch their breath. Now we are hearing more and more that another October market crash is around the corner. Higher yields, a hotter economy, geopolitical worries, and the possibility of more rate hikes, are all adding to the near-term worries.

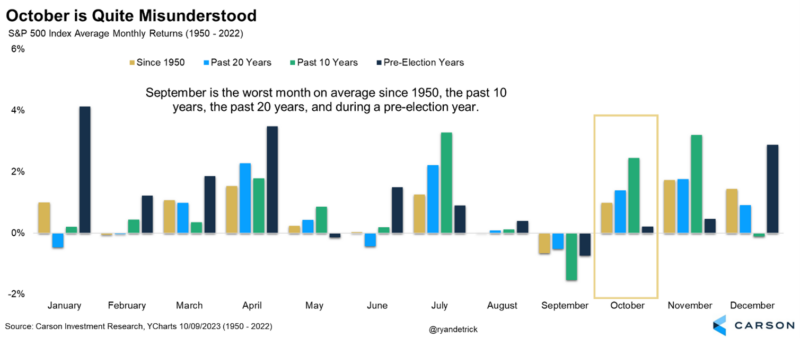

Think about it. Some of the most spectacular crashes in history took place during in October. 1929 and 1987 stand out, but 2008 was another horrible October. The worst month ever was a 31% drop in September 1931, highlighting that the fall months in general can be quite tricky. Here’s the thing though — I think October gets a bad rap, as it’s not so much a ‘bad’ month as a month of high volatility. Since 1950, the S&P Index has been up about 1% on average in October which ranks as the 7th best month of the year, not all that bad. It also ranks as the 3rd best month the past decade and 4th best the past 20 years. Pre-election years aren’t that great, but overall October has historically not been as bad as the media makes it sound.

How can this be? Well, positive average returns with such large declines means October has also had some huge gains. October gained 16% in 1974, 11% in 1982, and 11% in 2011. The bottom line is if you are looking for a crash this month simply because it has had a few crashes in the past, we think you’ll be quite disappointed.

Here are four reasons we don’t think we will see an October crash in 2023.

Stocks Are Oversold

First, stocks are quite oversold on many levels. Yes, most crashes took place from oversold levels, but with the economy as strong as it is, as Sonu discussed last week, we think the odds of a crash are very low. The majority of the time stocks are oversold we’ve been closer to a major low rather than close to a crash.

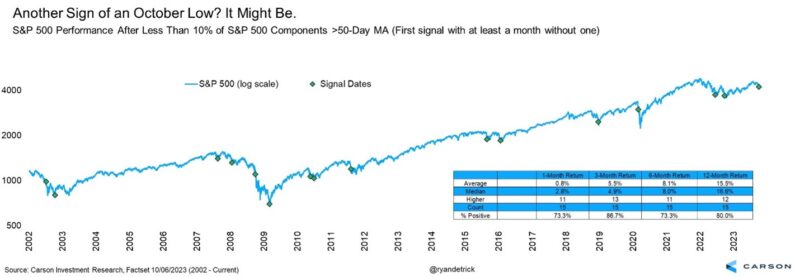

Last week, for example, saw less than 10% of the components in the S&P 500 above their 50-day moving average, a sign of extreme oversold levels. Although this signal didn’t work well in 2007/2008 or right before COVID, the majority of the other times we were close to a major low. Given we don’t think we are in the middle of another generational financial crisis or once in a century pandemic, now could be closer to a major low than most think.

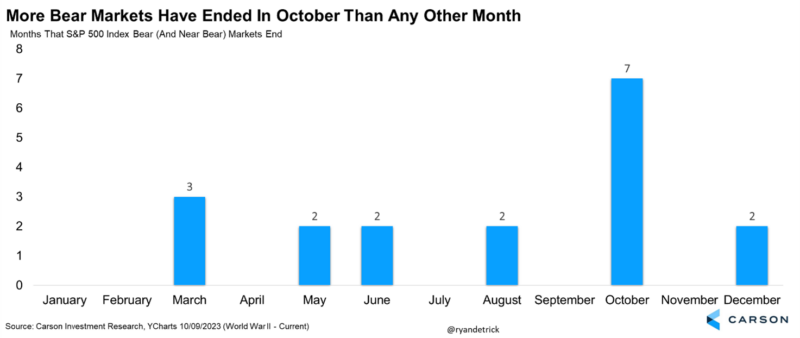

Stocks Tend To Bottom In October

Second, including last year’s bear market, 7 of the past 18 bear markets ended in October. Our friends at Bespoke reported that out of 60 corrections since 1945 (declines of 10% or more), 18 of them ended in October. The bottom line is we are much more likely to see a major low take place in October than a market crash, and we think this year will be another major low.

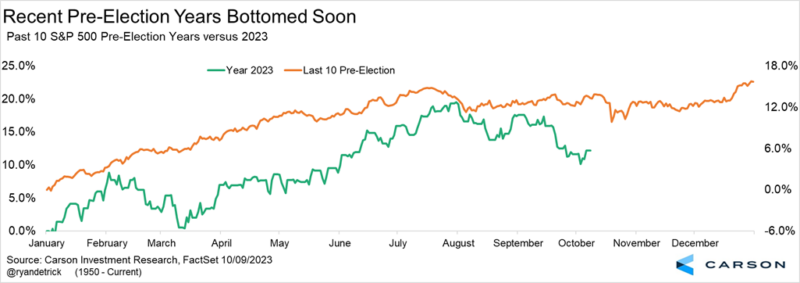

Also, looking at the past 10 pre-election years, stocks tend to bottom around now, right before an end-of-year rally. A major sell-off from here would be quite out of the ordinary.

A Weak September = A Better October

Third, September is historically a bad month for stocks and when the first half of the month is down big, the second half tends to do even worse. That sure played out this year.

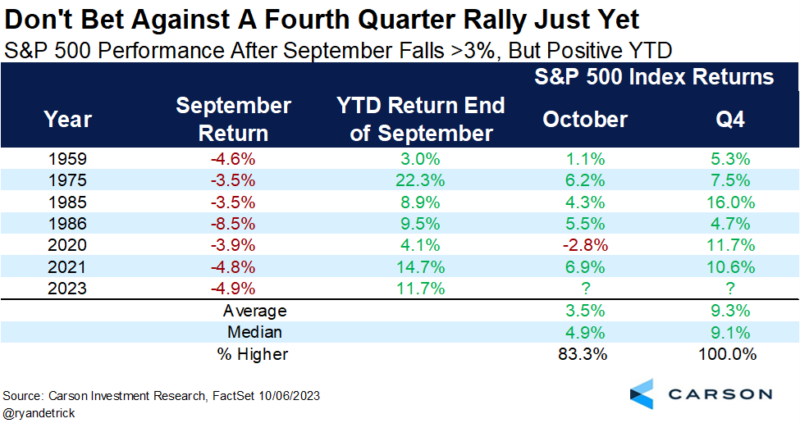

Here’s some good news. When the S&P 500 falls more than 3% in September, but is still higher for the year going into October, a bounce is quite likely. October has gained five out of six times when we’ve seen this and stocks have never been lower in the fourth quarter, with the average return in October and the fourth quarter both up substantially.

Fear Is Everywhere

Fourth, if everyone has already sold, then only buyers are left. Think about one year ago. Things felt horrible, but that is a classic time for a bear market to bottom.

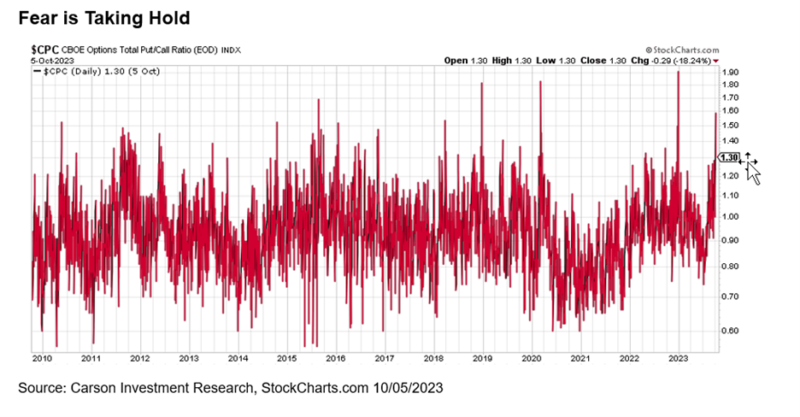

We think we are near a peak in negative sentiment, which could be another clue stocks won’t crash in October. One sentiment indicator we watch is the put/call ratio. On Wednesday of last week, we saw a huge spike in the CBOE Composite put/call ratio, one of the largest spikes ever going back two decades. That’s a lot of fear.

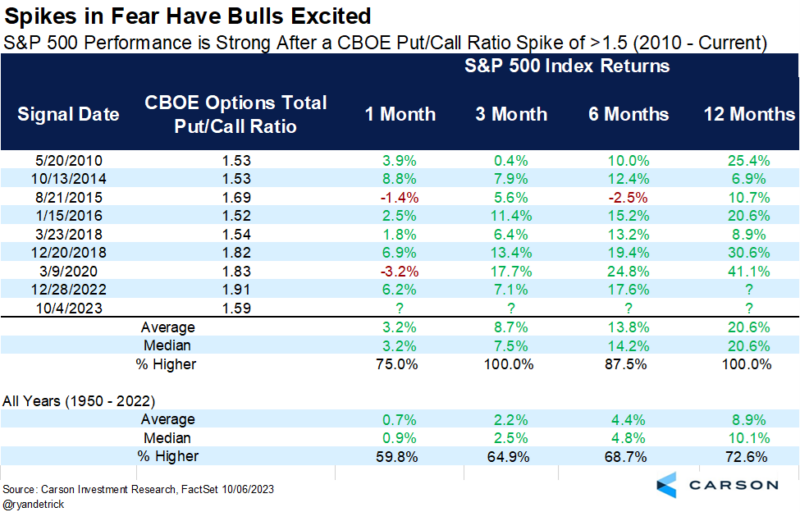

Here’s some examples of when we’ve seen the CBOE Composite put/call ratio spike above 1.5 since 2010. As you can see, this is quite a rare signal, but also very bullish, as stocks have never been lower a year later and in fact have averaged more than 20% higher.

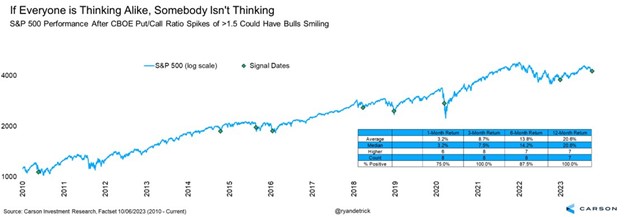

Here’s the same data, but overlayed on the S&P 500. Again, these signals have tended to come near significant market lows.

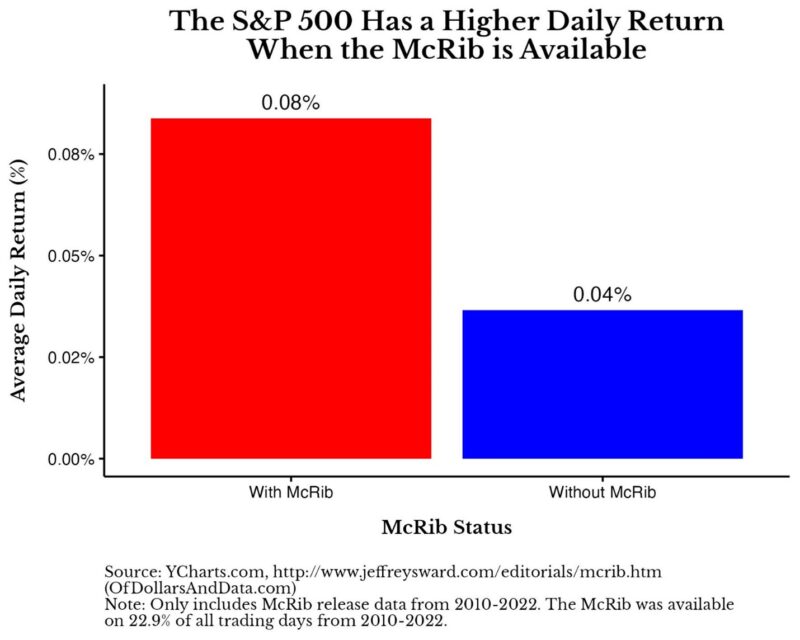

The McRib Is Back

Here’s a bonus reason we believe stocks won’t crash, and of course this one is meant to be fun. It turns out stocks do much better when the McRib is being sold. Given McDonald’s just brought it back (when they said it was gone forever), this could be another reason stocks can surprise higher in October. Thanks to my friend Nick Maggiulli for this one.

Wrapping It All Up

Yes, there is a lot of fear out there, but there’s an old saying that the market climbs a wall of worry. In late July, after one of the best starts to a year ever, there wasn’t a lot of worry out there. Now after seasonal weakness there are many worries building up. Given the economy remains on strong footing, we continue to expect stocks to make a major low soon and we believe we will likely see a nice fourth quarter rally.

1929711-1023-A