“It is human nature to overestimate risk and underestimate opportunity.” Jeff Bezos, Executive Chairman and Former CEO, Amazon

What an end to April, and May is off to a strong start as well. In fact, the S&P 500 finished higher the last seven days of April, trying the longest win streak to end that month ever. It didn’t end there though, as stocks gained the first two days of May too, for an incredible nine-day win streak, the longest since November 2004.

How Large Was April’s Reversal?

In the end, the S&P 500 fell less than 1% in April, but it was anything but easy for investors. In fact, during the second week of April stocks were down more than 20% intraday off of the February peak, causing historic worry and bearishness. Just in April, the S&P 500 was down more than 11% for the month at the lows, but then managed to close up more than 10% off of those lows. The last time we saw a reversal anything like that was in March 2020 and the lows of the Covid bear market.

We found six other times the S&P 500 was down at least 10% in a month, but finished more than 10% off the monthly low. Potential weakness or choppiness is normal in the near term, but a year later stocks have never been lower, up more than 22% on average. As we discussed last week, there were multiple rare bullish signals and the lows for 2025 are likely in, but this doesn’t mean it will be straight up and some back-and-forth volatility would be perfectly normal.

Where Did the Bulls Go?

We’ve noted many times over the past month that sentiment in many cases was about as bearish as we’ve seen and that was potentially a bullish driver on any good news. Well, we saw the reversal last week, but we continue to see signs that overall sentiment is still quite dour, which again is bullish from a contrarian point of view.

Barron’s over the weekend released their latest Barron’s Big Money poll (which comes out in October and April) and it showed the most bears in the poll going back nearly 30 years! Compare this with six months ago when bulls were everywhere and the masses expected continued explosive growth for investors in the US, and sure enough that hasn’t worked, as the US is one of the very few stock markets this year that is down on the year. Well, here we are six months later and we view this complete 180 as another reason to expect potentially better times ahead.

When Do Nine-Day Win Streaks Happen?

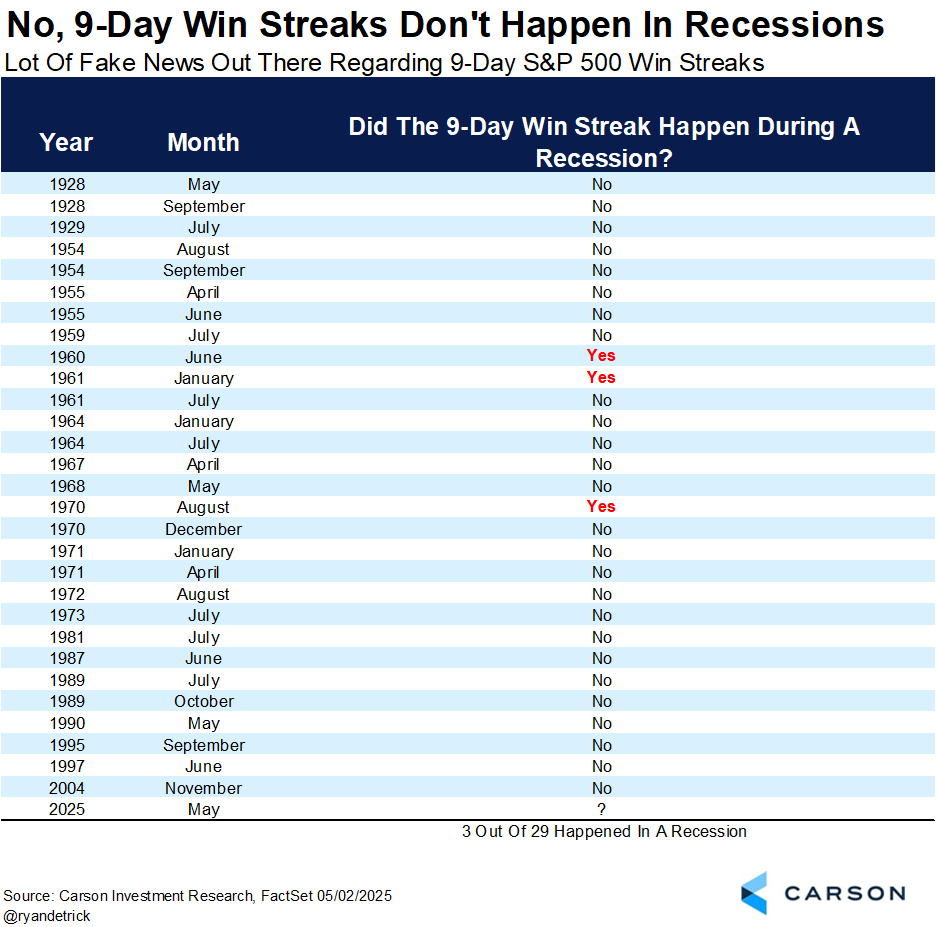

Social media was abuzz that long win streaks (like we just saw) only happen during recessions or bear markets. Well, the good news is that simply isn’t true. It really upsets me that people with large followings simply lie, knowing it isn’t true, which leads many average investors to make poor investment decisions. All we can do around here is continue to share honest research, trying our best to combat those trying to sell a newsletter.

Here I found all the months that had a nine-day win streak for the S&P 500 and how often the strength occurred in a recession. Well, we were told this happens 80% of the time, but using the actual data showed only three times out of 29 did a nine-day rally take place in a recession. Be careful who you follow out there.

Another Clue the Lows Are in for 2025

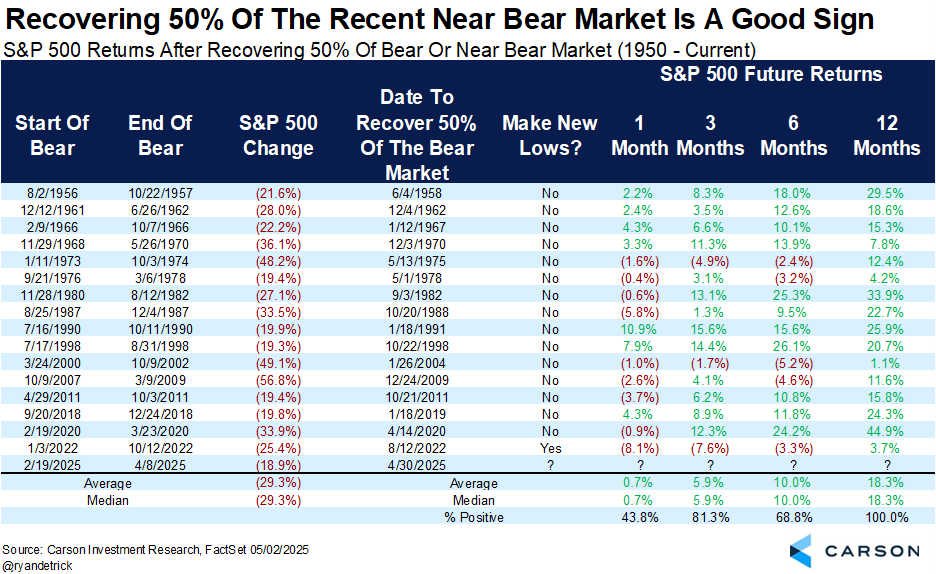

The S&P 500 fell 18.9% from the February 19 peak to the April 8 lows, in what we are calling a near-bear market. Trust me, if you were there it sure felt like a bear market, as investors were battered and bruised for sure.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The good news is stocks have recovered half of that near-bear market, potentially a good sign. In fact, looking at the past 16 bear or near bear markets only once did stocks go on to make new lows after half of the bear market was recovered. Of course, that was the very last time, in 2022, but this is still a good sign. Lastly, a year later stocks were higher an incredible 16 out of 16 times after recovering half of the bear (or near bear) market.

Think about what we’ve seen in the last month:

- Widespread over-the-top negativity

- Strong buying thrusts (discussed recently)

- A historic reversal in April

- With some good news on the trade front sprinkled in

I joined CNBC’s Power Lunch last week to discuss many of these concepts. Thanks for reading!

For more content by Ryan Detrick, Chief Market Strategist click here.

7937911.1-0525-A