“AI is no longer science fiction; it’s science fact. It’s woven seamlessly into the fabric of our daily lives, from the moment we wake up to the moment we go to sleep.” – Fei-Fei Li, Stanford University

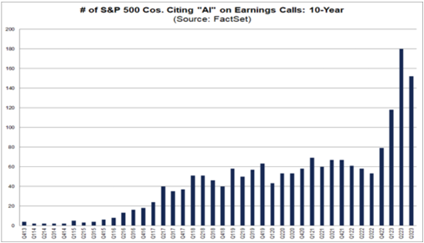

This earnings season has highlighted how rapidly artificial intelligence is becoming a ‘real thing.’ The last several years have witnessed the market go bananas over hot topics, like when Facebook rebranded to Meta because the Metaverse was the next big thing. For a six-month stretch, the rush to establish a foothold in the digital universe was palpable among CEOs, but that discussion, along with GameStop and NFTs, faded into memory. That’s not the case with AI, and the financial impact is already becoming evident.

Just a few months ago, AMD anticipated AI-related revenues exceeding $2 billion in 2024; today, those expectations have surged to $3.5 billion. Microsoft’s cloud-based AI tools swiftly reached a $4 billion run-rate within a month of launch, and demand is surging. Analyst’s estimates for NVIDIA’s 2026 sales have skyrocketed from $40 billion to $110 billion over the past year. Major players like Amazon, Meta, Alphabet, Apple, and Tesla expect to generate substantial sales in AI-related products in the next several years. The advent of generative AI marks a breakthrough in computational power, unmatched by previous generations. Contrary to being a speculative bubble or a “trade that’s run too far,” AI is delivering tangible results and offers a significant opportunity for long-term investors.

The line between AI enablers and AI beneficiaries is starting to blur, as many of the technology giants will be both. For instance, Amazon’s AWS cloud, with its monumental data centers chocked full of cutting edge hardware, powers artificial intelligence for users. However, Amazon is also already using AI to enhance its logistics capabilities and is excited about Rufus, its new shopping assistant. It sounds like a gimmick, but Rufus will help reduce billions of dollars Amazon spends on search and social media advertising. Amazon’s retail business posted the most profitable quarter in years, in part because of the efficiency AI affords. CEO Andy Jassy believes that AI services could drive “tens of billions of dollars” in revenue. Of course, the demand for AI is an enormous benefit to its cloud services, but the benefits of employing AI are also impactful and almost immediate.

Clearly, Microsoft and Nvidia are enjoying early leads in the space as some of AI’s most prominent enablers. However, as this nascent technology becomes ubiquitous, the opportunity for businesses in every sector are enormous. Take farming for instance, where technology is readily embraced to combat problems like labor shortages, changing weather patterns, and inflation of key inputs. For decades, farming has become more mechanized and automated, but artificial intelligence promises a transformation. As an example, AI can not only detect weeds emerging before they’re visible to the human eye, but it can also direct a drone to deliver a drop of potent herbicide precisely on target. Precision AI, a Canadian startup, is developing this technology and estimates it can reduce chemical input by up to 90%. A reduction of that magnitude would dramatically alter the economics of growing crops.

Of course there are radical ideas that come with any novel technology, such as self-driving cars, elderly care from robots, and implants powered by our brains. All of these are in development and rightfully deserve investment to bring to reality in the future. However, AI is making an impact now in a variety of ways and already generating profits for companies that are early to adopt it. As the technology moves rapidly from science fiction to reality, it’s delivering measurable financial benefits to firms which should ultimately benefit investors.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more of Jake’s thoughts click here.

2111253-224-A