We started this year discussing how the economy has been at the “edge of normal” in our 2023 outlook. The good news is that we have slowly but surely moved towards normal since then, even in the face of a banking crisis and debt ceiling drama. The “soft” economic data from sentiment surveys have been poor, but the “hard” data that measure actual employment, sales, and production, have painted a much brighter picture.

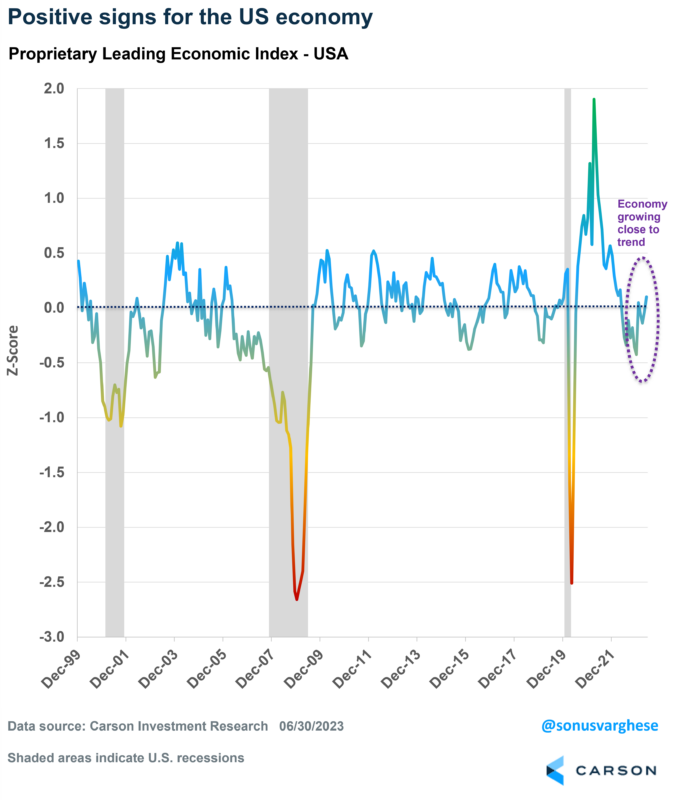

We discussed last month how we combine a lot of the economic data into our own proprietary leading economic index (LEI), which we produce for 30 countries around the world, each one custom-built to capture the dynamics of those economies. The individual country LEIs are also subsequently rolled up into a global index to give us a picture of the global economy. The idea is to give us an early warning signal about economic turning points. Simply put, it tells us what the economy is doing today and what it is likely to do in the near future.

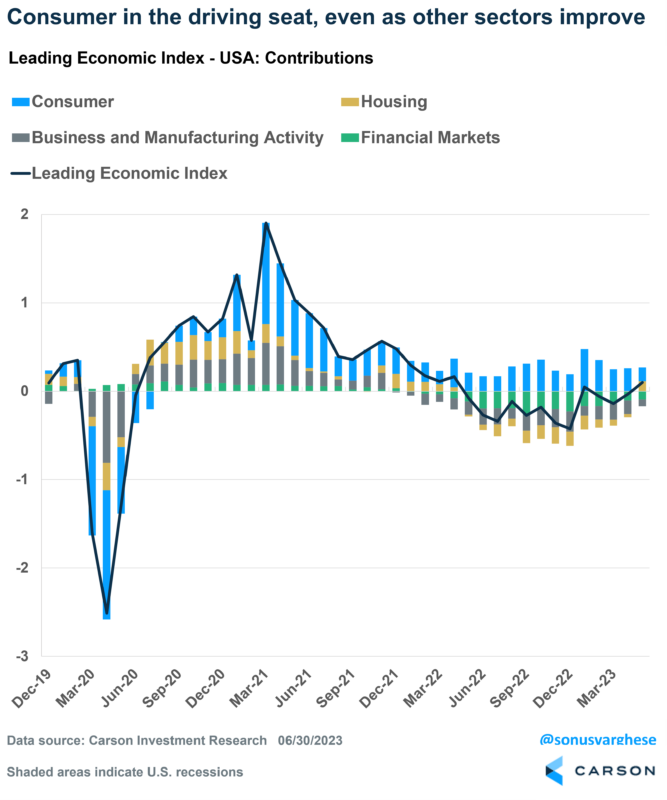

For example, our index for the U.S. includes 20+ components, including consumer-related indicators (which make up 50% of the index), housing activity, business and manufacturing activity, as well as sentiment and financial markets data. This contrasts with other popular LEIs, which are premised on the fact that the manufacturing sector and business activity/sentiment are leading indicators of the economy. This worked well in the past but is probably not indicative of what’s happening in the economy right now.

Right now, our LEI suggests the US economy is growing along trend, or slightly above it. The economic picture looks even better than it did at the end of 2022. Six months ago, the risk of recession was higher, though even then, the LEI didn’t say that we were in a recession, or even very close to one.

However, we’re seeing some interesting dynamics under the hood.

2022 Headwinds are Fading

As I mentioned above, our LEI has been consistently saying that the U.S. economy is not in a recession. That was almost entirely thanks to a resilient consumer, with strong employment gains powering incomes and consumption. Pushing against this was an aggressive Federal Reserve and tighter financial conditions. Consequently, the sector that took the biggest hit last year was housing, followed by a slowdown in business spending and manufacturing activity.

But a turnaround looks to be happening now.

As you can see below, the LEI has been rebounding over the last few months. That’s come on the back of declining headwinds from housing (yellow), business/manufacturing activity (green), and financial conditions.

In fact, housing has moved to being a positive contributor! We’ve written about how why we believe housing will no longer be a drag on the economy after 8 straight quarters of pulling GDP growth lower. Even business activity is exerting a lower drag on the economy – we just wrote last week about how investment has been rising recently, hopefully signaling a bottom.

Financial conditions appear to be easing, especially with the Fed moderating the pace of rate hikes and interest rates inching close to their terminal level for the cycle.

Most importantly, consumption remains positive, though less so than a few months ago. This is not really a concern in my opinion (at least, not yet), as it simply indicates that consumption trends are normalizing. The latest contribution from consumption to our LEI is equivalent to its pre-pandemic contributions.

Ultimately, the big picture is that the economy looks to be finally normalizing after a few years of being whipped around by the pandemic, and its after-effects.

Ryan will provide some brief highlights in our next blog. Keep an eye out for it!

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

0824674-0723-A