Closely Watched Leading Indicators Are Turning, and That May Be Good For Markets

At Carson Investment Research, we have a proprietary set of leading indicators for countries and regions that inform our process and kept us clear of near universal recession calls at the end of 2022. (For the most recent update of our indicators, see our recent blog. For a more comprehensive look at our 2024 market outlook and how our leading indicators contributed to it, see our recently released Outlook ’24: Seeing Eye to Eye.) But we still pay attention to the widely covered Conference Board Leading Economic Index (LEI), which we view as informative but less powerful as a recession indicator than it once was.

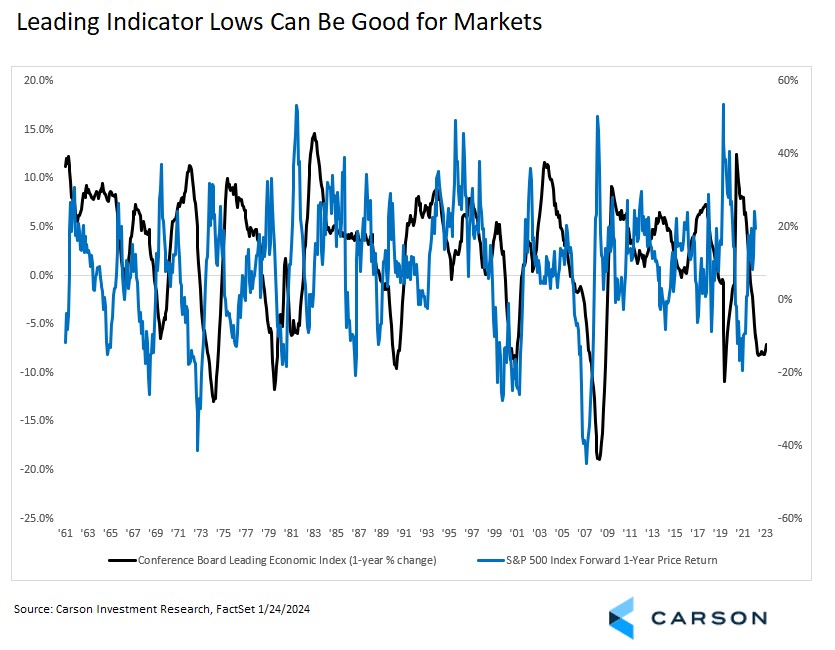

The Conference Board’s LEI is in an interesting place. As of its most recent update it’s been negative monthly for 22 consecutive months, a streak topped only by the Great Financial Crisis (24 months) going back to the index’s inception in 1960. The streak itself isn’t all that significant, since sometimes there’s a noisy month that’s ok within a larger period of weakness, but the continued overall decline is significant, enough so that the Conference Board still views it to be suggesting an elevated likelihood of a recession. What’s more interesting to us right now is that the decline in the LEI has slowed. In fact, the one-year decline bottomed almost a year ago, in April 2023, and while still low is showing clear signs of turning. We expect to see more improvement over the year as the yield curve starts to steepen as the Federal Reserve cuts rates among some initial signs of improvement in manufacturing surveys.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

As seen below, the one-year change in the LEI is generally a lagging indicator of market performance over the next year. This makes perfect sense, since the S&P 500 is a leading indicator for the economy and part of the LEI. This provides at least a caution in using the LEI as a market forecaster, since that would mean using the market (in part) to forecast the economy to in turn forecast the market. At best this tells you to pay attention to market momentum to understand what may happen next, but we would look for an outstanding technical analyst to interpret the totality of market signals. (We happen to have one of the best in our own Chief Market Strategist Ryan Detrick.)

From our perspective, leading indicators are constructed to be mean reverting, and when they are overextended but bottoming, it’s signaling potential improvement ahead, which we would expect to be good for markets. Of course, this isn’t always true. For example, the US recession in 2001 was fairly mild, but it still took markets some time to work through historic valuation extremes even as the economy recovered. But in this case, based on what we see across the economy, we think the standard pattern should hold.

While the Conference Board LEI itself isn’t calling for an economic rebound, from a market perspective we think the marginal improvement off year-over-year lows is meaningful and consistent with our 2024 S&P 500 return forecast of 11-13%. We’re not expecting blockbuster returns after a strong 2023. (Remember, the LEI started improving year over year back in May.) But we think the economic backdrop is likely to support solid market gains. If our proprietary LEI tells us anything different, we’ll let you know.

For more of Barry’s thoughts click here.

02085897-0124-A