“Just a small town girl, livin’ in a lonely world. She took the midnight train goin’ anywhere… Don’t stop believin’, hold on to that feelin’.” Journey, “Don’t Stop Believin’”

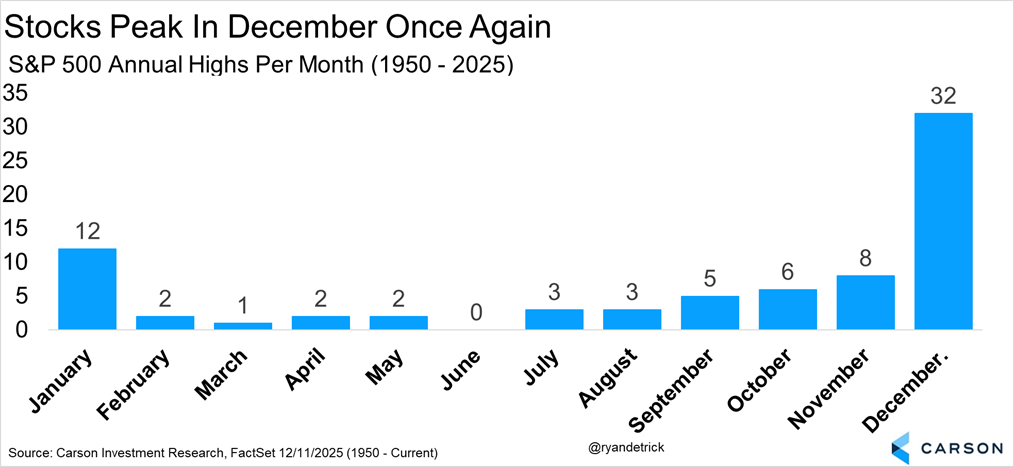

After peaking on October 28 and seeing a more than 5% mild pullback into late November, the S&P 500 moved back to new all-time highs on Thursday of last week. A positive reaction to the Federal Reserve (Fed) cutting rates sparked the recent rally, but it is important to remember that after a 38% rally off the April lows, some type of weakness in November was perfectly normal and even healthy, as we noted at the time. In the end, we didn’t expect stocks to peak for the year in October, as we thought 2025 would be another year that peaked in the last month of the year. And here we are.

What stands out about the recent new highs is how broad based they’ve been. Areas like micro-caps, small caps, midcaps, transports, the Equal Weight S&P 500, and the NYSE Composite all hit new highs last week. We’ve pushed back repeatedly on the idea that this market was top heavy and only led by a few large technology names. It wasn’t ever true. Even with tech and AI names weak, we have been quite encouraged to see the baton passed to other areas of the market. As we like to say, the lifeblood of a bull market is rotation and we are clearly seeing that.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Time for a Santa Rally?

As we noted earlier this month, December is indeed historically one of the stronger months of the year, with gains more than 73% of the time. No month is more likely to be higher and when 2025 is said and done, we think the S&P 500 has a good chance of seeing gains the second half of this month.

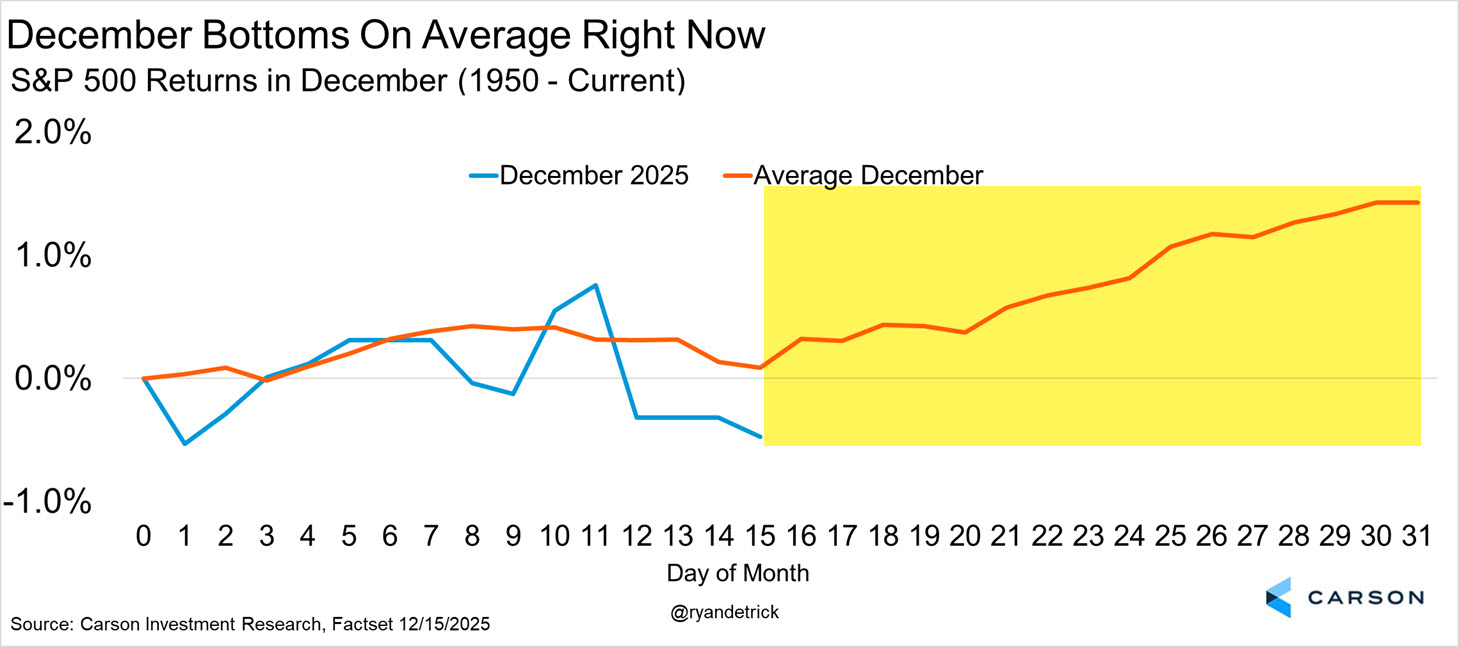

Should we stop believing in a Santa rally? The S&P 500 is pretty much flat the first half of this month after all. We’d say no, keep believing, as December gains typically happen more in the back half of the month and late December strength is perfectly normal. Here’s what the average December since 1950 looks like, with gains tending to happen in the latter part of the month as we get closer to the holidays.

Don’t Fight the Fed

So don’t stop believing in the near term, but what about bigger picture? Well, the bulls appear to still be in firm control and we think you shouldn’t stop believing there either.

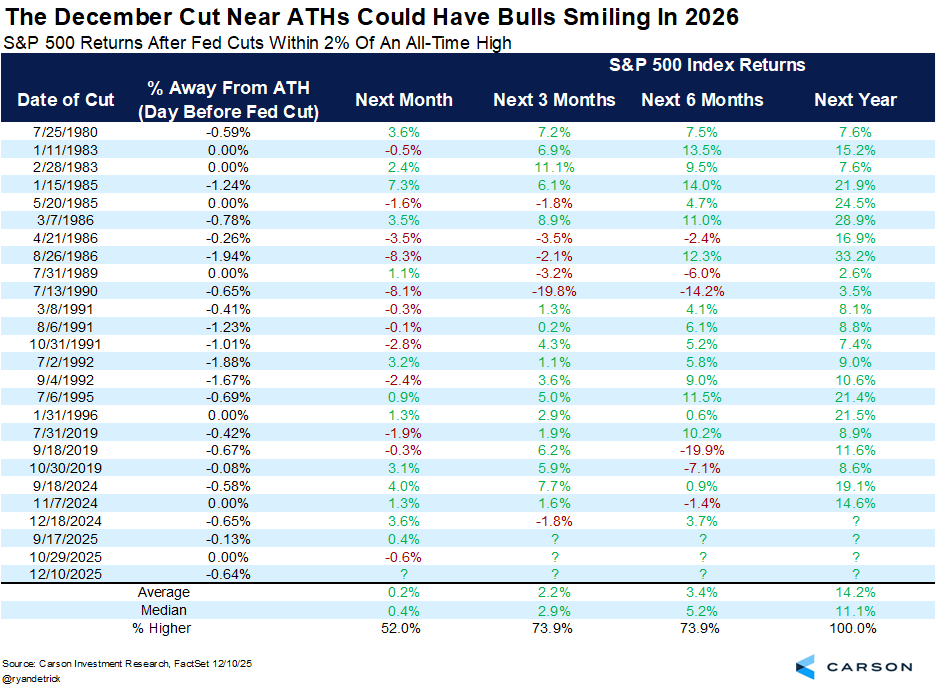

The Fed cut interest rates for the third time this year last week and the bottom line is this cut took place near all-time highs, which could have the bulls smiling.

We found 22 other times the Fed cut interest rates when the S&P 500 was within 2% of an all-time high (based on the prior day’s close) and stocks were higher a year later 22 out of 22 times and up more than 14% on average. “Don’t fight the Fed” is an old Wall Street saying and we think there’s some genuine truth to it. If the Fed is hiking (like in 2022) then there can be headwinds, but if they are dovish (like now) that very well could be a tailwind for investors in 2026.

Thanks as always for reading! We appreciate you taking the time to see what our team has to say and it means a lot. Lastly, go read that quote at the top of this blog again from “Don’t Stop Believin’” and try to do it withing singing the song in your head. Bet you can’t do it 😉

Happy holiday season and stay warm out there!

For more content by Ryan Detrick, Chief Market Strategist click here.

8667949.1. – 16DEC25A