Today is the Ides of March, as March 15 is called. Known best for the day on which Julius Caeser was assassinated, it was also celebrated in pagan antiquity as the Feast of Anna Perenna, the goddess of the Wheel of the Year, and marked the end of the New Year festivities. March was the first month of the year then, but we don’t mind a longer celebration. As we hit mid-March, with the first quarter winding down, it does feel like a time when the year is transitioning from being “new” to the story for the year playing out.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For the S&P 500 so far it’s been a very solid quarter but not overwhelming, and that’s actually been the sweet spot historically for gains over the next three months. As of yesterday’s close, the S&P 500 Index price was up 8.0% year to date. Multiply that by four and it would be a fantastic year, but markets don’t work that way. However, something around an 8% gain has pointed to a good year looking forward.

RETURNS ARE GOOD, BUT NOT TOO GOOD

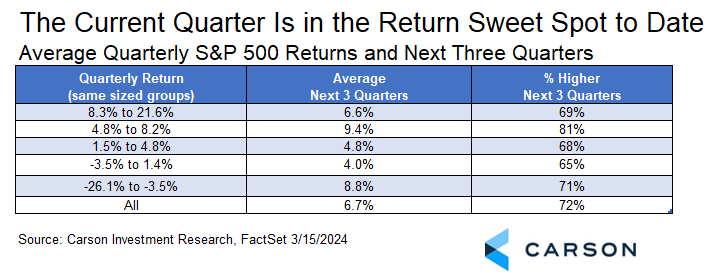

The 8% gain, if that’s where we land at month end, would be in the 78th percentile of all quarters since 1950 (higher is better). We ranked all the quarters since 1950, divided them into five equal groups (best quarters, next best, etc.), and looked at how the S&P 500 performed over the next three quarters. The second group, which is where this quarter’s return sits right now, has historically performed the best over the next three quarters and posted a gain with the greatest frequency.

None of these groups have bad returns, but maybe lower your expectations if one quarter returns are towards the middle. It’s also worth highlighting that the bucket we’re currently in has the lowest variability in returns, while the bottom group has the highest even though it has the second best performance. Low variability is a good thing. And even if we drift in to that top grouping by the end of the quarter, we would be in the lower part of it, where expectations are better.

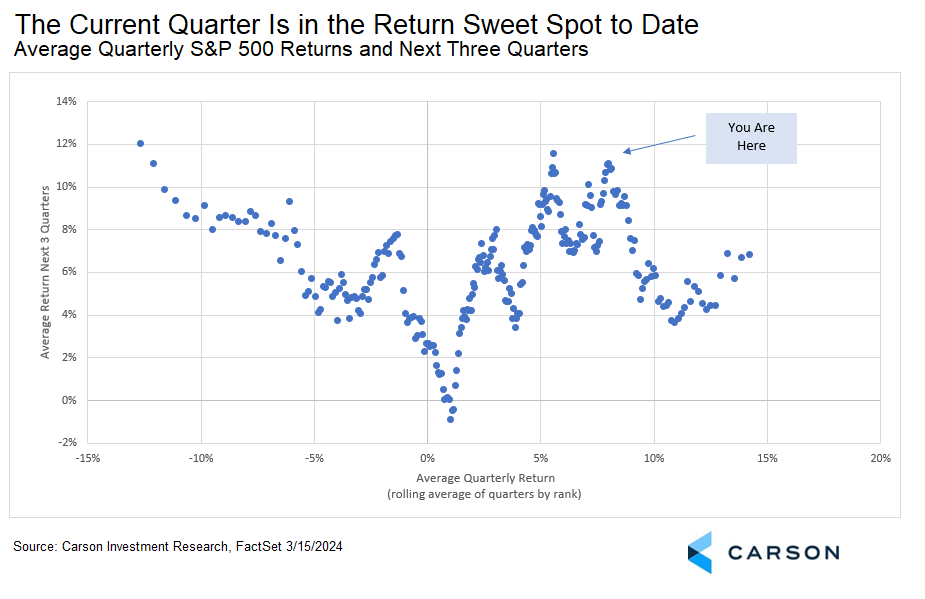

Here’s another way to look at it with more detail, viewing 10% of the data at a time based on rank, so similar quarters are grouped together. Low returns (x-axis) have resulted in better returns over the next three quarters (y-axis). Minimum future expected returns, historically, bottom at around a quarter with a 1% return and gets better from there. The two peaks on the right-hand side are at about 5.5% and 8.0%, but keep in mind that this is an average return of a grouping of quarters, so think of this as about the center of about 10% of the data available. Then things tail off a bit with stronger returns.

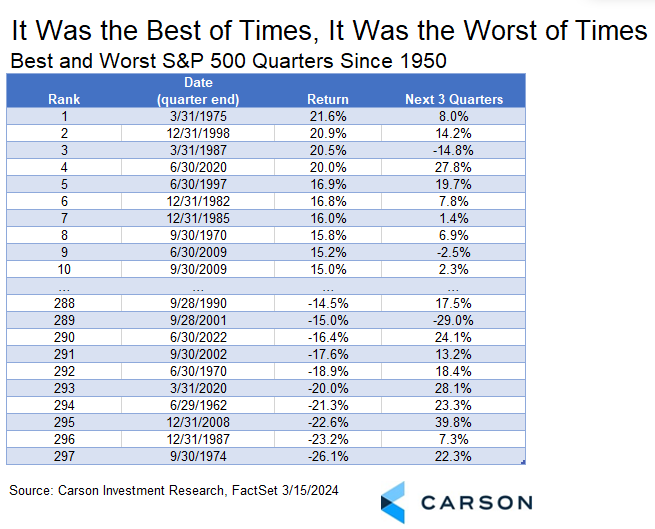

If curious, here are the 10 best and worst quarterly returns for the S&P 500 since 1950 and how the next three quarters looked. Not surprisingly, they generally hold true to form even if this is a very small sample.

This is only one angle on the current environment, but worth paying some attention to. We always look at the preponderance of the evidence when making market calls, and even then always think about what the numbers mean in the current context. But at the very least you can take this away: We shouldn’t be worried about performance over the rest of the year just because the first quarter has been “too good.” If anything, performance over the first quarter as it looks now should be encouraging and there’s plenty more that points to the rest of the year playing out well. We would only caution that with the strength of the rally we’ve seen since the late October 2023 lows, a bit of a pause would be perfectly normal and we wouldn’t be frightened by any near-term volatility.

Overall, we’re still confident about maintaining our Outlook 2024 estimate of stocks gaining between 11-13% this year.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02159663-0324-A