“You won’t lose your job to AI, you’ll lose your job to someone who uses AI.” Jenson Huang, CEO at NVIDIA

I read a lot each week and it seemed like the past few days I’ve come across some very interesting charts or ideas. In today’s blog, I wanted to share some of what I’ve found interesting and I hope you do as well!

Bigger and Better

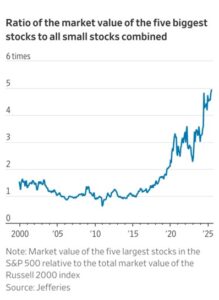

The ratio of the largest companies to the smallest companies continues to increase. It was such a big deal with Apple first crossed $1 trillion in market cap, now it isn’t that big of a deal when other companies do it. Taiwan Semiconductor did it just yesterday and it wasn’t much of a celebration. NIVIDA just crossed $4 trillion and it was a reminder that in bull markets these things tend to happen.

Some have claimed (for years I might add) that it was a bad thing that the largest companies were growing faster than the smallest companies, but I never agreed. I guess the thought was the market was top heavy, but the gains the past few years have turned thinking on its head.

Here’s a nice chart from Jeffries that showed the five largest companies are about five times larger than the smallest companies. Again, I don’t think this is a bad thing, just be sure to invest in the largest companies.

Productivity Soars

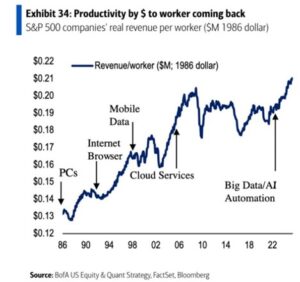

My kids can lock themselves out of our house, text me while I’m on an airplane, and I can then open up the garage door for them on my phone while 2,000 miles away … all in only a couple of seconds. I have no clue how you put that into the productivity data, but the truth is we are so much more productive than we’ve ever been. In fact, I’m not even writing this blog, AI is doing it. I’m just kidding!

I loved this chart from the BofA team that showed revenue per employee was at an all-time high. In other words, companies are doing more and more per employee than ever before and there’s a good chance this isn’t going to slowdown anytime soon. Read that quote from Jensen above one more time for more on how this will probably all go.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

What Inflation?

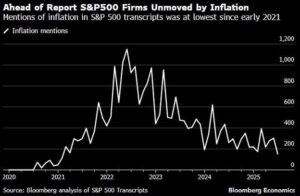

Remember being told how tariffs would mean soaring inflation and a crashing stock market? The good news is neither are happening right now, but there are some signs of inflation showing up where you would expect it (household furnishings, sporting goods, and toys), which you can read all about in this awesome blog from Sonu Varghese, VP, Global Macro Strategist.

Are companies worried about inflation? Apparently not, as the number of mentions about inflation is near the lowest level since 2021, before the huge surge in prices started in 2022. It is earnings season, so this is one we will watch closely, but this surprised me.

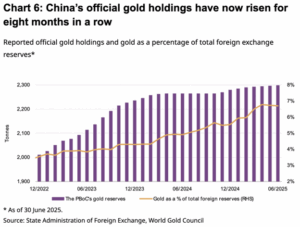

China Is Buying A Lot Of Gold

Gold remains in a bull market and we continue to think having some exposure makes a lot of sense in these uncertain times. In fact, Sonu will write later this week our continued bullish thoughts on the yellow metal.

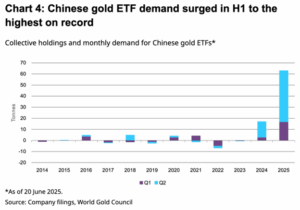

We hear how China is buying a lot of gold, which is true, but they are also buying gold ETFs as well, which I didn’t realize.

Here are two interesting charts from The World Gold Council that sum it all up. The first one shows their gold holdings have increased eight months in a row, while the second one shows their purchasing of gold ETFs have exploded the past two years. When a country the size of China is doing this, it is another reason gold has had the run it has had and likely continues. Again, stay tuned for our latest thoughts on gold later this week.

Message Of The Market Is Bullish

I’m an old school John Murphy disciple and one thing he taught so many of us over the years is the market doesn’t care about our feelings and if you want to succeed, you need to follow the message of the market.

The Carson Investment Research team has been doing this for nearly three years now and it has suggested higher prices were coming and we remain in that camp now. Being bullish hasn’t always been popular, but we aren’t doing this to be popular, we are doing this to help our Carson Partners and their clients.

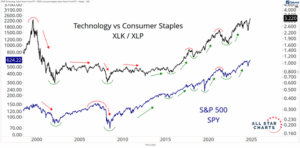

Here are three great ways to show that this bull market is alive and well. Yes, there are scary (sometimes crazy) headlines, but we are seeing the right leadership in the right areas and that is a great sign.

My friend JC Parets of Trendlabs has correctly been bullish for years and here he shows that technology relative to stapes is breaking out to new highs. To see an offensive area like tech doing this relative to a defensive area like staples likely means the overall market will follow higher.

Similar to what JC shared, I like this one from Cam Hui, as it shows things from another angle, as Cam shows that the defensive areas continue to lag overall. This is another healthy sign. I’ll never forget Q4 of ’21 when the defensive stuff started to lead and many investors thought the market could only go up. It was a major warning sign something was changing and many ignored it, which then led to a 25% bear market that lasted 10 months. Fortunately, the defensive stuff is lagging today, just the way we like it.

Thanks for reading and thanks to everyone out there who consistently shares amazing content. There was a time 20 years ago that you had to work at a large bank to get most of the good stuff, now all you need is a free X account. It really is an amazing time to be alive and investing.

For more of our thoughts on inflation (or the lack thereof), but sure to watch our latest Carson Take Five below.

8194207.1.-07.22.25A

For more content by Ryan Detrick, Chief Market Strategist click here