“So, you’re telling me there’s a chance?” Lloyd Christmas in Dumb and Dumber

As I wrote about last week in Houston, We Have A Correction, Now What?, the S&P 500 has been volatile lately and recently moved into a correction (down more than 10%). Today I want to discuss a few more things you should know about stocks in a correction and why panicking right now and selling could be a bad investment decision.

Why a Quick Move into a Correction Could Be a Good Thing

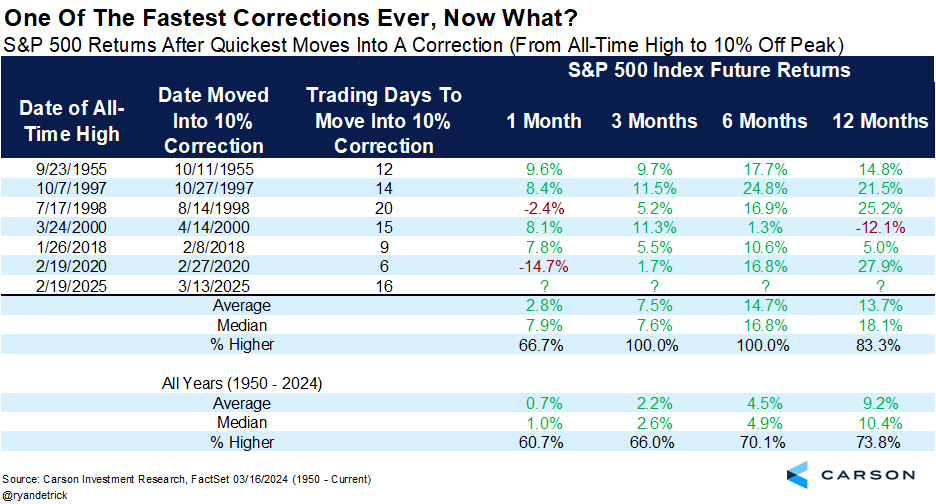

If your head is spinning from being at an all-time high to down more than 10%, then you aren’t alone, as this was one of the quickest trips ever to do just that. In fact, it took only 16 trading days to achieve this dubious feat, but it turns out this isn’t really bad news.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

We found six other corrections off an all-time high that took place in less than one calendar month (or about 21 trading days) and the good news is quick snapbacks are quite common. In fact, the S&P 500 has never been lower three and six months later, with an average return six months later of an extremely impressive 14.7%. Who said roller coasters weren’t fun?

What If This Isn’t the Next Bear Market?

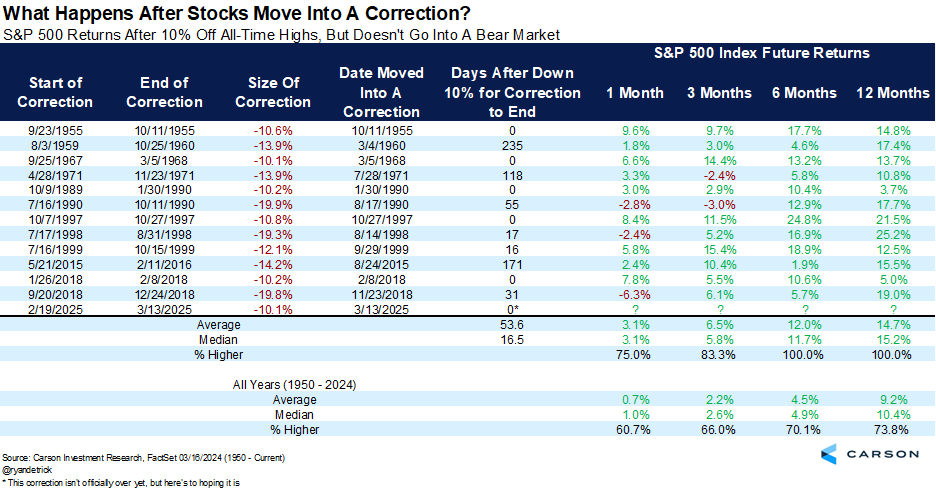

We are on record that this won’t turn into a full-fledged bear market, which means stocks won’t be down 20% or more. That right there is a reason not to sell, but assuming that is the case, we found 12 other times stocks moved from an all-time high into a correction, but didn’t fall into a bear market. Looking into this showed stocks were higher six and 12 months later every single time, with much better than average returns as well.

What I found incredible is that five of those 12 times saw stocks bottom the day they moved into a correction (which in our case would have been Thursday). That is way more than I would have ever expected. Will we do it again? Well since we haven’t violated last Thursday’s low yet, to quote our friend Lloyd Christmas, I’m saying there’s a chance!

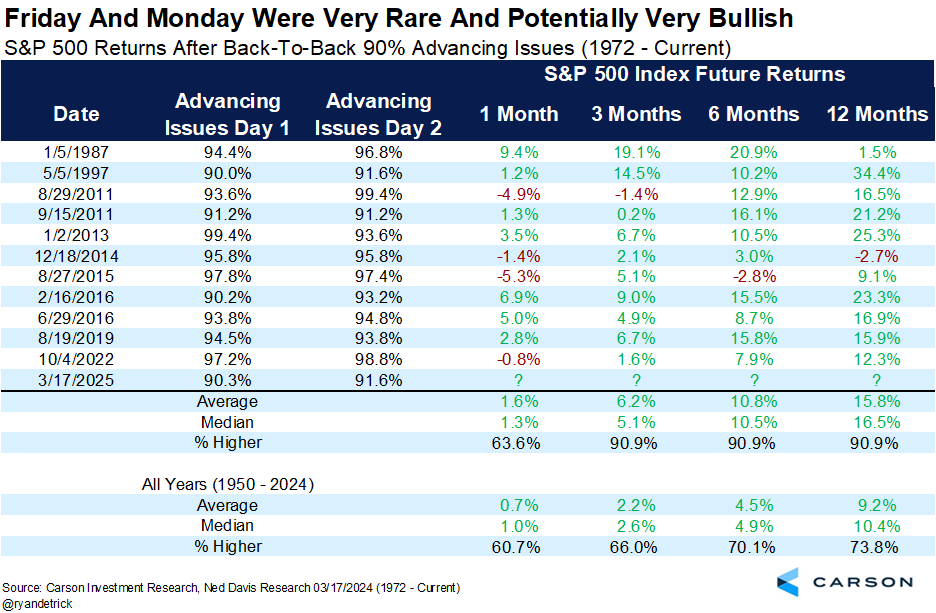

Friday and Monday Were Rare and Potentially Bullish

Some more good news and why you shouldn’t sell right now is we saw a potential buying thrust, consistent with higher prices coming. How do weak markets end? I like to say when the selling stops. Kind of obvious, but with all the negativity we’ve seen anyone who wanted to sell likely has done so, leaving only buyers. Well, the buyers showed up Friday and Monday, as both days saw more than 90% of the components of the S&P 500 higher. This is extremely rare but could be a clue a major low is in place or trying to form.

The last time we saw this was in early October 2022, right as that bear market was ending. You can see on the table below we’ve seen strong returns after previous buying thrusts, with the S&P 500 higher six months later 10 out of 11 times and up nearly 11% on average. This coupled with the data from above suggests the potential for better-than-expected returns over the next six months, which might surprise many investors who are positioned for the worst.

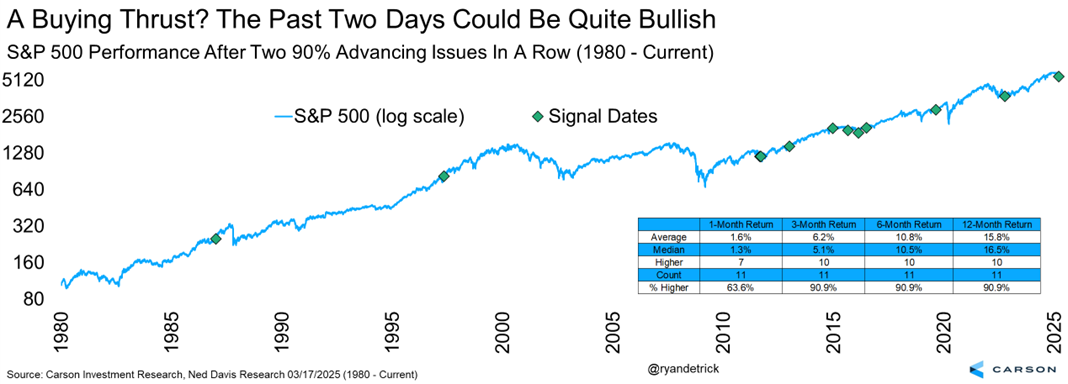

Here’s the same data but in the form of a nice chart of the S&P 500.

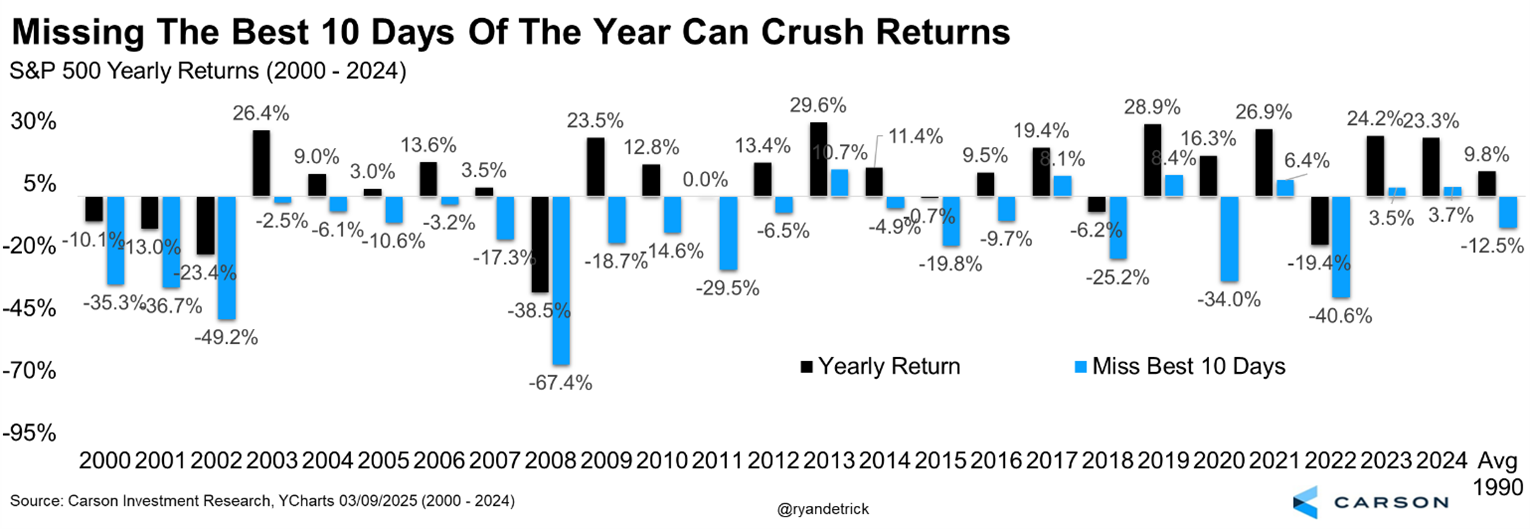

Lastly, a Valuable Reminder

We’ll leave you with this always popular reminder. If you miss out on the 10 best days of the year historically, you will miss out on significant gains. The catch is the best and worst days usually happen close to each other! So if you have to sell after the worst days, it likely means you will miss out on the eventual coming best days. We saw this just last week: Monday last week was the worst day of the year so far, but Friday was the best. Last year stocks gained more than 23% but if you missed the 10 best days that drops to less than 4%. Same thing for 2023. In fact, the average year since 2000 has gained 9.5%, yet drops to negative 12.5% if you missed the best 10 days of the year, a more than 20% drop!

We know this correction doesn’t feel good. Corrections never do. But understanding market history is an important aid in making the decisions needed to achieve long-term investing goals.

Sonu Varghese, VP Global Macro Strategist, and I were honored to join The Bull of Wall Street podcast last week, where we talked about many of these concepts with our friends from The Wealth Consulting Group. We were honored to sit down with their team and we hope you enjoy the conversation as much as we did!

For more content by Ryan Detrick, Chief Market Strategist click here.

7760007-0325-A