“The whole problem with the world is that fools and fanatics are always so certain of themselves, and wiser people so full of doubts.” – Bertrand Russell, British philosopher

First things first — our thoughts go out to everyone that has been impacted by Hurricane Helene and those in the path of Hurricane Milton. If there is anything Carson Group can do, do not hesitate to reach out and stay safe!

The Bull Is Young

This Saturday marks the official two-year birthday of the bull market that stared on October 12, 2022. That was a vicious 25% bear market made worse by also having some of worst bond market performance ever. As long-time readers know, Carson Investment Research has been on record since November of 2022 that the lows were indeed in and prices were going higher, and that the economy would surprise to the upside and avoid a recession. Two years later, we are still saying it 😁.

To be bullish two years ago (and most of 2023) was quite an experience, since any optimism was widely greeted with scorn. The quote above from Bertrand Russell perfectly fits the permabears, who were so certain of a recession and bear market in early 2023, only to see the complete opposite to occur.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

I’ll never quite understand why so many people were bearish, and almost seemed to take joy in rooting for bad things to happen. But fortunately instead we have stocks up more than 60% from those lows and an economy that appears to be warming up, not slowing down.

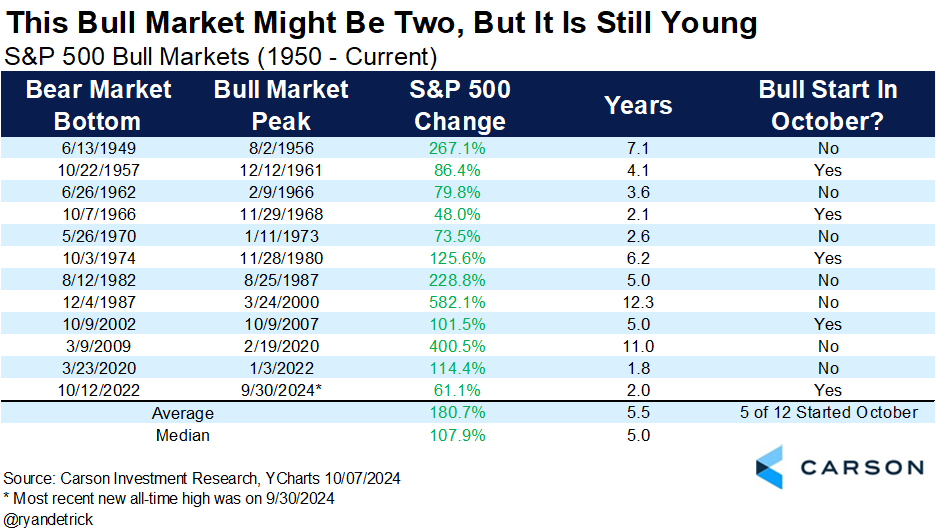

Want some more good news? This bull market is actually quite young. That’s right, a two-year bull market historically has plenty of life left, with the average bull market since 1950 lasting more than five years and gaining more than 180%. How long this bull will last is anyone’s guess, but we remain in the camp that looking out the next six to nine months we simply don’t see any reason to expect a recession or end of the bull market. Will it last another three years? All we will say there is the odds are better than many expect.

A year ago at this time we noted that previous bull markets that made it to one year made it to year two every single time except the post-pandemic bull, and even that one saw a gain of over 100%. Remember, a year ago right now we were told by many that a weak first year to a bull market suggested the end was near, as stocks were barely up more than 20%. We noted this was probably the wrong way to look at it and suggested being open to the possibility of huge gains in year two. Well, after more than 30% gains during the second year of the bull market we would say that indeed was the way to look at things. 🎯

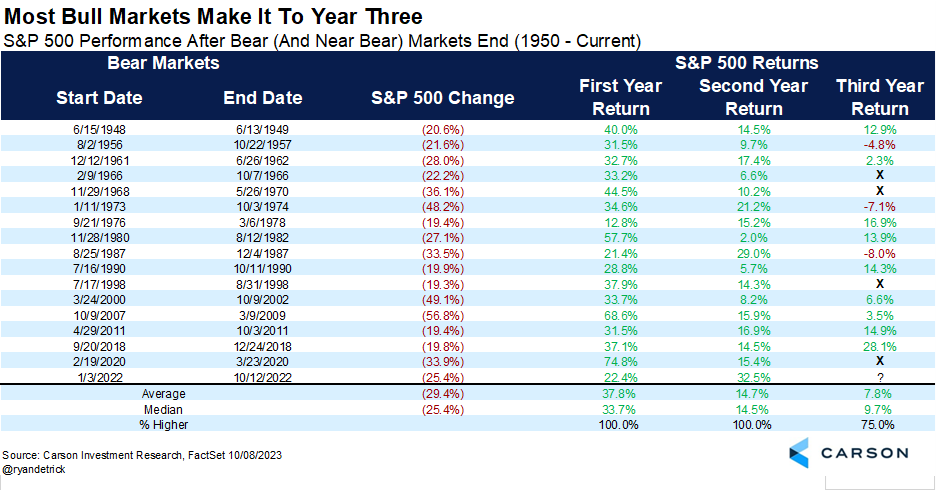

Will this bull market make it to three? We think so, but history would say we should temper our expectations for another 30% gain. We found that out of 16 previous bull markets (after bear or near bear markets), 12 of them made it to their third birthday, with an average gain of about 8% and a median return of nearly 10% in year three, pretty much what your average year does. All in all, we expect stocks to be up at least low double digits over the next year and this study does little to change that view.

Some Bad News

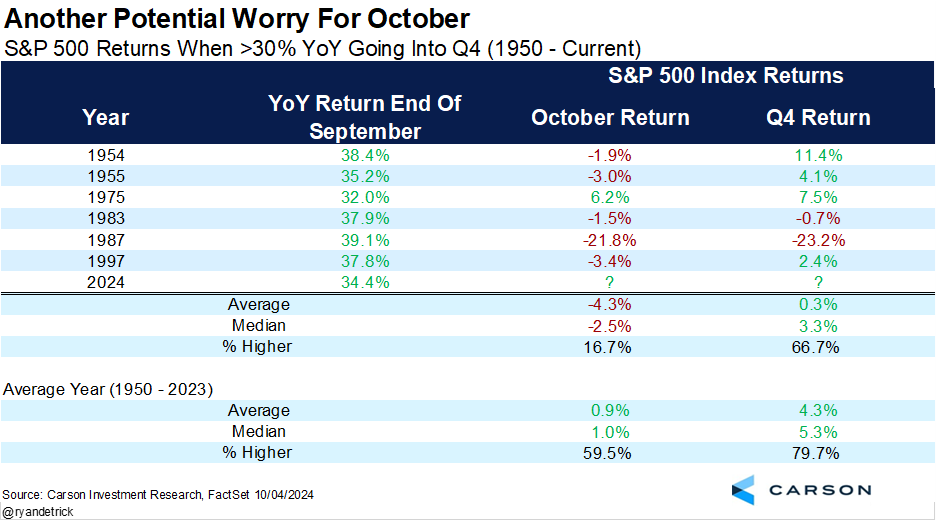

As we laid out last week, October can be volatile and historically the S&P 500 hasn’t done well in October during an election year. The good news is November and December tend to be quite strong after the October seasonal weakness. Turning to times the S&P 500 was up at least 30% the previous 12 calendar months heading into October, there is reason to be on the lookout for some near-term weakness, as stocks fell five out of six times. But it is noteworthy that outside 1987, the S&P 500 did make gains the final two months of the year.

Some More Good News

Big picture though, the underpinnings that got us to new highs and huge gains the past year are still alive and well. We might sound like a broken record, but this is still a bull market, we believe there is not a recession coming, and any weakness should be fairly contained and eventually bring higher prices.

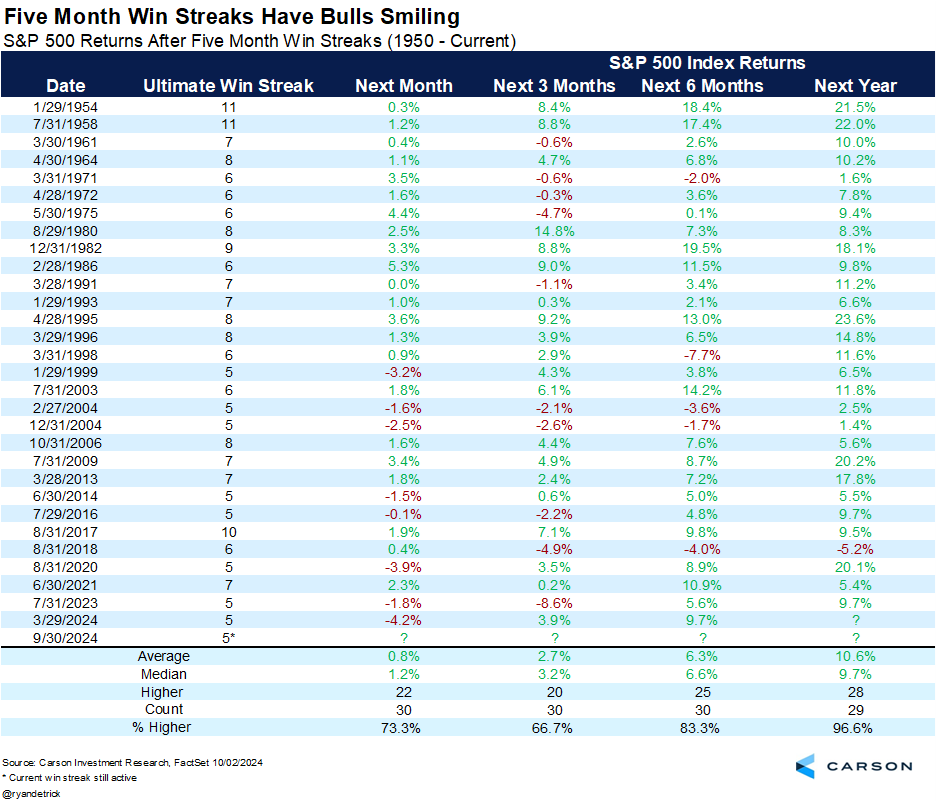

One reason to expect higher prices over the next year? The S&P 500 is up five months in a row. That’s right, it turns out that five-month win streaks tend to happen in bull markets and higher future prices are the hallmark of bull markets.

Going all the way back to 1950, we found 29 other five-month win streaks and stocks were higher a year later 28 times, for a win rate of nearly 97%. Yes, this is just one signal and we would never suggest investing based on a single data point, but looked at in the context of all the bullish signals we continue to see, it further reinforces our overall bullish stance.

Conclusion

So many investors were tricked into believing the constant doom and focused on things like yield curves, LEIs, PMIs, weak breadth, and many other scary sounding warnings, all of which ended up being completely wrong the past two years. Hopefully if you are reading this, then you’ve been on the right side of what has been a tremendous two years for investors. We thank you for reading our research and we will continue to give an honest (and maybe not always in consensus or popular) take on what is really happening out there.

For more of our thoughts on why this bull market has legs, please listen to or watch below our latest episode of Facts vs Feelings.

For more content by Ryan Detrick, Chief Market Strategist click here.

02448954-1001-A