2023 was been a year unlike any other. It had its share of unpredictable shocks, including the regional banking crisis in March and the terrible war in the Middle East.

But it was also a year in which the equity markets and many industry strategists didn’t seem to be seeing eye to eye. Everyone expected a recession and extension of the bear market at the start of the year, followed by one of the best first halves to a year for stocks ever, to the standard year-end rally in the face of October weakness and building skepticism.

Despite all that, it’s amazing how 2023 played out to form. Pre-election years tend to be strong, especially when you have a new president – not to mention that there still hasn’t been a recession in a pre-election year since World War II.

There were ups and downs throughout the year, but it’s incredible how closely markets followed the typical script. And while we certainly don’t think markets are beholden to that script, we think awareness of what it is can help investors do a better job seeing eye to eye with markets.

So, what could be next? In the end, it comes down to the macro backdrop, and we believe the economy is on firm footing. There are places where some are seeing danger, but what some view as slowing, we view as normalizing.

Could we really keep growing at 400,000 jobs a month like last year? No, but a steady 150,000 to 200,000 is perfectly normal and in line with pre-COVID trends. The consumer remains strong, and incomes are growing at a very healthy clip as well. If we can avoid a recession in 2024 (our base case), then we think the chances of a year with potential low double-digit returns or better is quite likely.

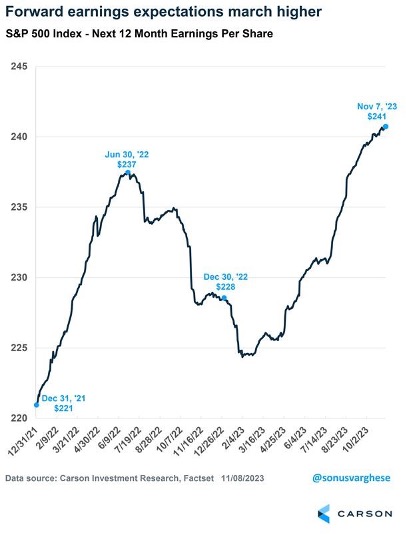

What could help drive stocks higher, and likely even to new all-time highs during the first half of the year? Earnings. We’ve seen analysts continue to come in too low on estimates, and this trend will likely continue. Looking ahead, companies in the S&P 500 now expect to see record profits over the next 12 months. When companies are posting record profits, stocks tend to follow, something we expect to see in 2024.

Potentially even more surprising than expected record profits are improving profit margins. There was a lot of skepticism about margins last year, with expectations that they were too high and must fall. But since March 2023, we’ve seen forward 12-month profit margins increase. Improving profits and profit margins supported by continued economic growth next year would provide a strong tailwind for equities.

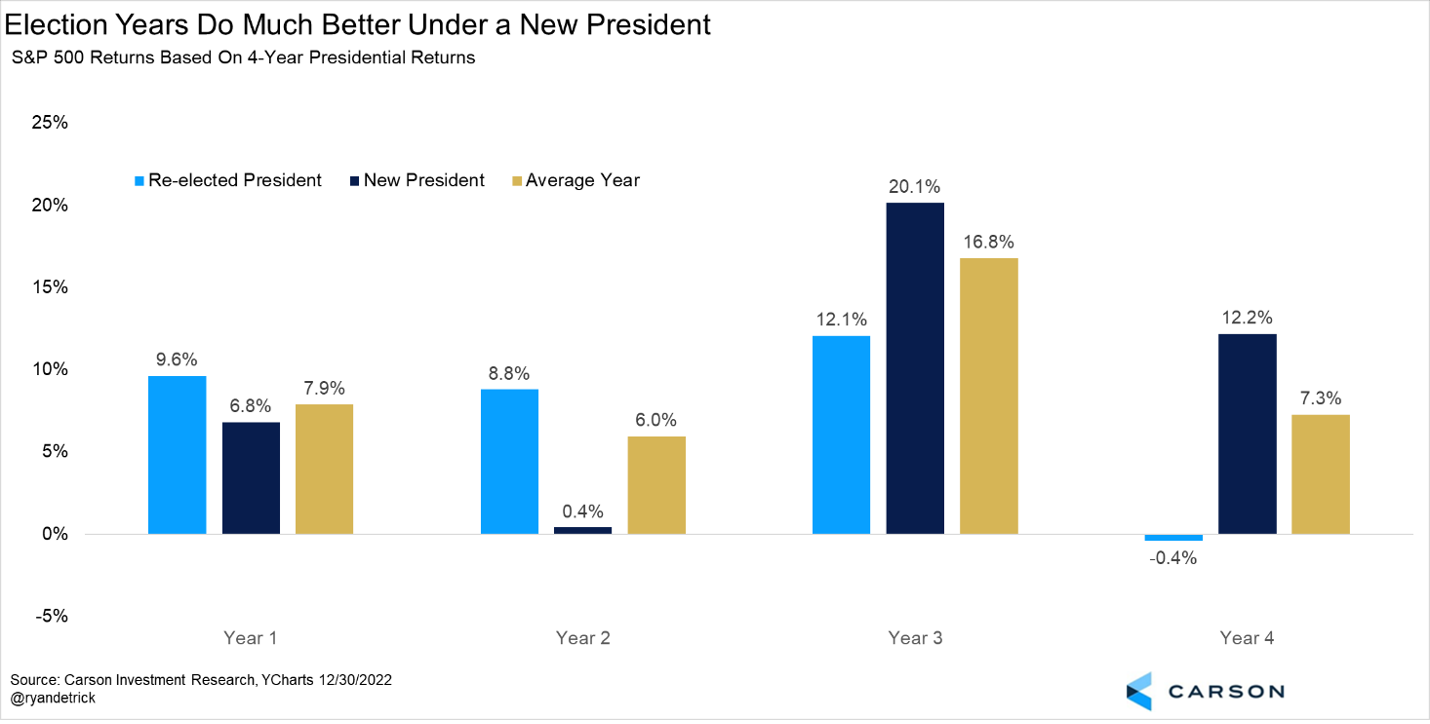

Looking at last year’s “script” and thinking about this year’s, we noted many times in 2023 that a pre-election year tends to see strong equity returns, which played out according to form in 2023. Looking at the broader script for the four-year presidential cycle, under a first-term president, returns tend to be weak early, especially during a midterm year, then get much better during the pre-election year (2023 this cycle) and election year, which is where we are in 2024.

Looking back, markets followed the presidential cycle script, with a very weak midterm year and solid pre-election year. Why do we see this pattern? It could be as simple as this: When a president is up for re-election, there are certain levers they can pull to get the economy – and, thus, stocks – into a better mood. Presidents may also lose political capital late in their second term as “lame duck” presidents – and, in fact, 2000 and 2008 were horrible years for stocks, although we know in both years there was much more going on than the presidential cycle.

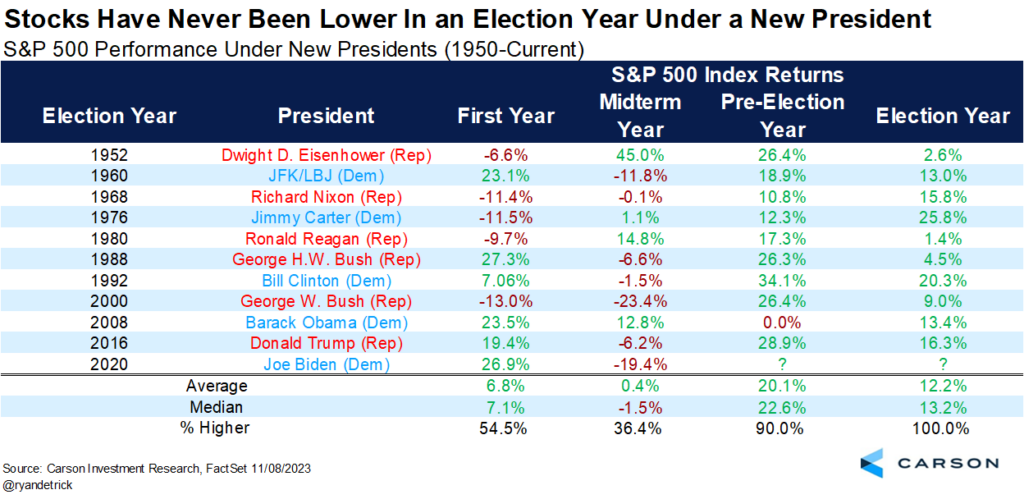

Diving more deeply into the data, stocks have been higher during the election year of a first-term president, which is where we will be in 2024, for the past 10 presidents! Even the historically strong pre-election year hasn’t seen that happen. Election-year gains for the past 10 first-term presidents are 12.2% on average, which gives us more confidence in our fundamentally driven forecast of potential low double-digit return in 2024.

How It Fits into the Bigger Picture

The continuing bull market and election year dynamics are just a couple pieces of the puzzle when it comes to our economic forecast for 2024. See how they fit into the rest of the picture and get other insights by checking out Outlook ’24: Seeing Eye to AI.