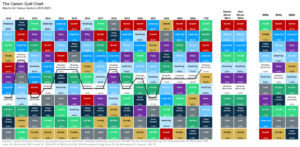

We have come a long way since I last published a Carson Quilt chart, and the situation at that time for market returns was immensely different. Commodities were leading the way, up just 2.1% for the year, followed by fixed income, illustrating how the diversifying parts of a portfolio can be beneficial when the going gets tough. We indicated that one of the simplest and most straightforward ways for investors to protect themselves from volatility, concentration risk, and other concerns is to own a variety of asset classes and stay within an appropriate risk tolerance.

Since the April lows, the market has recovered strongly, but this time not led by high-flying Growth and A.I. names, but by international stocks. Growth has had very strong returns once again and surged off of the lows of the year, but the head start that both developed international and emerging markets had going into that time period has made for a very strong year—so strong in fact, that emerging markets are on pace for their best year since 2017 and have a chance to eclipse returns we haven’t seen on an annual basis since 2007. And don’t forget developed international markets, which are sitting on their best returns since 2009.

On the commodity front, gold has deservingly garnered all the attention, and is still having a historic year (+52%) despite recent volatility. However, elsewhere in commodities, crude oil has logged a -15% return and alongside agriculture (-5%) has pulled down commodity index returns to a still-very-respectable 12.5% YTD. The underlying theme playing out with international stocks and commodity (particularly metals) performance is a declining U.S. dollar, down 8% on the year and heading for its worst year since 2017.

Broad fixed income is having its best year since 2020 yet that still pales in comparison to any other major asset class besides cash. Lost in the strong global stock market returns, a near 7% year-to-date return for high quality fixed income is nothing to bat an eye at, with certain areas of credit doing even better.

Putting this all together, a traditional well-balanced moderate portfolio of 60% stocks and 40% fixed income/cash—what we use as our moderate benchmark—has returned 14%! That is lagging just behind U.S. Large Cap stocks with much lower volatility. Diversification has paid off, despite small, mid-cap, and value stocks lagging the overall market (but again, with strong absolute returns). The headlines may indicate otherwise, but this has been an outstanding year for markets across the board, and therefore an outstanding year for a diversified portfolio. As we enter the best period of the year for market returns, stocks will likely continue to surprise and disappoint those offsides or under-allocated.

8576795.1.-05NOV2025A

For more content by Grant Engelbart, VP, Investment Strategist click here.

Past Performance does not guarantee future results.