“Wake me up when September ends.” Green Day

The S&P 500 moved back to new highs last week and gained in the month of August during a president’s second term for the first time since 1950, so that’s the good news. The bad news: summer is over and we aren’t out of the woods yet, as September is the worst month of the year and the chances for some volatility over the coming month or so is high.

What a Summer

Remember in early April when all those economists were telling us a recession would be here by now? I sure do. Yeah, they couldn’t have been more wrong, as the economy continues to chug along. Not to mention all the bears promising us a market crash around the globe this summer.

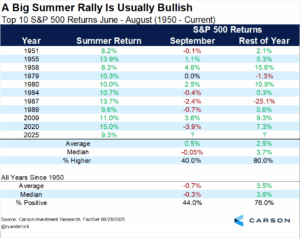

Well, instead we just had one of the best summer rallies (measured by the returns in June, July, and August) in history, with the S&P 500 up 9.3%, which came in as the best summer rally since 2020 and 2009 before that. Here are the top 10 best summer rallies ever and what happened next. All in all, September tends to be weak, while the rest of the year was higher eight out of 10 times.

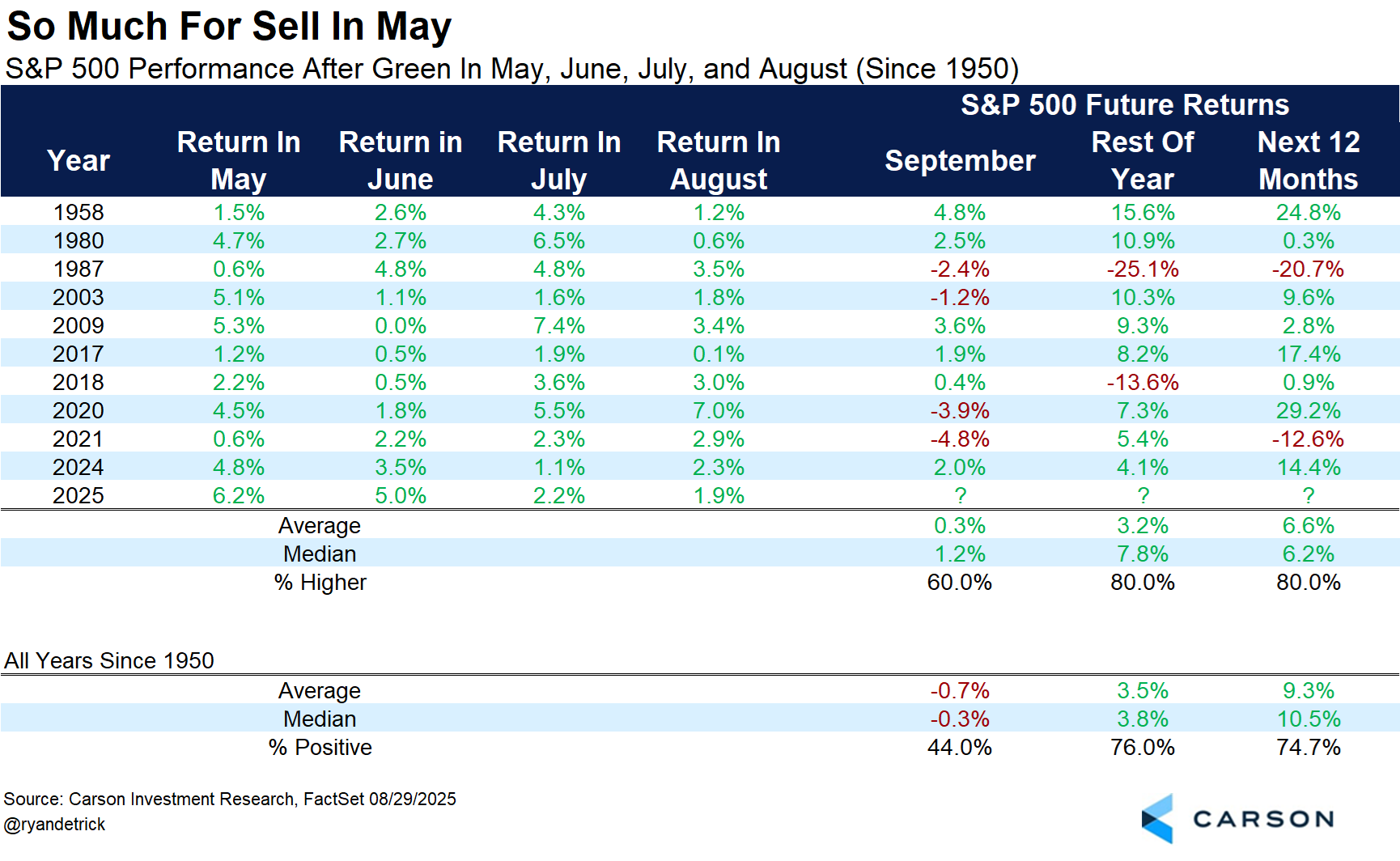

Taking things a step further, the S&P 500 gained in May, June, July, and August this year, which is the second year in a row this rare feat was accomplished. The median return the rest of the year after this is a very impressive 7.8% (over just four months), with the average only 3.2% thanks to the 25.1% drop in 1987 skewing things. All in all, up these four months isn’t bearish for the rest of the year, but going out the next 12 months the returns are actually weaker than normal, something to remember.

The Worst Month of the Year

First off, we’d like to stress this is still a major bull market and we expect higher prices from current levels before the end of the year. None the less, after an impressive four-month win streak and 30% rally from the April lows, the calendar isn’t doing anyone any favors currently. That’s right, welcome to September.

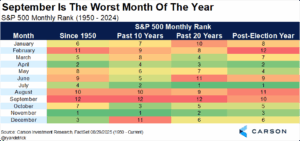

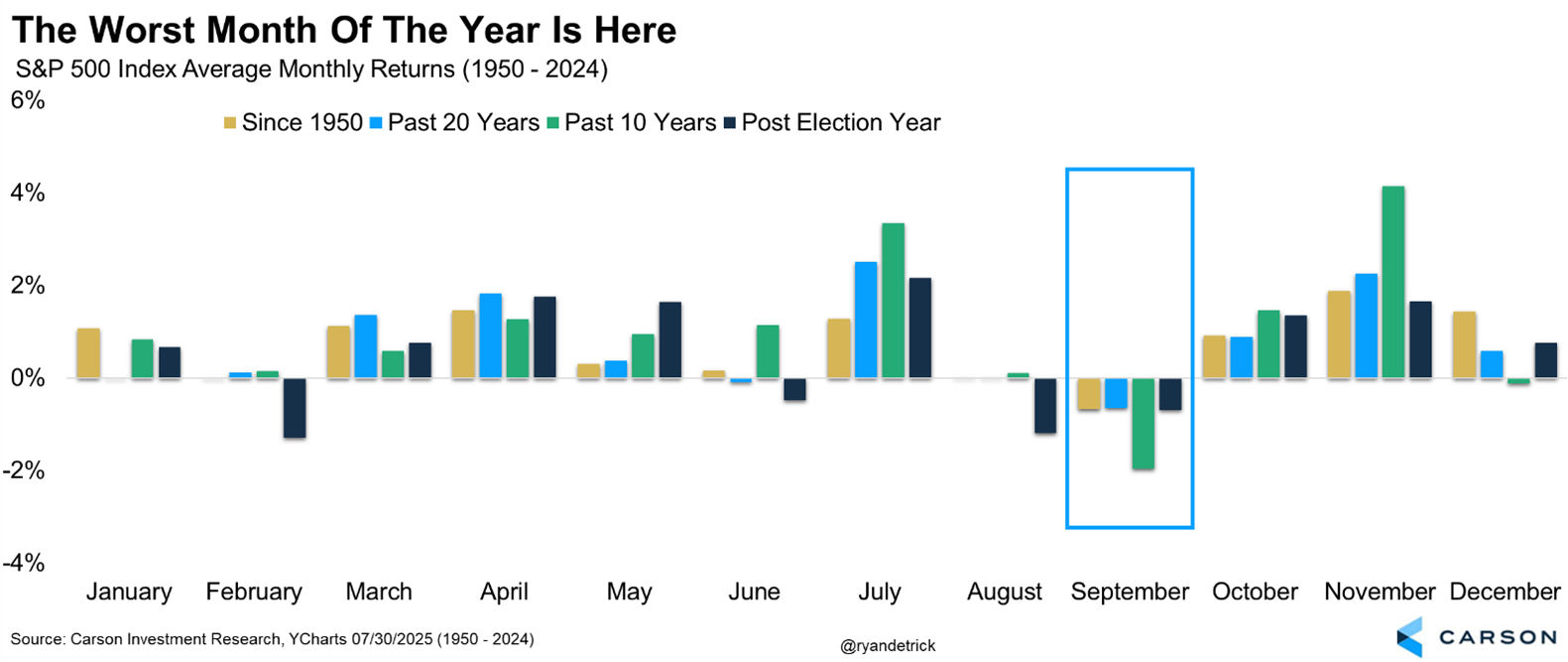

Here’s a nice way to show how weak this month has been historically. It is the worst month since 1950, over the past 10 years, over the past 20 years, and the third worst in a post-election year. We would never invest blindly solely based on calendar effects, but it is better to know about them than not. Of course, we noted a month ago that stocks usually do poorly in August (especially in a post-election year) and the market bucked the trend this year. That’s not completely unexpected—surprises to the upside are just more likely to happen in bull markets. The catalyst this time was Federal Reserve (Fed) Chair Jerome Powell’s dovish pivot in his speech at Jackson Hole on Friday, August 22.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Speaking of post-election years, August was higher this year, but did you know that August and September have both been higher only three times (out of 18) in post-election years since 1950? We aren’t saying stocks can’t move higher this September (it is a bull market after all), but the best way to approach it is to be prepared for some volatility.

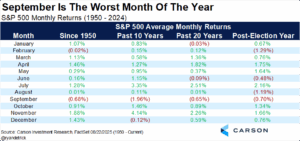

Here’s a similar table as above, but it has the average returns this time. September is indeed the only month to be down on average in all four categories, with no other month down even in three.

Lastly, here is the same data as above, just shown another way to better visualize things. The bottom line: after a historic run, some turbulence this month would be perfectly normal, but with many other reasons to be positive about the outlook, we expect any weakness to be fairly well contained.

Another Warning Sign?

Could a strong August be a warning sign that things got a little too good and it is time for a pause? Maybe Green Day was right about just waking up when this month is over.

Turns out when the S&P 500 gains at least 1% in August and has at least five all-time highs, the month of September has never been higher (lower eight times out of eight).

I was honored to join Scott Wapner on CNBC’s Closing Bell on Friday to discuss September and this bull market. Thanks for reading!

8345100.1.-02SEPT2025A

For more content by Ryan Detrick, Chief Market Strategist click here