At Carson Investment Research, one of our investment pillars is to understand information about market supply and demand dynamics by looking at price action, volume, measures of aggregate breadth, sentiment, and similar data. That’s a fancy way of saying we look at “technicals,” which includes both the collective wisdom of some skilled practitioners and, from a different angle, a vast academic literature around these effects. There’s also considerable controversy around them, but where in the investing world isn’t there a debate? As the saying goes, that’s what makes a market.

The simplest form technicals take is just observing price momentum, traditionally performance from 12 months ago to 1 month ago. While a simple idea in principle, some of the controversy about using momentum is how difficult it is to implement the idea in real time with actual investable securities. In part, this is because momentum investing typically comes with heavy turnover, which brings with it hidden frictional costs from taxes and implicit and explicit trading costs (bid/ask spreads, slippage, direct trading costs, and similar). Most momentum research is also focused on individual equities rather than comparing how different sectors, styles, regions, or factors are performing relative to one another.

One way to get exposure is to use a strategy that specifically aims to get exposure to the “momentum factor” where any trading goes on beneath the surface. There are also “multi-factor” strategies where momentum plays a role but isn’t the sole aim.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Momentum historically has proven to be one of the best performing factors, and there are many funds that explicitly include it as part of a strategy, or even the basis of an entire strategy, although gains have been harder to come by since 2000. Nevertheless, momentum is a factor that we think has a favorable environment right now.

In addition to high turnover and frictional costs, another risk with momentum investing is that while historically it has worked more consistently than other traditional factors such as value, size, quality, profitability, and low volatility, when it doesn’t work it can get hit very hard. Momentum suffers when a market is undergoing internal rotation, and often gets slammed when there is a major market reversal. In 2009, a market-neutral portfolio long momentum stocks and short anti-momentum stocks crashed over 80%. (Data generously shared by Dartmouth University’s Ken French, one of the founders of factor investing and the French part of Fama and French you’ve likely heard of over the years.) On the other hand, in 2022, when the Russell 3000 Index fell 19.2%, the market-neutral momentum portfolio climbed 15.5%, using the same data set. The lesson here isn’t to avoid momentum outright but rather to lean into it judiciously.

Since we don’t select individual stocks in our portfolio process, I did a brief, simply study to get another perspective on momentum. I broke the Russell 3000 Index into four constituent pieces captured by other Russell Indexes: the Russell 1000 Growth Index, the Russell 1000 Value Index, the Russell 2000 Growth Index, and the Russell 2000 Value Index. I also threw in the MSCI EAFE Index of international developed stocks, whose history goes back as far, to provide added perspective. Shared return data goes back to 1979.

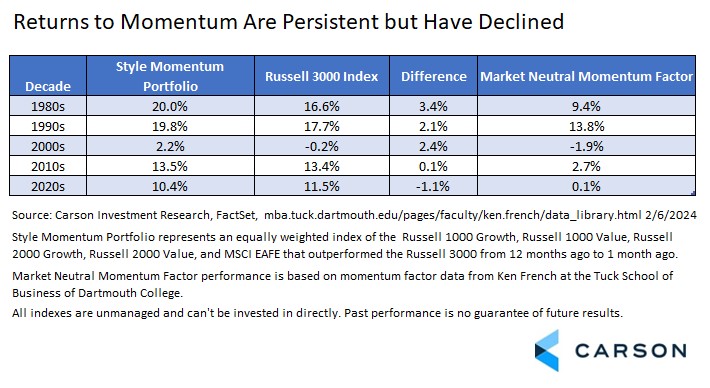

Using the usual “12 months ago to 1 month ago” approach, I created an equally weighted index for any of the five indexes that outperformed the Russell 3000 over the period, calling it the “Style Momentum Portfolio” in the table below. I also added the performance of the individual stock market neutral portfolio, again from Ken French’s data library.

The takeaways:

- Long-term hypothetical performance reflected strength in a momentum approach, although the lack of a strong economic basis for momentum investing has contributed to some of the skepticism about its potential persistence.

- The strength of the effect using both approaches seems to be diminishing over time. If you looked at the longer history of the market neutral momentum factor, it exhibited strong, steady performance since the 1930s that has flattened since around 2000. We have seen this happen to many factors that nevertheless will likely still have some persistence as awareness of the factor creates added demand for exposure and pushes prices closer to fair value.

- The Style Momentum Portfolio underperformed the Russell 3000 in 2021, 2022, and 2023 leaving it slightly underwater for the decade so far despite a strong 2020.

- Looking at momentum on an individual security level seems to add value over comparing broader related buckets of stocks, although some value does seem to persist in the latter too.

- We would not recommend relying exclusively on momentum due to the extreme volatility it can experience when over-investment in momentum stocks breaks, and there is no signal for when that may happen.

For us, these takeaways reinforce why market technicals are a pillar of our investing process, but only one of many. We have high conviction that price dynamics and related indicators can help form a forward-looking view of markets. We also have high conviction that they are insufficient on their own, which is why we also lean heavily into our analysis of the macroeconomic environment, policy, valuations, and market fundamentals. After a difficult period, in the near term momentum does seem to be getting its mojo back, but as with so many allocation problems right now, only if you have a way of maintaining near benchmark exposure to the “Magnificent 7” US megacap stocks relative to broad benchmarks.

For more of Barry’s thoughts click here.

02104359-0224-A