“If Santa should fail to call, bears may come to Broad and Wall.”

—Yale Hirsh

One of the little-known facts about the Santa Claus Rally (SCR) is that it isn’t the entire month of December; it’s actually only seven days. Discovered in 1972 by Yale Hirsch, creator of the Stock Trader’s Almanac (carried on now by his son Jeff Hirsch), the real SCR is the final five trading days of the year and first two trading days of the following year. In other words, the official SCR is set to begin tomorrow, Wednesday, December 24, 2025.

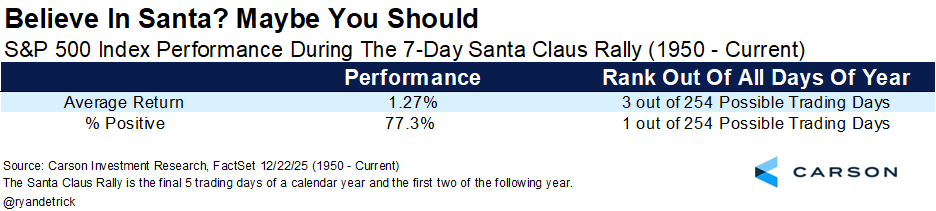

Historically, it turns out these seven days indeed have been quite jolly, as no seven-day combo is more likely to be higher (up 77.3% of the time), and only two combos have a better average return for the S&P 500 than the 1.27% average return during the official Santa Claus Rally period.

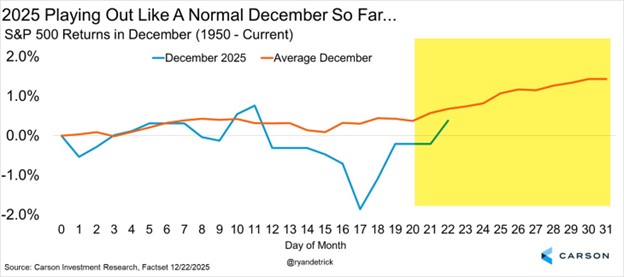

Here’s a chart we’ve shared many times so far this month, showing that the latter half of December is when most of the seasonally strong gains occur. So far, this year has played out true to form with weakness early and already some strength late.

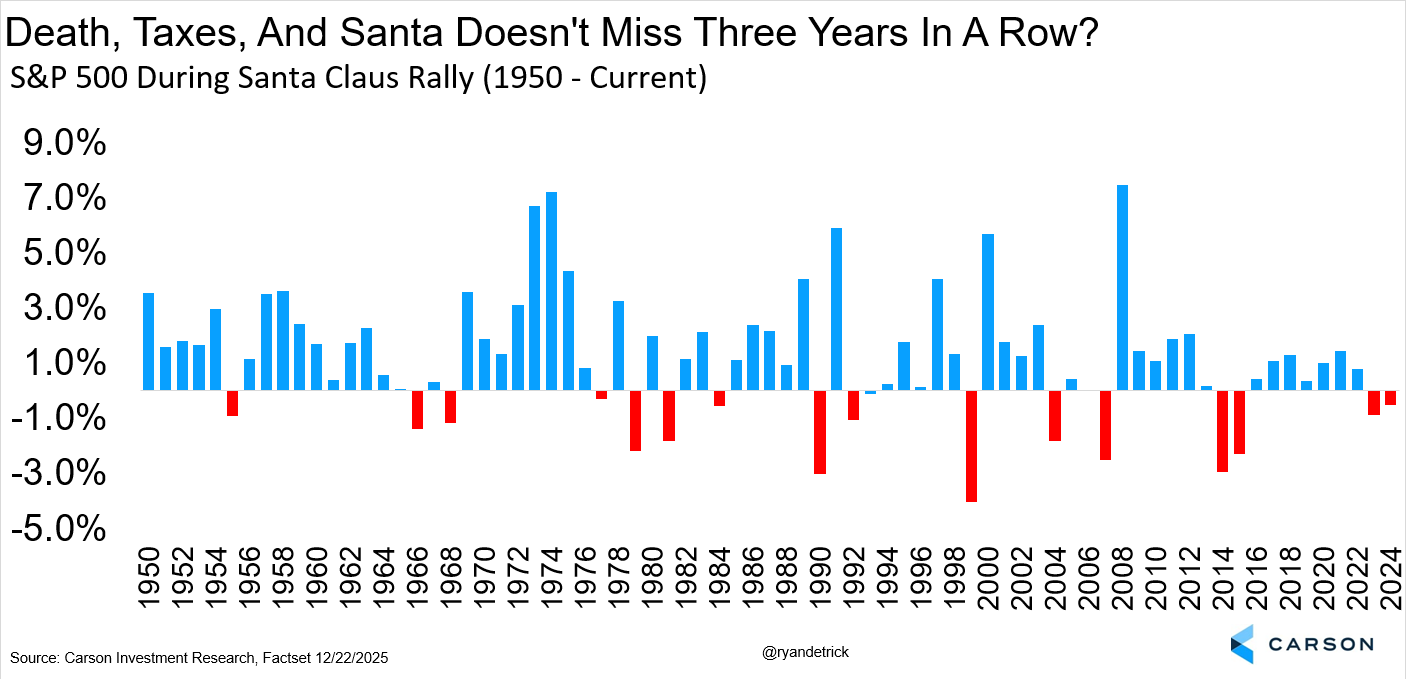

These seven days tend to be in the green, so that is expected. But we actually haven’t seen Santa the past two years, which is akin to coal in your stocking for two straight years. The good news? We’ve never had a negative SCR period three years in a row.

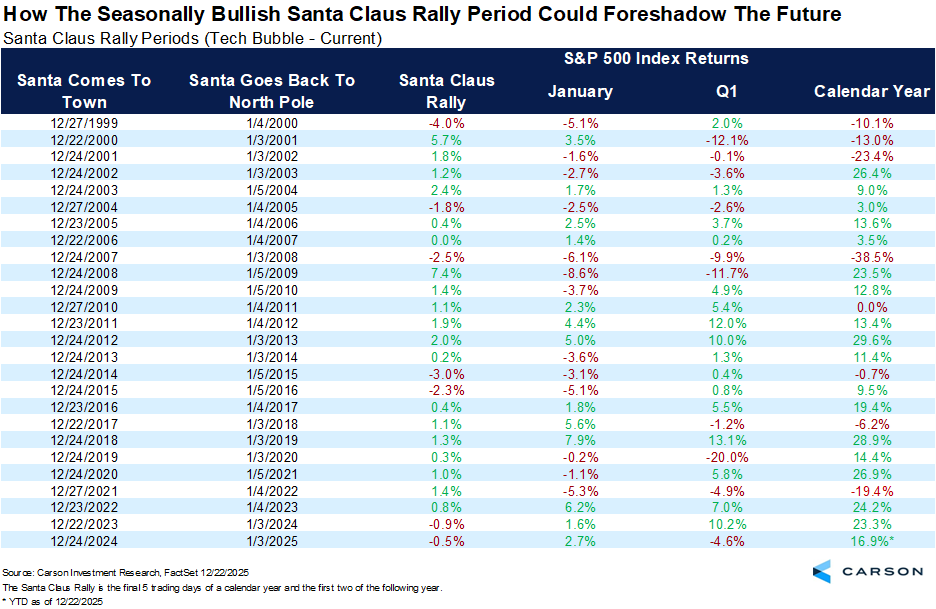

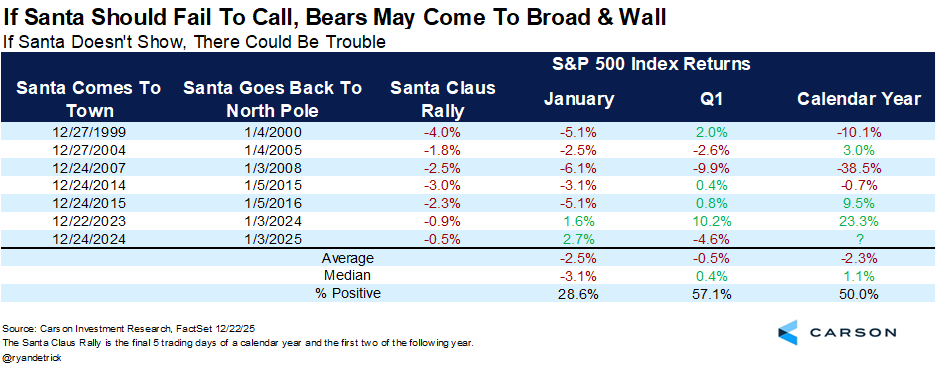

Here are all the SCR periods and what happened next, going back to the tech bubble implosion. As you can see, when Santa comes the chances of continued solid times are high, while when Santa takes a break and stays in the North Pole then trouble is higher. Even last year for example, Santa didn’t come and Q1 was a rough one for investors and we all remember what happened in April after Liberation Day.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The bottom line is that what really matters to investors is when Santa doesn’t come, as Mr. Hirsch noted in the quote at the start of this blog.

Here we show some recent times investors were given coal during these seven days, and the results after weren’t very good at all. The past two times saw a higher January, but the five before that all saw a red first month of the year. Notably, there was no SCR in 2000 and 2008, not the best times for investors, and potentially some major warnings that something wasn’t right. Lastly, after the big drop in Q1 last year, returns the first quarter were negative when we don’t see Santa. We like to say on the Carson Investment Research team that hope isn’t a strategy, but I’m hoping for some green during the SCR!

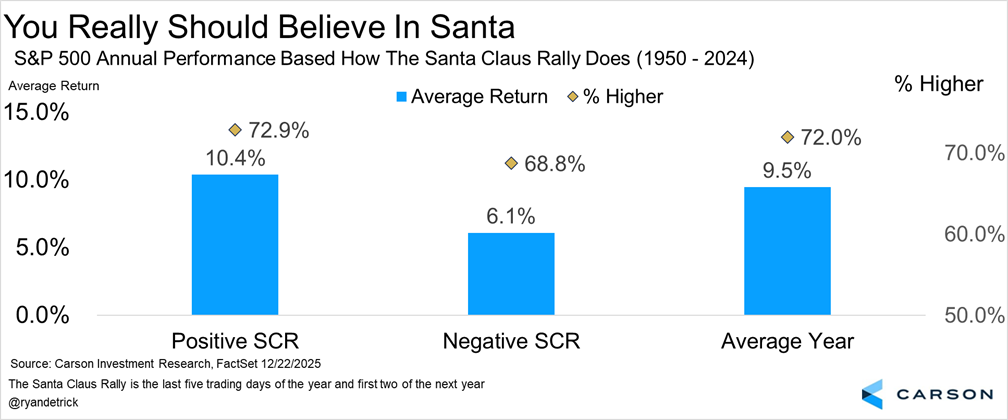

Finally, the average gains each year for the S&P 500 is 9.5% and the index is higher 72.0% of the time. But when there is an SCR, those numbers jump to 10.4% and 72.9%, falling to only 6.1% and 68.8% when there is no Santa. Sure, this is only one indicator, and we suggest following multiple indicators when making investment decisions, but this is clearly something we wouldn’t ignore either.

Thanks as always for reading and we hope everyone has a great holiday season! I had the honor to join Mike Santoli on CNBC last week, live from Times Square. I do a lot of tv, but to do it live with the Squawk crew is always a fun time. Here’s a picture I took right after the hit and you can watch the full interview below as well.

Link to watch, click here!

For more content by Ryan Detrick, Chief Market Strategist click here.

8679881.1. – 23DEC25A