The January payroll report was widely anticipated because it was the first “clean” report after the messy post-shutdown reports from November and December, which were also delayed. We also got annual benchmark revisions to prior years’ data (which impacted data from 2021 through March 2025). The Bureau of Labor Statistics also made a methodological change to how it estimates new business formations and closures, which resulted in big revisions to all of 2025. Let’s start with the revisions.

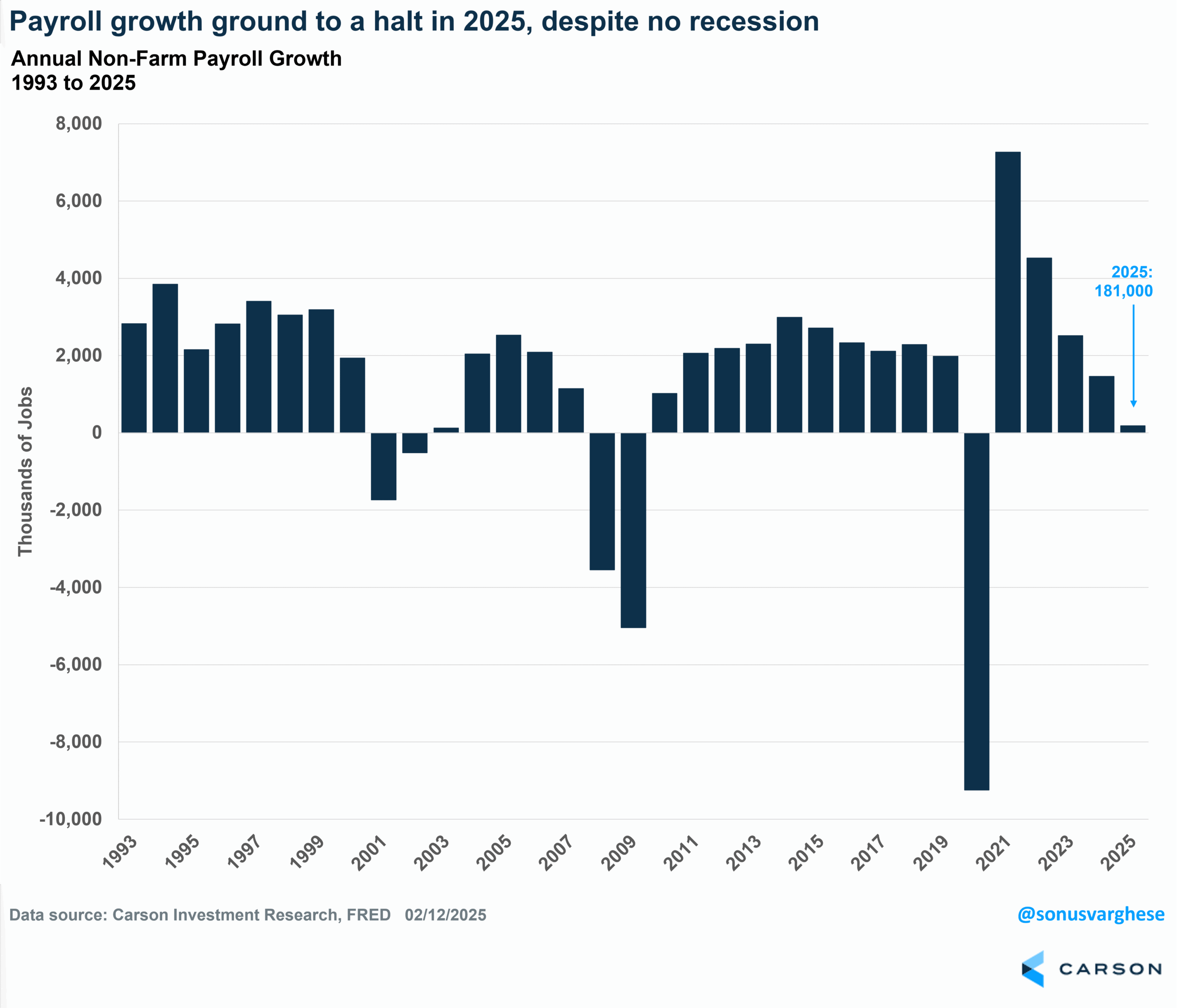

Job growth in 2021-2023 didn’t change significantly — these were strong years for the labor market. But job creation in 2024 was revised from 2.01 million to 1.46 million, which is not great but still just about ok. However, 2025 job growth was revised from an already low 584,000 to just 181,000 — the worst year for job creation since 2003 outside of recessions. In other words, monthly payroll growth averaged an awfully low 15,000 per month in 2025.

What’s amazing is that despite such weak job growth the economy didn’t enter a recession. In fact, real GDP growth clocked in close to the pre-pandemic trend of 2.5% (we’ll get 2025 GDP data next week). The story is one we’ve been talking about for a while now: hiring has been weak, but the unemployment rate hasn’t risen significantly because 1) there were fewer workers to hire, as immigration stalled; and 2) layoffs have been really low (which would not have been the case if we were in a recession and company revenue was falling).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Focus on What’s Happening Now — Things Are Looking Up

Here’s the thing — these revisions are for past data. While we didn’t know the exact magnitude of payroll growth last year, we knew the data was bound to be revised and it didn’t take a genius to figure out that the labor market wasn’t doing great. (I wrote a piece last September saying the labor market is flashing a big red sign.) You’re likely to see a lot of commentary focused on the terrible, no-good year for the labor market in 2025, but my point is that it’s old news right now. Been there, seen that.

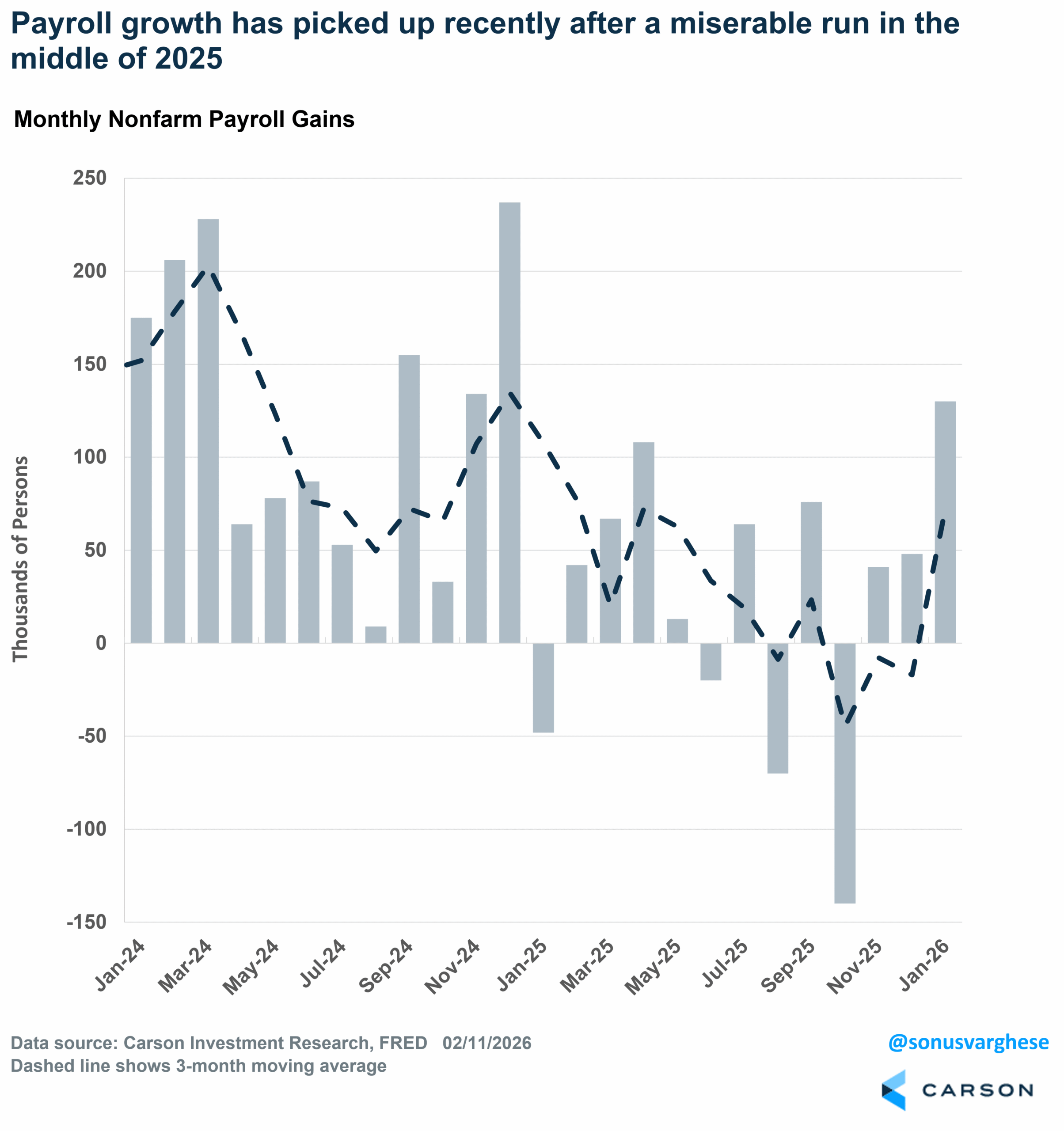

The news is actually much better right now. The economy created 130,000 jobs in January, well above expectations for a 65,000 increase. Now you should take the number with a grain of salt as it’ll likely be subject to big revisions. That’s why the three-month average is helpful — that’s now running at 73,000, which is the highest since last April. The story is that job creation job creation plunged in the middle of 2025 amid the tariff chaos and economic uncertainty. But it’s picked up recently with positive job growth in three straight months. Job creation is still well below the monthly average of 122,000 in 2024, but with immigration stalled, the economy probably needs to create less than 50,000 jobs per month to keep up with population growth and prevent the unemployment rate from rising.

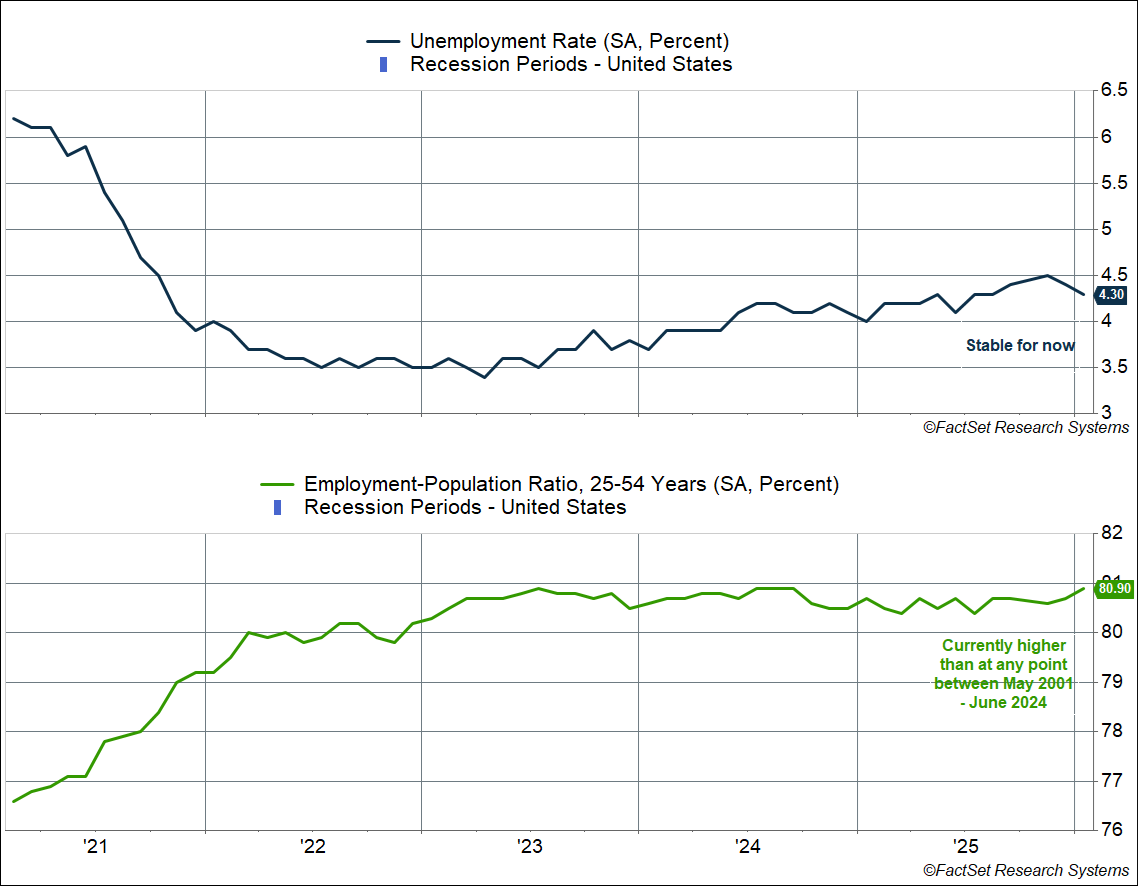

Even if you are skeptical of the recent payroll data, the unemployment rate, which isn’t revised, is telling the same story. The unemployment rate fell from 4.4% to 4.3% in January. It was 4% a year ago and climbed to 4.5% by November, but it’s fallen over the last couple of months, indicating that the worst is probably behind us and things are looking up now.

Even better is the prime-age (25-54) employment-population ratio, which rose to 80.9%, matching the peak we’ve seen in this expansion (back in July 2024). The current level is higher than at any point from May 2001-June 2024. Put another way, more people in their prime working years are currently employed (as a percent of the overall population) than at any point between mid-2001 and mid-2024. That’s pretty incredible and should put to bed any worries that AI is leading to job losses.

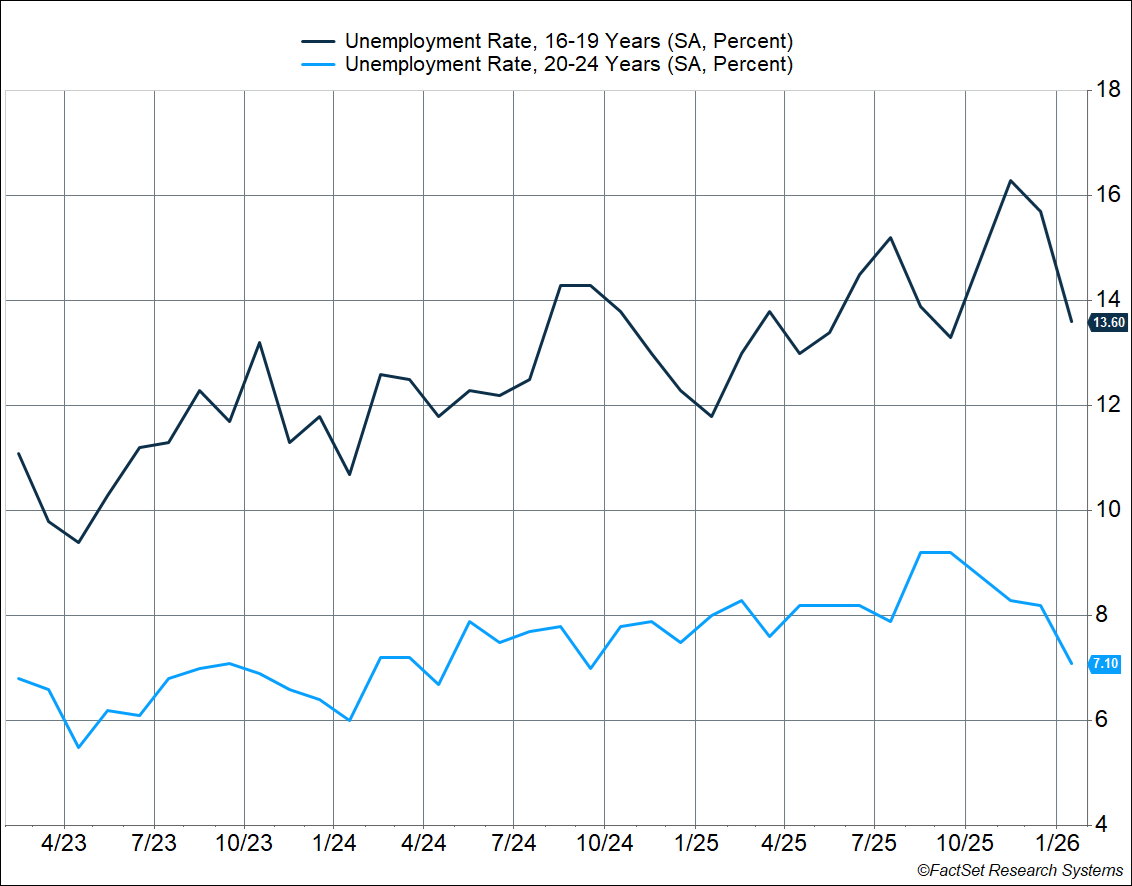

Now, younger workers have had a much harder time finding a job in this labor market, but that’s likely because companies pulled back on new hiring amid economic uncertainty. After all, new hires have a large cost associated with them, including training. But things are looking up even on this front:

- The unemployment rate for 16-19 year olds rose from 11.8% a year ago to a peak of 16.3% in November. It’s fallen since then, hitting 13.6% in January.

- The unemployment rate for 20-24 year olds rose from 8.0% a year ago to a peak of 9.2% in September. It’s pulled back all the way down to 7.1% in January.

Again, if AI were responsible for weak job growth, we wouldn’t be seeing the unemployment rate for young workers fall, especially as stronger AI was pushed out. Instead, the unemployment rate would rise, or at least remain elevated.

The big picture is that the labor market is weaker than it was a year ago, mainly because of a rise in economic uncertainty in the middle of 2025. But the bleeding has stopped and things are looking up, though there’s still a lot of room for improvement as we’ll see below.

Job Growth Still Needs To Broaden Out

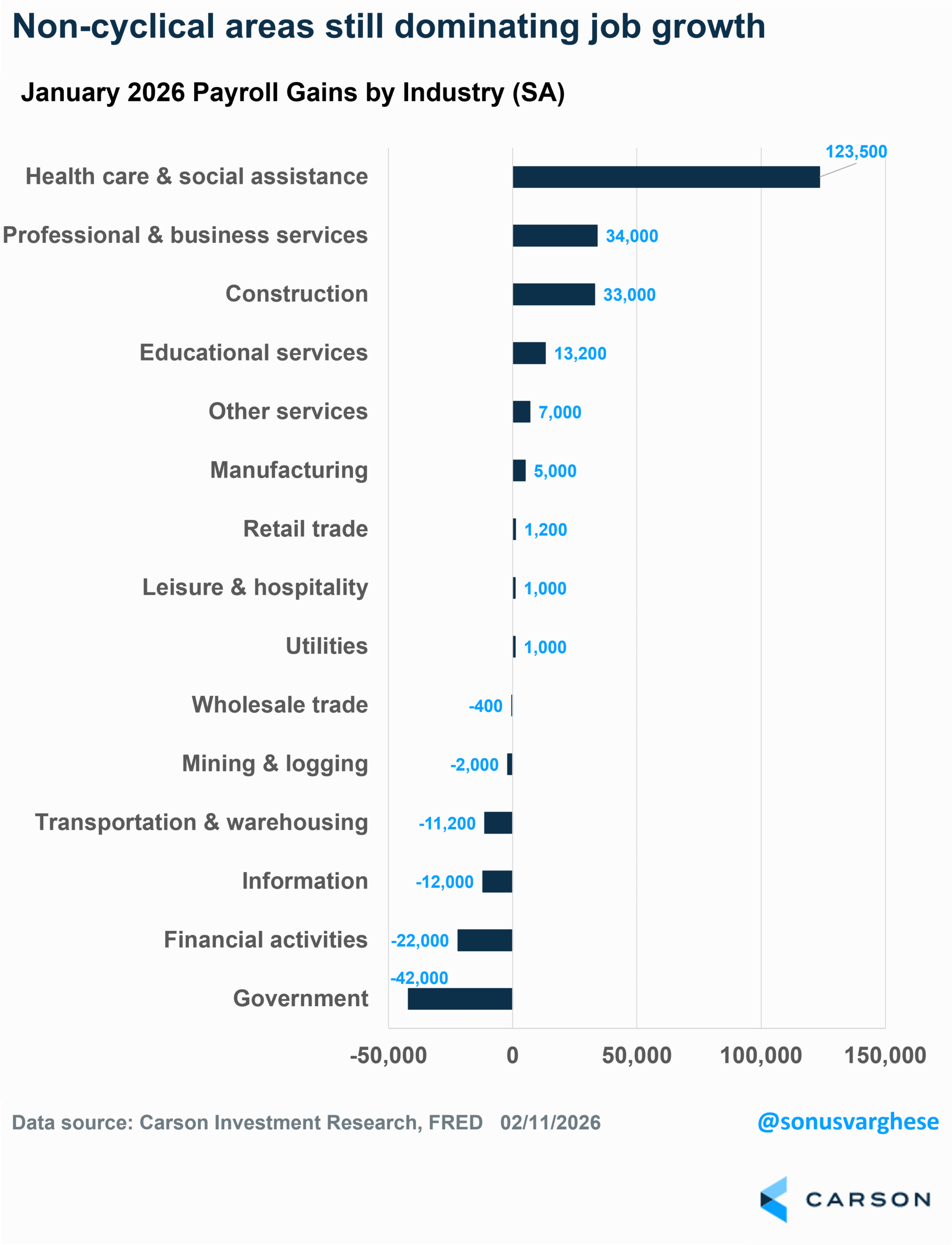

The private sector created 172,000 jobs last month, but a familiar story played out when you look at the industry breakdown. Health care and social services created 123,000 of those jobs, in a replay of what we saw in 2025:

- The private sector created 367,000 jobs in 2025.

- But health care and social services saw payrolls grow by 693,000.

- The private sector outside health care lost 326,000 jobs in 2025.

- Key cyclical areas lost jobs, indicating that this wasn’t about AI, including:

- Wholesale/retail trade and transportation: -202,000

- Manufacturing: -108,000

- Business support services like temporary staffing: -71,000

- Computer systems design: -52,000

- Telecom and data processing: -27,000

- Mining: -15,000

- Construction: -1,000

The good news is that January saw job growth small pickup in cyclical areas — manufacturing added 5,000 jobs and professional and business services added 34,000. Especially encouraging was that construction payrolls grew by 33,000, though 25,000 of this came from nonresidential specialty contractors, i.e. those working on data centers. But there were several key sectors that still saw job losses, as you can see below.

Of course, this is just one month of data, which could be revised anyway. We’re going to need to see across-the-board improvement rather than just one sector accounting for all the job growth. That’ll be a sign that cyclical activity is picking up, and the economy is on a more robust footing.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

8771066.1. – 12FEB26A