The other day I highlighted 5 charts that illustrate the strength and resiliency of the labor market. Ironically, this was perceived as “bad news” by markets. Why? Investors believe labor market strength will prompt the Federal Reserve (Fed) to continue raising rates at a torrid pace in a bid to get on top of inflation. Based on what Fed officials themselves have said, labor market strength puts upward pressure on wage growth, which in turn leads to higher incomes and more spending, leading to persistently high inflation.

So good news is perceived as bad news. And vice versa – bad news in the form of weaker employment data would be good news, assuming it prompts the Fed to pull back from interest rate hikes.

However, the economy is not a machine that can be fine-tuned with a blunt tool like interest rate changes. Chances are weak employment data would foreshadow even worse data, and that’s not going to be good for the economy or company earnings.

So, we’ll take the good news as good news, instead of hoping for weak data. Especially since every additional month of strength buys an additional month for inflation to reverse. Ultimately, that is what will prompt the Fed to ease up on rate hikes.

To that end, there are positive signs in the labor market as well if you know where to look. Here are 5 charts that show that labor market-driven inflation could be reversing.

1. Wage growth is easing

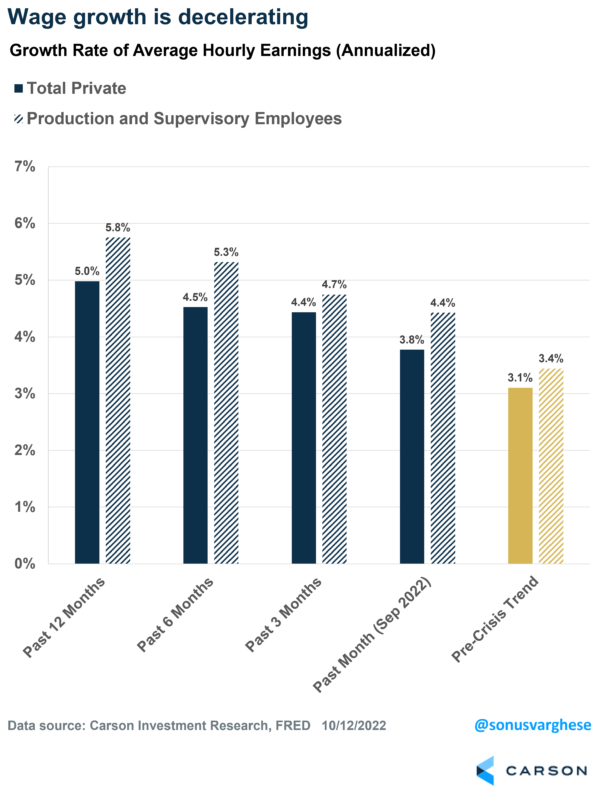

Inflation has obviously surged on the back of higher commodity prices amid the Russia-Ukraine war, supply-chain issues, and post-pandemic re-opening. Yet Fed officials have pointed to faster wage growth as a big cause for concern and a potential driver of persistently high inflation. The good news is that it looks like wage growth is decelerating.

The chart below shows the annualized pace of average hourly earnings growth over the last 1, 3, 6, and 12 months for all private sector workers as well as “production or non-supervisory employees”. Non-managerial workers earn less income and tend to spend a greater portion of their income – faster wage growth for this group can potentially put upward pressure on prices. However, wage growth has been slowing recently for private sector workers and even more so for non-managerial workers.

The pace of wage growth is still higher than the pre-crisis trend, but the deceleration should provide some comfort to the Fed (though perhaps not for workers). Of course, the question is whether this trend will continue, and that’s why the next three charts are important.

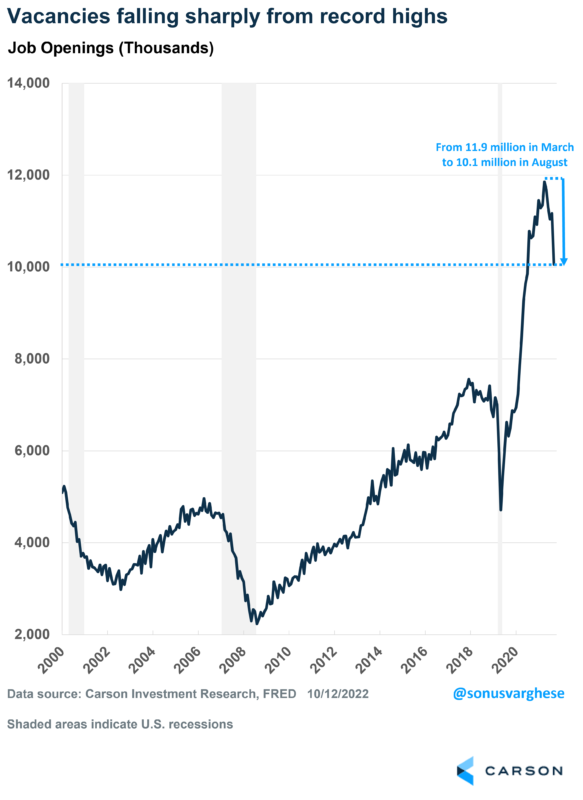

2. Job openings are falling

Fed Chair Powell has frequently cited the surge in job openings as a sign that the labor market is imbalanced. Demand (openings) far outstrips supply, which prompts firms to pay higher wages to attract workers. The good news as far as this is concerned is that job openings are falling. It’s fallen by 1.8 million between March and August. What is interesting is that such a massive drop in vacancies has historically occurred amid recessions – you can see this in the following chart, as the line falls sharply during the shaded periods (recessions). And it also coincides with a rise in unemployment, but the unemployment rate just fell to 50+ year lows as I noted in my previous blog.

The current reversal in job openings may simply reflect the fact that pandemic-era distortions may be abating. But we’ll take it, never mind what’s happened before or what should happen “in theory”.

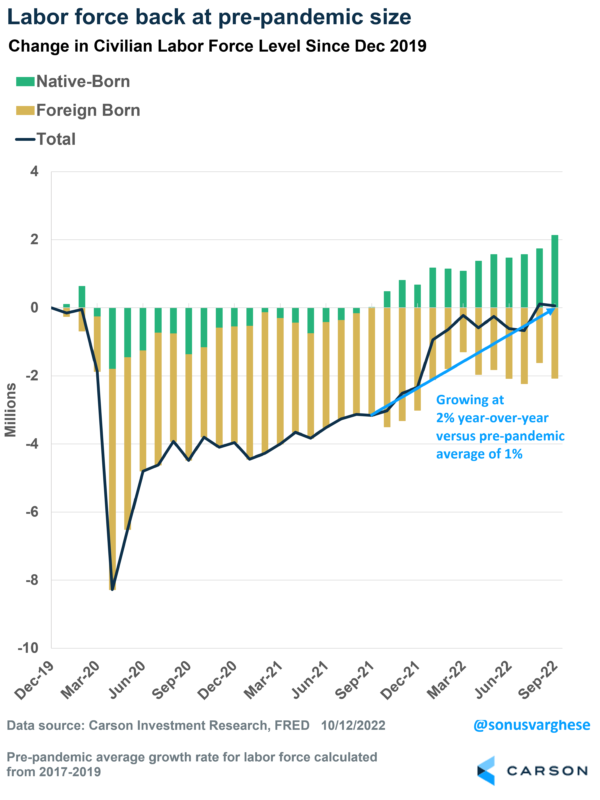

3. Labor force growth has picked up

There is positive news on the supply side as well. The labor force is now back to pre-pandemic levels of about 165 million. The labor force has grown 2% over the past year through September, which is twice the pace we saw pre-pandemic. Interestingly, the rebound in labor force growth has come on the back of foreign-born workers rather than native-born workers. There could be multiple reasons for this, including an aging population and early retirements, as well as pandemic-related issues like long Covid and child care (the female labor force is about 600,000 lower than pre-pandemic levels). The labor force is still below where it probably would’ve been in the absence of Covid but the current pace of growth is encouraging, especially if immigration continues to make up for slower growth in the native-born labor force.

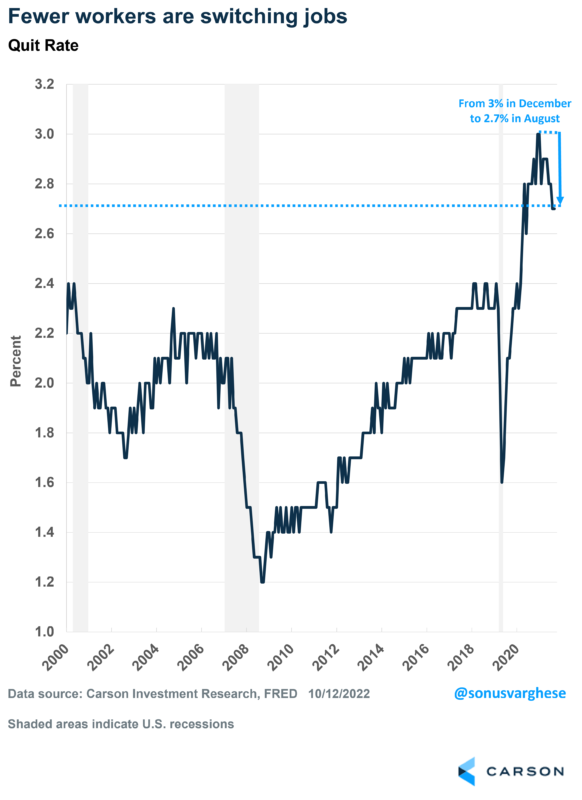

4. Quits are falling

One reason for slower wage growth is that the number of workers quitting their jobs has fallen. The “quit rate”, which is the number of people voluntarily leaving their jobs as a percent of all employed workers, surged to 3% last December. While often termed the “Great Resignation”, it was really the “Great Job Switch”, with workers switching jobs for better pay – which drove up wages. The Atlanta Federal Reserve finds that “job switchers” have seen much faster wage growth than “job stayers”. However, the quit rate has now fallen to 2.7%, which is still higher than the pre-crisis rate of 2.4%, but it does look to be in a downtrend.

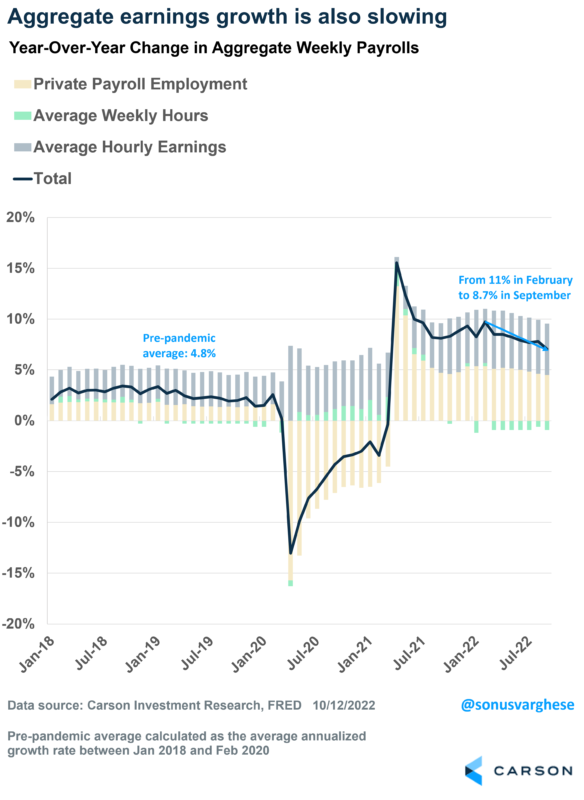

5. Aggregate earnings growth is slowing

I’ll wrap up with earnings again, but this time look at the pace of earnings growth over the entire economy – so that combines job growth, average hourly earnings per week, and the number of hours worked per week. This is a very important metric to understand how “aggregate earnings” are growing, which would be a key driver for “aggregate spending”, and thereby inflation. Pre-pandemic, aggregate earnings were growing at an annualized pace of 4.8%. The bad news is that the current pace is close to double that, running at 8.7% as of September. However, the good news is that it’s dropped from as high as 11% in February.

This has occurred due to two main factors. The first reason is slowing employment growth – in September 2021, more than a half million jobs were being created each month (3-month average), but that’s slowed to about 340,000 now. The second reason is fewer hours worked. The number of hours worked per week surged after the pandemic as companies produced more with fewer workers. But this is normalizing now as companies have hired more than 5 million additional workers over the past year.

Clearly, there are a lot of actual positives within the labor market to focus on with respect to drivers of future inflation. Without having to wait for actual bad news in the form of weaker employment data.

My colleague Ryan Detrick and I just discussed a lot of what I wrote about here in our latest Facts vs Feelings podcast episode. Take a listen here and leave a review.