“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.” – Winston Churchill

We noted last week that stocks fell during the normally bullish Santa Claus Rally (SCR) period and why this potentially could be a troublesome sign. Well, we have some more bad news, but don’t worry, we will end with some good news.

On the heels of no Santa, now the first five days of the new year finished slightly in the red for the S&P 500, another potential warning sign. As random as it sounds, how a year starts those first five days can be a good tell for how the rest of the year might go. Remember, for example, last year stocks had a huge first five days.

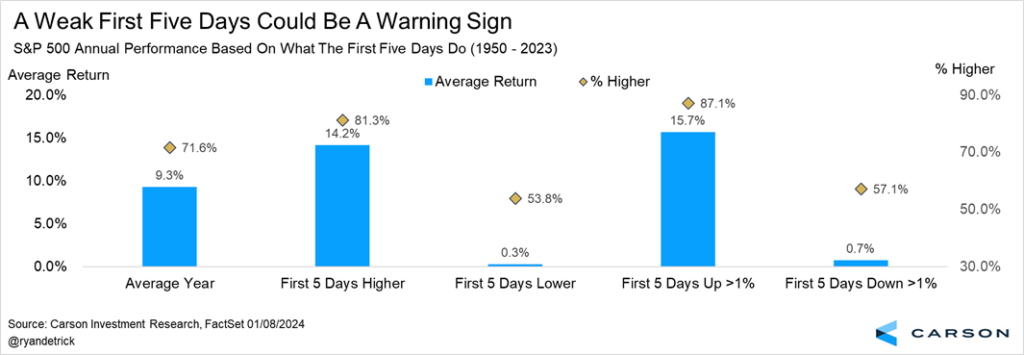

If those first five days are lower the full year average return is only 0.3% and the year is higher about a coinflip of the time, but if the first five days are up the returns jump to 14.2% and 81.3%.

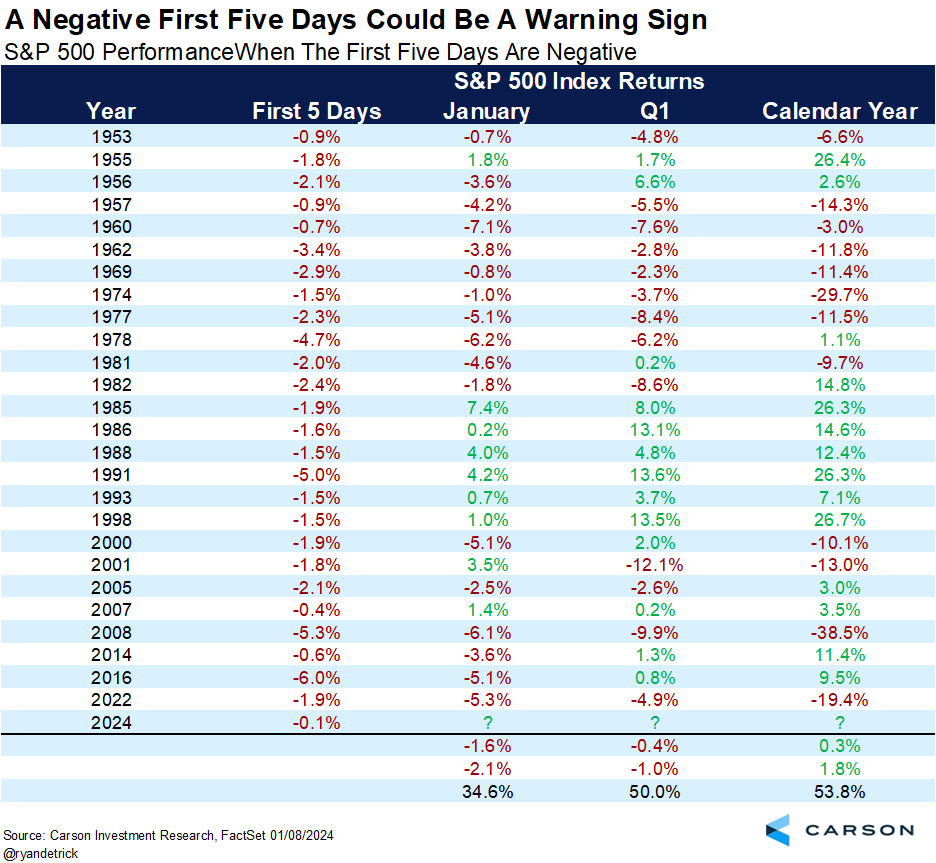

Here are the 26 times (since 1950) the first five days of the new year finished in the red. Yes, the returns overall are quite disappointing, but what stands out to me is some of the recent weakness all took place in troublesome times. 2022 saw the massive jump in inflation and an aggressive Fed, 2008 was the financial crisis, 2000 and 2001 saw the tech bubble implode, and 1981 was a recession. There were a lot of other years that saw a negative first five days and things turned out just fine. Could economic trouble come in 2024? Or course, but as of now, we aren’t seeing any major warning signs of impending economic trouble and that should comfort investors.

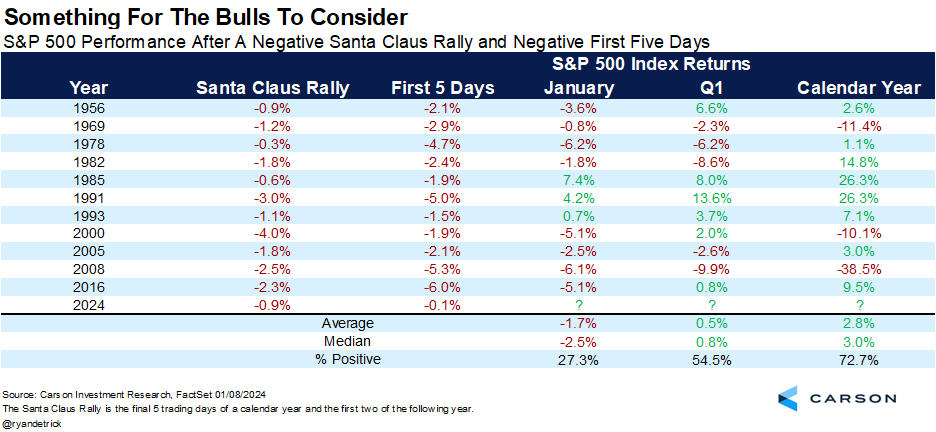

What about when stocks are down during the SCR and the first five days? Now we only have 11 instances since 1950 and again, the returns leave a lot to be desired. Again, 2000 and 2008 are there, and we also see 1969, another year we had a recession.

The bottom line is we remain bullish and expect higher prices in 2024, but the potential for some early ’24 weakness is heightened due to some of these signals. This weakness during a normally bullish time of the year has our attention, but after a 9-week win streak closing out 2023 (the longest since 2004), the S&P 500 was likely due for a break. The massive breadth thrusts we saw late last year, a healthy economic backdrop, and the pivot to a more dovish Fed still have us in the camp that better times are coming.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Ready for some good news? After reading the above, I know I sure am.

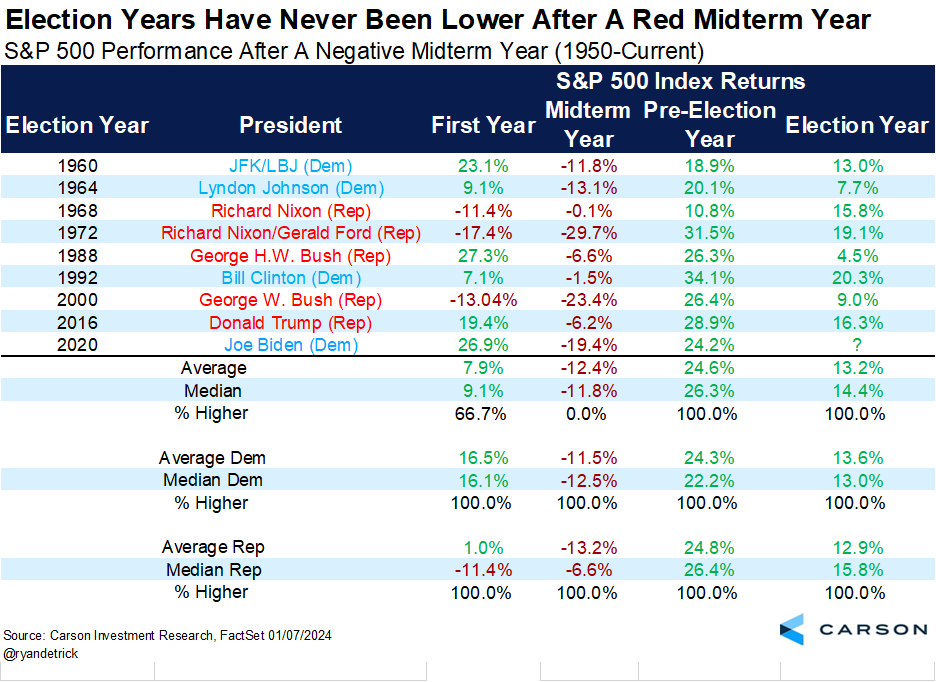

It turns out that one of the best reasons to be bullish this election year is because stocks fell in 2022, which was a midterm year. It turns out that the past 17 pre-election and election years that came after a negative midterm year finished in the green. 17 out of 17!

You can see all the breakdowns below, but we expect this year to make it 18 out of 18 when all is said and done. Lastly, looking at things through the lens of having a Democratic vs Republican president really doesn’t change the returns all that much either.

We are excited that our 2024 Outlook is set to come out very soon! There are many worries out there, but overall, we remain optimistic we can avoid a recession and investors should have another good year in ’24. Be on the lookout for our Outlook and thanks for reading!

For more of Ryan’s thoughts click here.

02062251-0124-A