“I don’t tell jokes. I watch the government and report the facts.” Roy Rogers

In case there wasn’t enough bad news out there, now we have to worry about a potential government shutdown in two weeks on September 30.

Congress has until then to fund the government or we could be looking at the first shutdown since late 2018/early 2019. The odds of a shutdown are slowly increasing each day, but we have been able to avoid some shutdowns the past few years, specifically in the fall of 2023 when one was widely expected.

With all the negative headlines, does Congress really want to delay sending checks to veterans? I don’t know, but this is something we will watch very closely over the next two weeks.

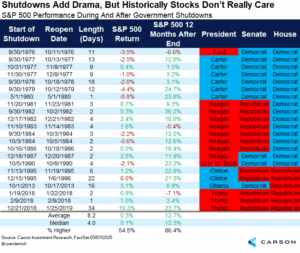

What could a shutdown do for stocks you ask? The good news is history says shutdowns have little to no effect on them. In fact, the last shutdown, in 2018–2019, was a record 34 days and stocks gained more than 10%! Most shutdowns last only a few days, so just enough to get in the headlines and then it is over just as quickly.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Below is a table we put together that shows how stocks are up a little bit during the previous 22 shutdowns, but a year later have been higher 19 times and up an average of nearly 13% a year later. Yes, each time is different and we would never suggest investing based on what the government does (or doesn’t do). But it is important to remember not to worry too much about your investments based on the dysfunction out of Washington.

As always, thanks for reading and buckle up, as the Federal Reserve (Fed) is set to announce their decision on interest rates tomorrow and could cause some volatility. Stay tuned, as we will break it all down on this blog over the coming days.

8397460.1.-16SEPT25A

For more content by Ryan Detrick, Chief Market Strategist click here.