Today is Day 100 of the second Trump administration (counting Inauguration Day as Day 1). We’ve learned a lot in the first 100 days, but if you’re a market person you’re aim is always to look ahead, not backwards. Carson’s global macro strategist Sonu Varghese did just that in his recent blog, “What’s Next? The Bull Case and the Bear Case.”

Today I look specifically at what happened in Trump’s first 100 days that changed expectations. Let’s start with a little history. President Trump, who likes superlatives, has earned one. No president, in my judgment, has had a greater direct impact on the global economy and markets in his first 100 days. The sole competition is FDR, who was the first to use a “first 100 days” benchmark, although it was more specifically what he wanted to accomplish in the first 100-day session of Congress. Roosevelt moved 15 major bills through Congress in 100 days, a much more difficult process than governing by executive order but perhaps the more extraordinary for it. Trump has signed five bills into law in his first 100 days, none of them major, but has signed 142 executive orders, topping FDR’s 99 in 1933.

No one can question the great energy Trump and his administration have exhibited in its first 100 days, but from an economic and market perspective, the outcome to date has been in the wrong direction so far. This is also a rare case where the responsibility lies almost entirely with the president. But keep in mind that there are 1,362 days to go and the Trump administration has framed this as current pain for future gain. But the level of uncertainty around getting anything like that remains high.

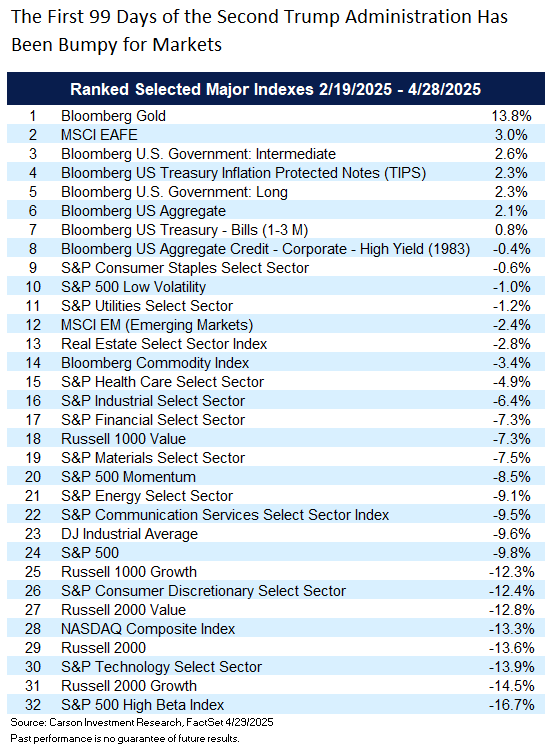

I’m not going to review the litany of sour consumer, business, and market sentiment indicators or anecdotes about how doing business has become more difficult to transact (especially for many small businesses). It’s enough to say the market’s judgment to date has been clear. After cheering Trump’s election on expectations of a more business-friendly environment based on his first term, the market’s take has reversed dramatically. But remember, markets are fickle and perfectly capable of reversing again (as we’ve seen of late).

So here’s what we’ve learned from the first 100 days that may provide some hints about what the next 100 may bring.

Tariffs Are Trump’s Signature Policy, but He Still Might Bend

Let’s not sugarcoat it. Trump’s aggressive tariff policy went well beyond what most analysts expected. That told us two things. First, Trump is deeply committed to his idiosyncratic views on tariffs. (I think it’s fair to call it idiosyncratic given we haven’t seen anything like it since Smoot-Hawley, and that didn’t end well.) Second, the near absence of establishment Republicans in Trump’s cabinet has given us a purer version of “Trumpism” this time around and when it comes to trade that’s been quite painful so far. By contrast, it highlights the larger role establishment Republicans played in Trump’s first administration (as well as a less compliant Congress). Missing that difference may have led many analysts to misread the policy direction of the president’s second term. That dynamic is not going to change—unadulterated Trumpism will be a signature of Trump’s second term.

At the same time, Trump has shown that there’s a level of pain he finds unacceptable, even to implement his most cherished policy. That includes what’s going on in markets (stocks but also rates and the dollar) but also input from business leaders and influential political doners. What I think doesn’t matter for Trump is polls, although that may change as midterms approach.

It’s important to recognize that markets did not respond to the 90-day tariff pause for dealmaking because tariff policy was pulled back to a manageable level. The average US tariff level after the pause is still over 20% and above what we had under Smoot-Hawley. Rather, markets responded to signs of flexibility and the hope that the final tariff policy would be moderate significantly from here.

The takeaway? The status quo on tariffs is probably not good enough yet to support a sustained market recovery. Market participants expect continued improvement toward a more moderate tariff policy. Whether we get there remains uncertain. The president instead may oscillate between more and less aggressive policy depending on the level of pain tariffs are causing at any point in time, and that in itself is not good for business.

The Fed Is Serious About Inflation and Willing To Risk a Recession To Contain It

How quickly we forget 2022 and 2023. Yes, inflation was generational, the highest we saw in 40 years, and far from where we are now. But after a slow start, the Fed showed a resolve in containing inflation that consistently surprised markets.

The Fed’s resolve to date, consistent with the past, is the main takeaway from Trump’s first 100 days because markets continue to be skeptical of the Fed’s commitment to fighting inflation and market direction is often about surprises. Based on fed fund futures, the current expectation is for four cuts in 2025, the first coming in June with just shy of one per meeting after that. Four more cuts would not mean a recession in ordinary times and it may not now. That’s really just the Fed working its way back to neutral. But it tilts recessionary in the current context given inflation concerns. Any additional downside to four cuts and the odds that we’re in a recession start to pick up quickly.

Unless we get a recession, Trump’s first 100 days tells us markets are probably not giving enough credence to the Fed’s resolve. The other side of that is when the Fed does cut rates it may be too late, but right now that’s a risk they are willing to take.

Some Damage to Businesses Is Already Done

Even if the president significantly moderates tariff policy, some of the damage we already are seeing in the economy cannot be undone, and these effects likely will build. Businesses are very good at adapting to different policy environments, but that doesn’t mean that some environments aren’t worse than others.

The economy is capable of absorbing some of these shocks. Household and business balance sheets remain fairly strong, employment levels are high despite some deterioration in labor markets, and there has been some more business-friendly policy to offset some tariff effects, especially around regulation, although the scale is still quite small relative to the tariff impact and the strain from higher-for-longer rates.

With tariffs still at historically high levels, expect to see more damage that begins to build on itself unless tariff policy moderates further. This may not break the economy, but the strain is rising.

Everything, Everywhere, All at Once

The other side of the Trump administration’s energy in the first 100 days is the difficulty, impatience, or indifference to exercising situational judgement while trying to work at scale. Granted, sometimes executing with energy is a more important priority, but that’s not always true. For example, we don’t have to fight a trade war with the whole world at once. it can help to have allies. While the US has the most powerful economy in the world, it’s not easy to make 200 trade deals, nor does it make sense to drive erstwhile allies closer to rivals. Similarly, DOGE’s aggressive culling of the federal workforce is likely to have downstream consequences, since in order to act quickly it also had a tendency to act indiscriminately.

Another aspect of this is that policy decisions that might mean little individually start to build collectively. The economy can absorb 200,000 lost federal jobs in isolation; or a large drop in tourism; or the workforce impact of immigration policy; or the loss or disruption of cutting-edge research due to a sudden loss of federal funding. But everything, everywhere, all it once could be a challenge.

The first 100 days highlighted the extent to which this approach will be part of Trump’s governing style. Expect the approach to expand rather than stabilize or contract.

The Fed Remains Independent, for Now

I did not think this one would come quite so quickly. In my previous policy update I wrote, “This one is unlikely to be a slow burn. If Trump oversteps, I would expect the market response to be unmistakable… I would consider this a very small risk, but with the consequences of a misstep potentially large.” Well, we did see the president begin to make more aggressive overtures to interfering with Fed independence. Markets responded negatively, and Trump backed off. (I had also written that jawboning that could be easily taken back did not pose an immediate risk.) But the risk remains and I don’t think this one is over.

The Fed’s May meeting, where the fed funds rates is expected to stay at its current level, is unlikely to cause problems outside of the garden variety Trump response on social media. But circle June 18 on your calendar. If the Fed does not cut then, especially if the economy is weakening, the challenge to Fed independence may escalate.

The “Big” Takeaway

Going big is part of Donald Trump’s personal and intellectual style. He may not be a great businessman but he is a master marketer (and also expert at bending the law to his favor, two skills that lend themselves well to real estate … and politics). If I had to summarize what we learned in Trump’s first 100 days it’s that he’s going big. Bigger than most expected. And I doubt that’s going to change. To the contrary, I think he’s not done yet. That doesn’t mean there aren’t checks or that he will never change course. We’ve already seen that. (And of course, where the president is correct, going big can be beneficial.) But in my view it likely means policy risks will persist for the next 1,362 days. But as with the first Trump administration, also expect to see some policy upside. Markets would have liked to have more of that in the first 100 days.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

7913933.1-0425-A