“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” Peter Lynch

2026 so far feels like a repeat of 2025, as stocks are making new highs around the globe, with gold and silver soaring as well.

As we noted in our just released Market Outlook 2026: Riding the Wave, we still think momentum is to the upside for equities this year. Well, we just had some more good news, as stocks were up more than 1% the first five days of the new year, potentially a bullish signal.

The First Five Days

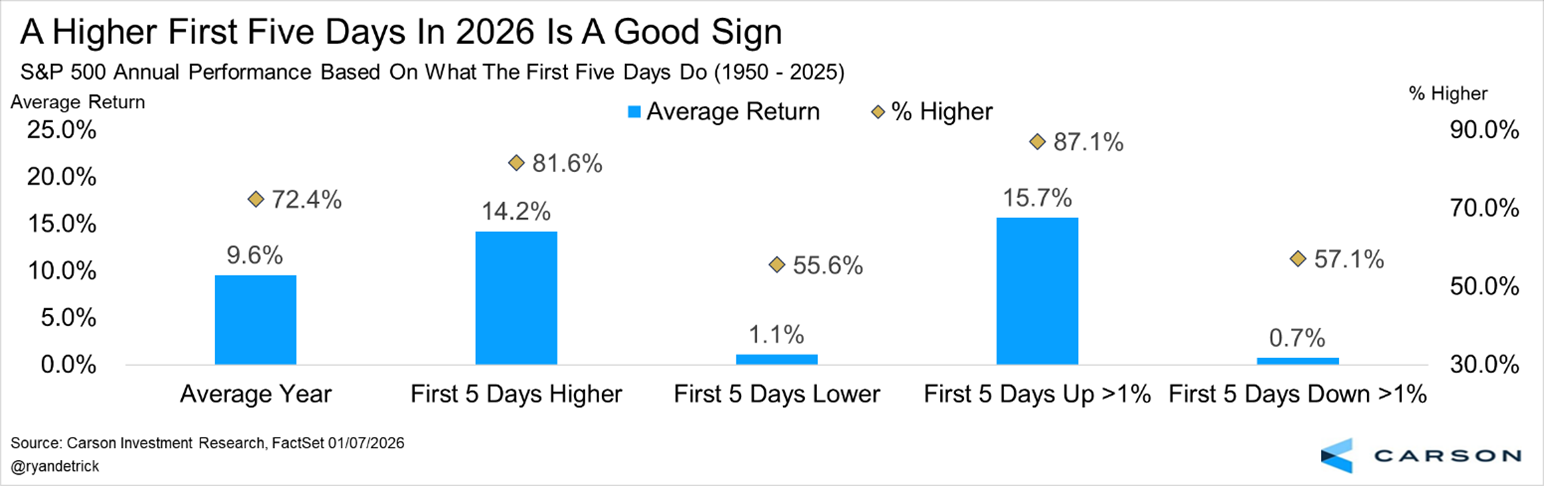

Historically, when the first five days of the new year are higher, the full year is higher nearly 82% of the time and up more than 14% on average, compared with the average year higher about 72% of the time and up 9.6% on average.

Taking it a step further, a negative first five days takes the full year to positive just over a coinflip of the time and a modest 1% average return for the full year. No, you should never invest based on just one indicator, but we’d still put this in the “better news than not” file for this new year. Oh, and when stocks are up more than 1% those first five days, something we did indeed accomplish this year, the returns get even better, up nearly 16% on average for the full year and higher more than 87% of the time.

But What About Santa?

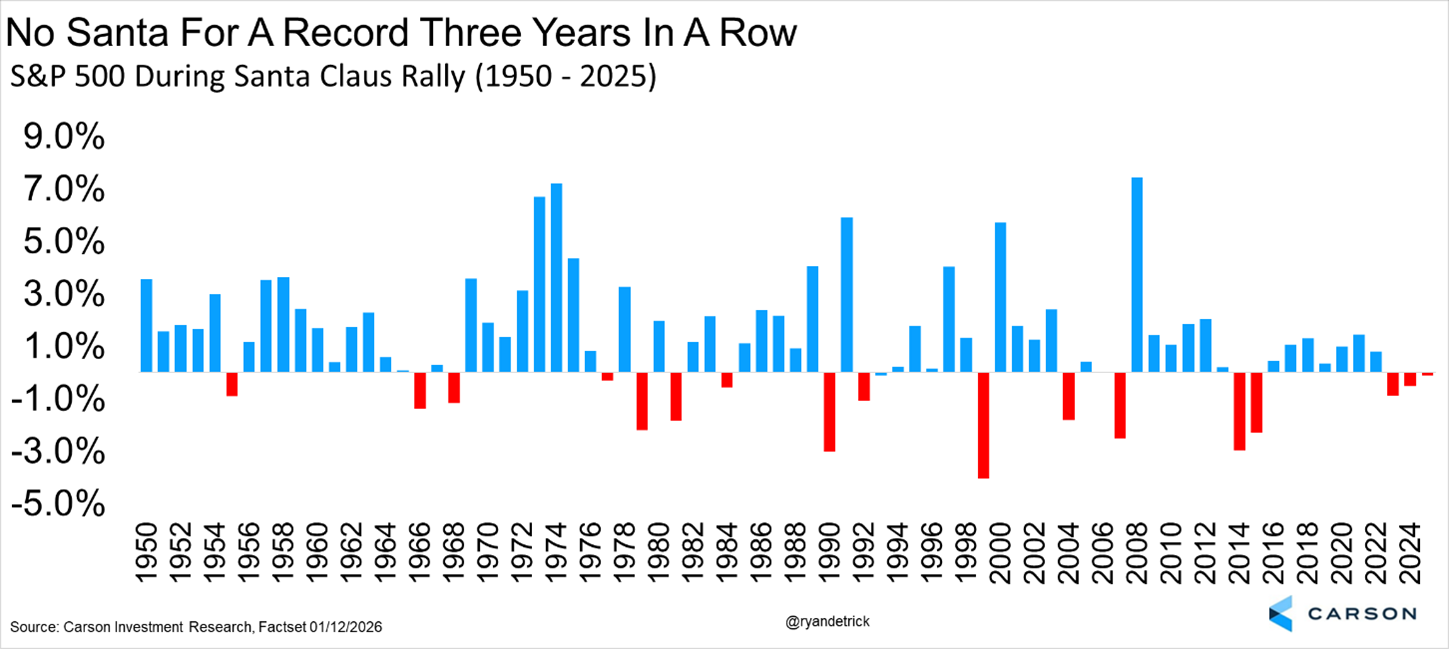

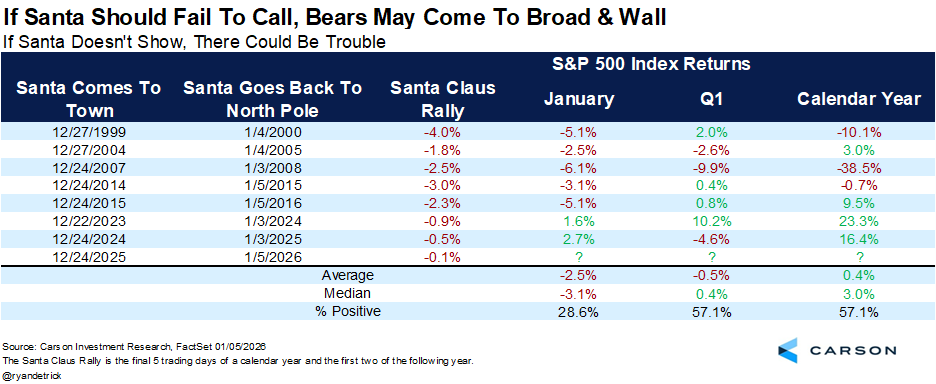

Yes, I get it, stocks fell during the historically bullish Santa Claus Rally (SCR) period this year. (The SCR is the final five trading days of December and first two of the new year.) Although in the end, the S&P 500 soared back late during the SCR period and finished down only 0.11%, it was still the first time in history we didn’t see Santa for three consecutive years.

As we noted back in December, when stocks fall during this period, it very well could be a warning sign, as we didn’t see Santa in 2000 and 2008 for instance. The good news is the past three times Santa didn’t come, stocks were still up nicely on the year. Of course, you could argue that in 2016 and last year not seeing Santa maybe have been a clue of some rough seas early in those years.

Put It All Together

My friend Jeff Hirsch, CEO of Almanac Trader, is the master here (as his amazing father, Yale, literally invented the Santa Claus Rally indicator), and he says to get the full picture, you need to look at a combination of the SCR, the first five days of the year, and January’s full month return. Should we see a positive January (off to a good start in 2026), then this trifecta would still be classified as overall net bullish in 2026.

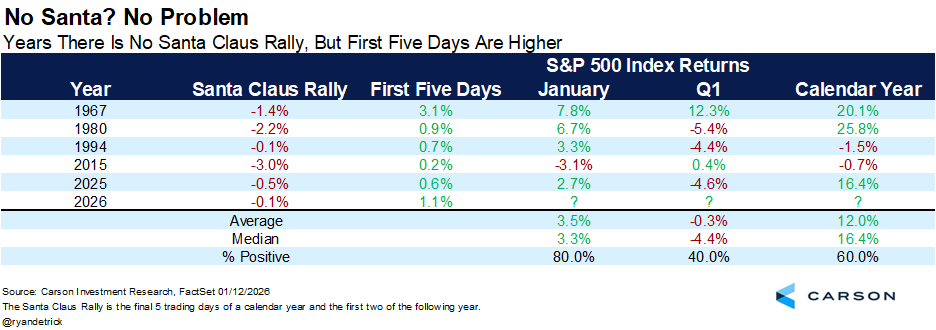

Lastly, we found five other years that didn’t see Santa, but had a positive first five days of the year. I found it interesting that Q1 under this scenario could be rather weak, but the full year managed to do well overall. Peeling back the onion showed that two times the full year was negative, but the returns were only very slightly in the red, and the other three times all saw double digit gains for the full year.

Let’s see how January shapes up, but we’ve been in the bullish camp for three years now and the good news is we still think a wave of policy and earnings strength may carry investors forward this year and it could be another solid one for the bulls.

We discussed our 2026 Market Outlook in the latest Facts vs Feelings, which you can watch below. Thanks for reading and here’s to a happy and healthy year.

For more content by Ryan Detrick, Chief Market Strategist click here.

8708434.1. – 13JAN26A