“Oh NVIDIA, oh NVIDIA, say have you met NVIDIA? NVIDIA the AI chip maker?” -Groucho Marx (adapted)

In yesterday’s blog by my colleague Jake Bleicher we took a look at chipmaker NVIDIA’s latest earnings report and the wide range of places where artificial intelligence (AI) is being deployed. Today we take another look and some of the current economics behind AI from the perspective of NVIDIA’s earnings.

The economic story in some ways is very simple, and goes back to Econ 101. NVIDIA’s earnings highlight a large, but still early, shift in demand for AI chips and hardware that simply can’t be met by current supply. From a microeconomic perspective that means strong profits from current suppliers, of which NVIDIA is currently the most important. We see that all over NVIDIA’s earnings numbers. Other players will surely be drawn by those profits (it’s already happening) and over time NVIDIA’s advantage will erode, but NVIDIA has a nice lead that persist for some time.

Remember IBM, a still formidable company but not included among the “Magnificent Seven” of tech-oriented giants, manufactured 70% of the world’s computers in the 1960s and had become the largest company by market cap by 1966, holding onto the position until the late 1970s. While “Big Blue” may not be a dominant player in hardware anymore, it helped lay the foundation for the continued leaps in computing we’re talking about today. And its more-than-a-decade reign as the world’s largest tech company is impressive. Similarly, while today’s story is NVIDIA, the enduring story is AI. It’s hard to gauge whether to measure NVIDIA’s lead in years (as seems to be the emerging case with Tesla’s leads in electric cars) or the more than a decade that IBM had. But whatever the lead, any ground made up on NVIDIA will likely be accompanied by a rising tide that lifts all ships as the AI space continues to expand.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Diving into NVIDIA’s numbers, the Q4 2023 earnings report was impressive across the board. Sales more than tripled compared to a year ago, clocking in at $22.1 billion versus Q4 2022’s $6.2 billion. That’s also more than an 8% beat versus the consensus expectation of $20.41 billion.

Every segment reported higher than expected sales. Demand for their graphic processing units (GPUs), which are used in training AI, remains very robust. Data center revenue (the huge server farms that provide the AI computing environment) beat expectations by 7%. Even with the strong beats, revenue guidance topped expectations. And all this took place despite falling revenue from China because of US sanctions, which makes the demand picture even look even stronger.

Moving to the profit side, net profit was $12.29 billion. A year ago net profit was $1.41 billion, so an 872% improvement. Gross margins surged to 76%, an extraordinary number for a hardware company.

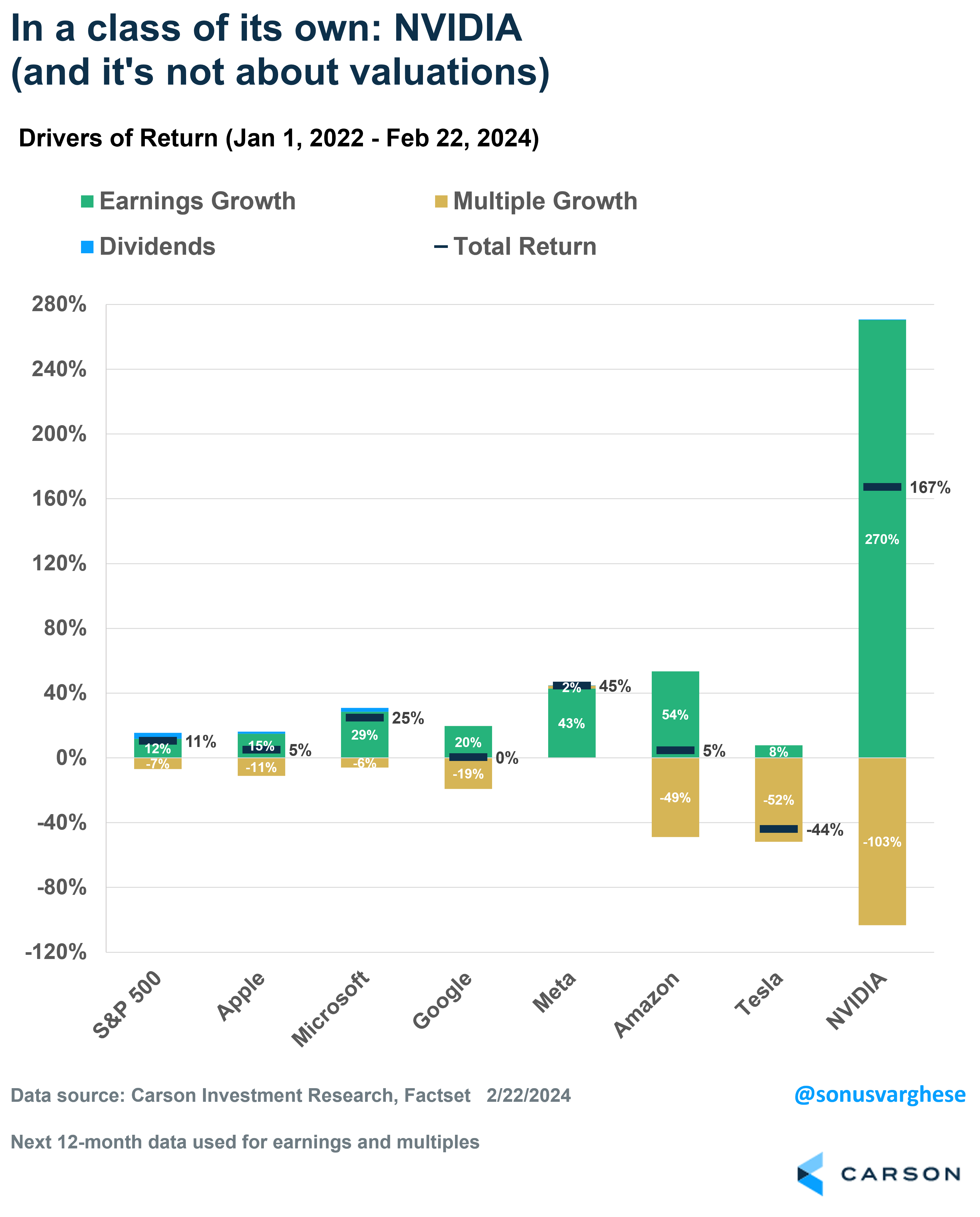

Of course, the stock movement has been strong. It gained over 16% on Thursday, the day after it reported earnings, and is up almost 60% year to date after a spectacular 2023 (but following a very weak 2022, like many tech companies). While not reviewing NVIDIA in particular, we do get the general question whether price appreciation for Magnificent Seven stocks simply reflects unreasonable valuations based on untethered investor enthusiasm. NVIDIA’s traditional valuation metrics are lofty, but since the start of 2022, valuation changes have actually been a drag on prices and have been gradually getting less extreme. While strong future profit growth is still needed to justify valuations, NVIDIA has been more than growing into its valuations in the last two years, which is true of the Magnificent Seven in general.

Our Global Macro Strategist Sonu Varghese provided some telling insight. In the chart below, we divide the total return since the start of 2022 for the Magnificent Seven stocks into three main components: earnings growth, valuation changes (“multiple growth”), and dividends. It’s noteworthy that since the start of 2022 all seven companies experienced multiples compression, which means any gains were driven largely by profit growth. This is quite different from the tech bubble, where multiples expansion drove returns, requiring a multiyear reset that was painful for markets. In a sense, investor enthusiasm during the tech bubble was correct. The lofty expectations of the global impact from the widespread adoption of the internet and associated technologies have more than been fulfilled. The bubble was about mispricing the business case—an important lesson but not what we think we have here.

AI is in a different place than the tech bubble was. Expectations are high, but leadership is coming from seasoned companies meeting investor demand by running lean while still investing in the future. All this is also positive for the overall economy, as it can boost productivity, which was a forward-looking theme in our 2024 Outlook. Perhaps Meta has been the poster child for this, a company whose entire brand had been shifted to the speculative potential of the “metaverse,” which required both creating an entirely new technological ecosystem AND the demand for that ecosystem. Meta has since been changing course, focusing more on learner investing in areas in which it is an AI leader. It’s a surprising mistake from Meta founder Mark Zuckerberg. After all, he started Facebook in his dorm room in the immediate wake of the tech bubble excesses. Talk about a lean beginning. But more on Meta on Monday as we continue to review earnings season.

For more of Barry’s thoughts click here.

2127974-0224-A