While the Carson Investment Research team’s economic views for 2024 are more aligned with the consensus than in 2023, we take a different view on what the drivers of economic growth will be, emphasizing the upside from productivity growth that may differentiate the current central bank-tightening cycle from typical cases in the past.

That view tilts us optimistic on the expansion continuing in 2024, with all the investing implications that follow. Our view is that the watershed moment for generative (artificial intelligence) AI in the last year is not about what artificial intelligence can do for us right now –even if it has enormous potential down the road – but the environment that allows generative AI and other transformative innovations to flourish. To speak to that, we need to look more closely at productivity.

There are a lot of ways economists break economic growth into constituent pieces. One of the simplest is to look at economic growth as a combination of two basic factors:

- More hours worked (which usually means higher employment levels)

- More output per hour worked

If you want to increase economic output (make more stuff), then increase the number of workers or increase what each worker can produce. The latter is productivity, and it’s an essential economic force. Over the long run, productivity growth is what raises the standard of living, since greater productivity justifies increased inflation-adjusted wages without weighing on profitability.

When it comes to workforce growth, demographics is largely destiny. There are only so many people who are able and available to work. That limit creates challenges as populations age and the percentage of people who are working age declines. When that occurs, labor demand will increasingly outpace labor supply, a phenomenon we’ve already started to see over the last decade.

There are ways to offset some of these demographic effects: people retiring later or starting to work earlier (for example, through college co-op programs or vocational apprenticeships); creating more family-friendly workplaces; or giving businesses more scope to compete for foreign labor. But ultimately, available labor is a finite resource.

While productivity growth can’t be created on demand, there are environments that foster it – for example, by incentivizing investment, encouraging competition and protecting property rights. That’s what’s created the environment that has given us generative AI, which itself can then seed additional productivity growth in the future.

Productivity by the Numbers: The Post-Pandemic Story

To understand recent changes in productivity, let’s take a look at the numbers. Productivity data, as measured quarterly, can be noisy, and so it helps to broaden the lens out. Since 2020, productivity has increased at an average of a 1.4% annually, which is faster than the 2010-19 pace of 1.2%. But there have been a lot of dynamics at play during the last four years.

Productivity surged after the pandemic hit. Economic output regained its pre-pandemic level by Q1 2021, with 8 million fewer workers – which translated to higher productivity. But this was not because the productive capacity of the economy expanded. Workers can be squeezed for a time to produce more amid downsizing – the same thing has happened amid prior recessions. But it lasts only for so long.

Productivity subsequently fell in 2022, “reversing” the gains from 2020-21. As workers got hired once again, it looked like productivity was falling. Newly hired workers had to be trained or re-trained, and periods like these are not great for productivity growth.

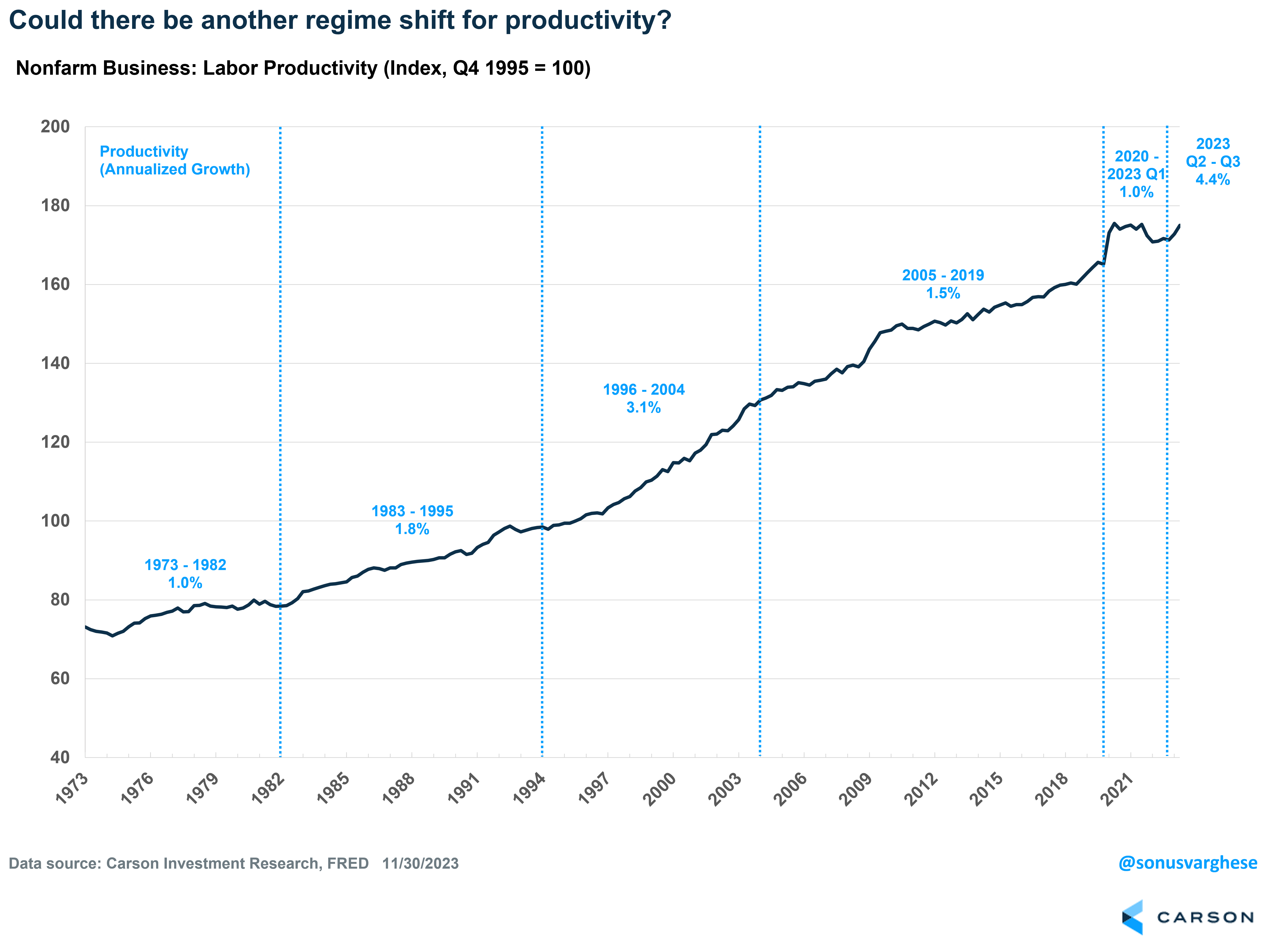

But now that the economy is normalizing, all the investment over the last couple of years (including labor, which is business’ largest investment) is bearing fruit, and productivity is accelerating. Over the last two quarters, productivity growth is now running at an annualized pace of more than 4.0% – the fastest two-quarter pace since the late 1990s outside of recessions and immediate post-recession periods.

Higher Productivity Is a Big Deal for the Economy – and Inflation

Wage growth for workers is essentially the sum of productivity growth, inflation and the change in labor’s share of income. Faster wage growth implies:

- Faster productivity growth

- Higher inflation

- An increase in the share of output going to labor (instead of profits)

- Some combination of the above

Higher wages can result from higher productivity in any number of ways, including businesses introducing more machines and technological resources, or organizing work more efficiently. Workers can also be incentivized to be more efficient. Higher wages can also force less productive firms out of business, raising overall productivity across the economy.

The relationship between wages, productivity and inflation is probably best illustrated by looking back to history. Here’s a chart of productivity starting in the 1970s, broken into various periods.

You can see that productivity surged after 1995. Wage growth ran at a 4.5% annual pace between 1996 and 2004. However, inflation averaged just 2.4%, translating to significant growth in inflation-adjusted incomes. This was because productivity surged to a 3.1% annual pace during that period.

There is also a positive feedback loop between monetary policy and productivity. Strong productivity growth that is accompanied by low inflation could lead to more expansionary monetary policy. That could lead to greater investment and a “tighter” labor market with low unemployment and faster wage growth, which could in turn fuel further productivity growth and signal to the central bank that it can keep rates low.

This is essentially what happened in 1995, with then-Federal Reserve Chair Alan Greenspan choosing to reduce interest rates despite strong wage growth. He bet that productivity would increase due to technological breakthroughs, and he was right. Part of it was also because expansionary policy led to tight labor markets that boosted productivity further.

We could potentially be in a similar situation right now, with tight labor markets leading to productivity gains rather than inflation. Of course, there is a risk that the reverse could happen, with overly tight monetary policy leading to falling investment, more unemployment and slower wage growth, which in turn leads to lower productivity growth.

The good news is that the Jerome Powell-led Fed no longer seems to believe that a recession and sharply rising unemployment are required for inflation to fall. They’ve watched inflation fall over the past year even as real economic growth has accelerated and unemployment stayed low. They are now concerned about the risk of doing too much. That’s a big deal, since it means we could see policy easing if inflation heads down in a sustainable way – which it could if productivity runs strong.

How It Fits into the Bigger Picture

Rising productivity is just one piece of the puzzle when it comes to our economic forecast for 2024. See how it fits into the rest of the picture and get other insights by checking out Outlook ’24: Seeing Eye to AI.