By Michael Barczak, CFA

Bulls On Parade

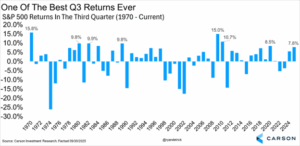

If the story of 2025 heading into the third quarter was one of “uncharted waters,” then Q3 held up its end of the bargain by flipping the script on history. Historically, the third quarter tends to be the weakest period for equities as investors contend with summer slowdowns and seasonal volatility, but this year was anything but typical. Investor sentiment remained resilient, and the market continued to grind higher despite a steady undercurrent of policy and geopolitical uncertainty.

Two main catalysts have driven this remarkable market resiliency. First, corporate earnings growth has been robust, supported by steady consumer spending, healthier profit margins, and solid productivity gains from ongoing technological innovation. Over 50% of the S&P 500’s returns over the past year have come from earnings growth (the combination of sales growth and margin expansion). This is a much healthier and more sustainable source of return than simple multiple expansion, although all major components of return decomposition — including valuation expansion and dividends — have contributed positively during this period.

The second driver of strength has been policy expectations. The Federal Reserve delivered its first rate cut of the year in September, citing weaker job market data and moderating inflation pressures. Markets now anticipate one or two more cuts in 2025 and additional easing in 2026 as the Fed steers rates toward a more neutral stance. This policy shift has supported risk assets broadly and boosted confidence that a soft landing remains achievable. Together, these factors helped power one of the strongest third quarters in recent history and extended the S&P 500’s winning streak to five consecutive months.

Economic Outlook

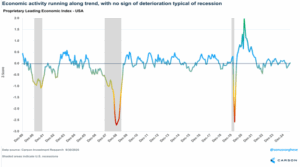

Carson’s proprietary Leading Economic Index (LEI) suggests that economic momentum remains near its long-term trend line, showing no decisive signs of either expansion or contraction. In other words, the economy continues to walk a narrow path between resilience and slowdown. Encouragingly, the LEI has rebounded modestly from post-Liberation Day readings that dipped below the trend line earlier this year, reflecting improving confidence in forward growth prospects.

The economic backdrop today feels reminiscent of mid-2022, when recession fears were widespread but ultimately premature. Consumers remain a source of stability, supported by healthy balance sheets and steady wage growth. Corporate spending, while selective, has begun to pick up in capital-intensive sectors tied to artificial intelligence (AI), energy infrastructure, and industrial automation — trends that could extend the business cycle.

That said, headwinds remain. The full effects of new and proposed tariffs have yet to ripple through the economy, and the eventual impact on inflation and trade flows is uncertain. Supply chain normalization has kept upward price pressures in check so far, but renewed tariff rounds could test that equilibrium. For now, the economy appears to be finding its footing in a later-cycle environment, with growth modest but stable and inflation trending lower, if unevenly.

The Fed

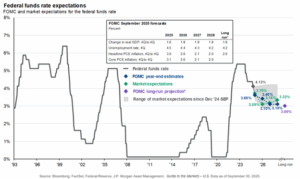

The Federal Open Market Committee (FOMC) continues to project a long-run policy rate of 3.00%, consistent with its estimate of a neutral rate — neither stimulative nor restrictive. However, markets remain more cautious, pricing in a path of slightly higher rates extending well into 2026. The first rate cut in September was a significant moment, signaling a transition from a tightening bias to a more balanced approach.

Rapidly weakening labor market data was the main catalyst behind the shift. Payroll growth has slowed, and job creation figures have been revised down throughout the quarter. Despite this, unemployment remains low by historical standards, suggesting a cooling but still functional labor market. For policymakers, that mix — slower but steady employment with easing inflation — opened the door to modest rate reductions designed to cushion growth rather than reflate the economy.

This pivot marks a subtle but meaningful change in the Fed’s strategy. After nearly two years focused primarily on containing inflation, the FOMC now appears more concerned with sustaining growth and avoiding overtightening. The challenge ahead will be managing policy normalization without reigniting inflationary pressures, particularly as fiscal spending remains elevated and tariffs complicate the inflation outlook. For markets, this evolving balance has provided comfort that the Fed is responsive — and that policy is unlikely to derail the current expansion.

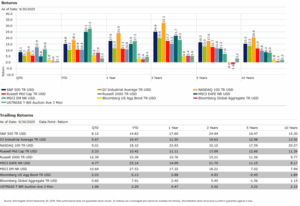

Markets at a Glance

US Equities

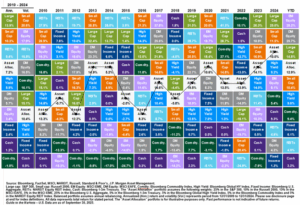

U.S. stocks delivered strong gains in the third quarter across the capitalization and style spectrum. Large-cap growth continued to lead the way, powered by robust performance in technology and communication services, but value and small caps also joined the rally as investors broadened their exposure beyond the market’s largest names. Resilient corporate earnings, optimism around AI-related innovation, and growing expectations for future rate cuts combined to fuel a steady, broad-based advance.

Still, valuations — particularly within mega-cap technology — have become increasingly elevated. Investors appear willing to pay a premium for quality, balance-sheet strength, and consistent cash flow generation, but those expectations also set a high bar for future earnings results. Encouragingly, market breadth has improved, with leadership gradually rotating toward cyclicals and smaller companies as confidence in the growth outlook strengthens.

International Equities

International equities also produced positive results in Q3, although performance trailed U.S. benchmarks. The MSCI All World ex-U.S. Index gained ground as both developed and emerging markets benefited from a weaker U.S. dollar and more accommodative monetary conditions globally. Strength was concentrated in Asia, where renewed optimism around Japan’s corporate reforms and stabilization in China’s manufacturing sector supported sentiment.

Emerging markets have begun to show tentative signs of leadership after several years of underperformance, helped by central banks that started cutting rates ahead of the Fed and by improving global liquidity conditions. Trade tensions and uneven global demand remain risks, but the broader international landscape appears to be on firmer footing than at any point in the past two years.

Fixed Income

Fixed income markets produced modest but positive returns in the third quarter as yields drifted lower and spreads tightened. The Bloomberg U.S. Aggregate Bond Index gained ground, extending its rebound from earlier in the year. With higher starting yields and moderating inflation, bonds have reasserted their traditional dual role — providing both income and portfolio stability.

Longer-duration assets outperformed as rate expectations softened, while credit-sensitive sectors benefited from tightening spreads and declining default risk. Despite positive returns, investors continue to face a more correlated stock-bond environment than in the prior two decades, underscoring the value of true diversification across asset classes. Going forward, the path of returns will depend heavily on the Fed’s success in engineering a soft landing, but the reset in yields has restored bonds’ relevance as a strategic holding.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here

8523481.1.-21OCT2025A