“If everybody is thinking alike, then somebody isn’t thinking.” General George S. Patton

Well, that October volatility and spookiness is happening, but to be honest, we aren’t surprised. Yes, worries over trade with China, regional banks, and private credit are taking “credit” for the recent weakness. (See how I did that?) But the truth is after a historic six-month rally and with the usually volatile month of October upon us, we are welcoming this volatility and potential weakness as an opportunity before a likely strong end of year rally.

Three Years Ago Today

We’ve talked a lot about this bull market turning three years old, but today marks one of my all-time favorite contrarian indicators.

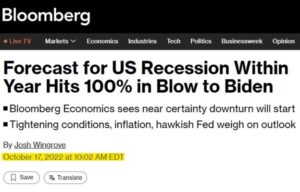

Three years ago today, at least one model was telling us there was a 100% chance of a recession (so much for models) and most economists were saying a recession was more likely than not. A Bankrate survey had 86% of economists saying a recession was more likely than not and a NABE survey had over half the panelists saying so. Everywhere we’d look investors and economists alike were proclaiming how much worse things would get. Stocks were down 25%, the yield curve was inverted, manufacturing was in shambles, inflation was soaring, the Federal Reserve was hiking at a pace rarely seen in history, and even bonds (usually a safety place when stocks do poorly) were getting crushed.

Yet, like the quote from General Patton above, for the very few who looked a little deeper, it became clear that not everyone was thinking, as stocks were bottoming and the vicious bear market of 2022 was over.

If you are reading this then you are probably aware we were one of the very few places out there in October 2022 saying things were going to turn around and we would avoid a recession. We were mocked nearly daily for this call. I was literally laughed at ON LIVE TV for saying the bear market was nearly over. Yes, I saved the receipts.

Going against the crowd is hard, and in a public forum like we are in, it can be merciless. But we followed our process, stuck to our guns, and we have outperformed nearly every other large money manager out there (some with research teams 100 times larger than us). You are only as good as what you’ve done lately, but we continue to see solid times ahead.

Now on to some timeless memories from 1987.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Remember The Crash of 1987

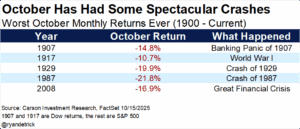

October is known for many things, with incredible market crashes likely at the top of the list. The crashes of 1929 and 1987 stand out for many investors and who could forget the selling and volatility of October 2008? Going back further we also saw spectacular crashes in 1907 and 1917.

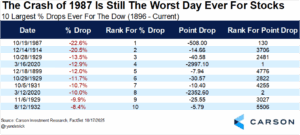

In honor of the greatest drop in stock market history, we’ll take a closer look at the crash of 1987. On Monday, October 19, 1987, the Dow fell 22.6% for the largest one-day drop in the more than 129-year history of the Dow. To this day it is still the largest percentage drop ever, but it now ranks as only the 130th largest point decline.

What caused it? The funny thing is that 38 years later I’m not sure everyone can officially agree. Here are some things to know about the Crash of 1987:

- For starters, stocks were in the midst of a huge run off the August 1982 lows, with the Dow up more than 40% for the year in early August 1987, amounting to one stretched rubber band.

- Then consider Alan Greenspan took over the Federal Reserve Bank in August and to cool things off, was hiking rates. Talk about a bad time to start a new job.

- Program trading was blamed as well. The Friday night before the crash, Louis Rukeyser was pointing out issues with program trading. (Simply put, program trading meant stocks were automatically sold as certain levels were hit. It worked fine until stocks began to fall more than ever expected, leading to more selling as prices dropped.)

- Currency markets were on edge as well, as the U.S. wanted Germany to weaken their currency due to the latest trade deficit numbers. The back and forth was all over the media, as recently as the Sunday before the crash.

- The selling started earlier actually, as the three days before the crash the Dow was down 3.8%, 2.4%, and 4.6%, making it safe to say investors were on edge all weekend for how things might open on Monday morning.

In the end, the Dow fell a then record 508 points for a 22.6% one-day decline, topping the previous largest one-day decline of 20.5% in December 1914, when the Dow began trading after being halted for nearly five months due to World War I.

Something most investors might not know is that stocks still finished the year in the green in 1987. Sure, they were well off their highs and the huge volatility was too much for many investors to handle, but if all you saw was the yearly gain of 2% in 1987, you’d think it was a boring year!

We might not know what caused the Crash of 1987, but we also still don’t know what caused the Flash Crash either. The Flash Crash occurred in May 2010 (when many stocks and ETFs saw huge losses, only to regain the losses by the close for one wild few minutes of trading). The truth is with more and more computers involved, we are due to get big swings periodically.

Today we do have circuit breakers in place to help calm nerves should we see another major decline in prices, but it’ll take a huge drop for those to kick in.

In the end, volatility, as always, was the price of admission for investing for the long run. It is just part of the process—the bigger risk for investors is not volatility itself but failing to recognize that it’s going to happen. Just always remember that the Dow started trading on May 26, 1896, and it has seen wars, famines, pandemics, inflation, deflation, booms and busts, and more. Yet, it has always eventually come back to new highs and whenever we have the next bear market, we don’t think this longer-term pattern of eventual new highs will change. Thanks for reading and have a great weekend!

For more content by Ryan Detrick, Chief Market Strategist click here

8512462.1.-17OCT2025A