By Brett Carson, Director of Equity Research

2022 was a rough year for investors. Stocks had their worst performance in many years, and shareholders are left wondering what is next. However, amidst all the uncertainty with inflation, rising interest rates, geopolitical tensions, supply chain bottlenecks, and volatile capital markets, there were important buyers that saw through these near-term hurdles and focused on long-term value – private equity and corporate M&A.

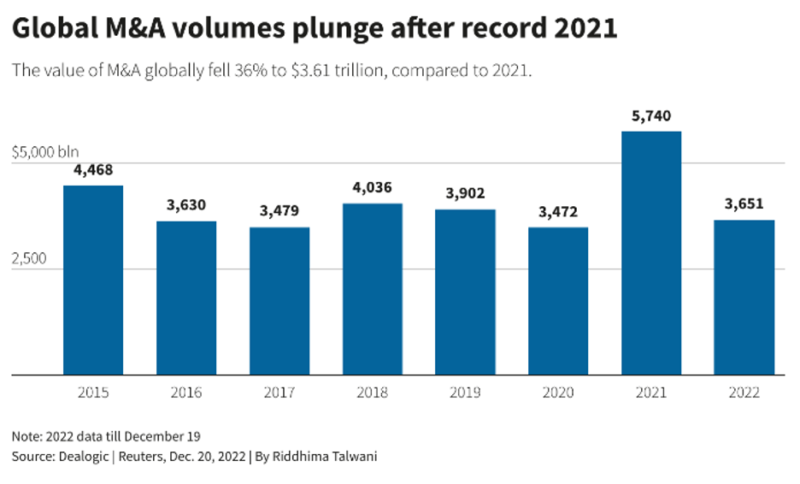

To be clear, global M&A activity dropped 36% to $3.7 trillion in 2022, according to Dealogic. However, that’s compared to the all-time record of $5.7 trillion in 2021, which was fueled by strong capital markets and low-interest rates. When comparing 2022’s deal activity to the average over the past eight years, it was down only about 10%, or just 4% if 2021’s record high is excluded. This is in stark contrast to just $24 billion being raised through US IPOs, which was the lowest since 2009. Considering all the headwinds and increased regulatory scrutiny, we think global M&A was surprisingly healthy last year.

What’s also impressive is the premiums paid recently for publicly-traded M&A targets. During times of high volatility, like in 2022, it’s not unusual for buyers and sellers to struggle to agree on price. Sellers tend to get anchored to where their stocks used to be when valuations were much higher (2020/2021), and buyers focus on where shares are currently trading (2022). A few of these recent M&A targets got a price close to their all-time highs (Abiomed, Horizon Therapeutics, Altra Industrial Motion). Yet, many sellers came to terms with lower prices compared to the past two years, but at a meaningful premium to their trading levels prior to the announcement.

What can this mean for broader equities? Perhaps that valuations have fallen too far in certain cases. Many of these transactions carry big premiums to where their peers still trade in public markets. Also, many of these recent takeouts were of firms with little to no profits. We find this interesting as investors’ appetites have completely swung from seeking high growth at any cost a couple of years ago to now wanting profitable growth. Or perhaps last year’s relatively healthy M&A activity proves that “animal spirits” continue to linger and that the market still needs to adjust to the new reality.

Our primary takeaway is that investors who take a longer-term perspective can use this recent volatility to purchase quality assets at reasonable or even depressed prices.