“Spurious: Outwardly similar or corresponding to something without having its genuine qualities.” Merriam-Webster Dictionary

This will be a more fun blog, as I’ve always been fascinated by spurious correlations, or things that might go up and down together, but one doesn’t cause the other to move with it. Sometimes the connection is random; sometimes there’s a reason. As we saw with my blog on the Super Bowl Indicator last week, these can be fun, but should never carry any weight at all when making investment decisions. This week, I’ll discuss a few more popular spurious correlations in the world of finance.

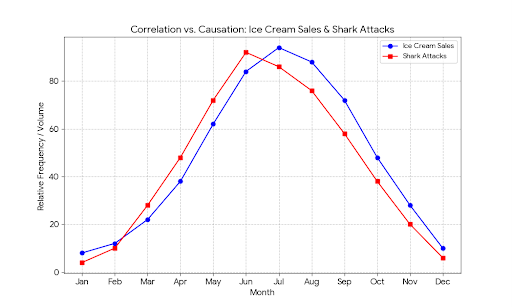

Here’s a great example of what I mean, and it is one of my favorites. Did you know that ice cream sales and shark attacks tend to trend together? Of course, no one thinks, let’s go buy some ice cream because ol’ Larry was bitten by a shark down in Destin last week, but likely the real reason is that in the summer we swim more and eat more ice cream! And I’ve noticed that markets have generally moved higher as my kids have gotten taller, but don’t expect me to become a permabear when they become adults because of it!

Source: Gemini 2/10/2026

Friday the 13th

Did you know today is Friday the 13th? Yep, sure is. Do you suffer from a fear of this frightful day? If so, you have paraskevidekatriaphobia. Good luck spelling it. Or maybe a fear of the number 13? That one is triskaidekaphobia. Either way, many superstitions take place around this day, and although I don’t believe in them, I’m still not trying to see any black cats or walk under a ladder today, not to mention avoiding any men running around in hockey masks! But I’ll happily watch the US Women’s National Hockey Team take on Italy in the Olympic quarterfinals.

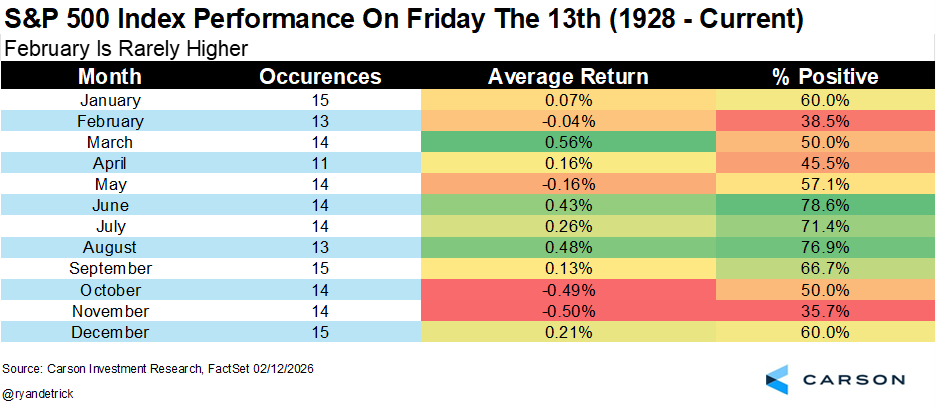

Turns out, this day has actually done worse when it has taken place in February than in most other months.

Friday the 13th fell on a trading day 166 other times throughout history, and the S&P 500 was up a solid 0.09% on those days. Be aware that it has been lower the past two times (December 2024 and June 2025). You have to go back 10 years for the last time it was lower three in a row.

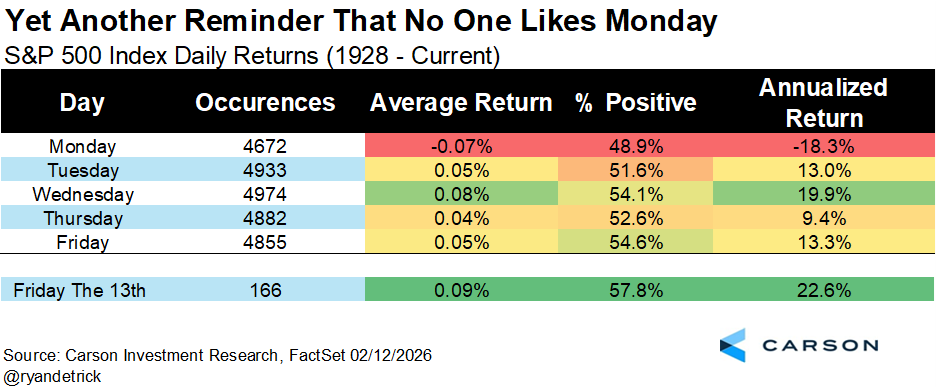

Getting to it, you shouldn’t be scared of Friday the 13th, as the S&P is up an annualized 22.6% on this day. It turns out, we should simply have a case of the Mondays, as that day is by far scarier for investors.

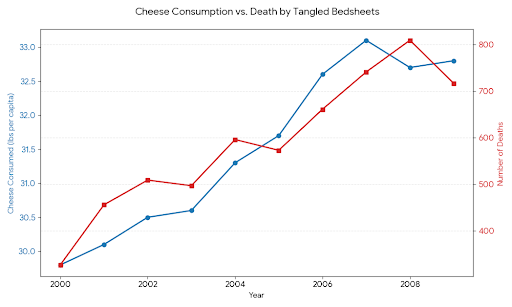

Want another silly spurious correlation? I give you cheese consumption and death by tangled bedsheets.

Source: Gemini 02/12/2026

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Welcome to the Year of the Horse

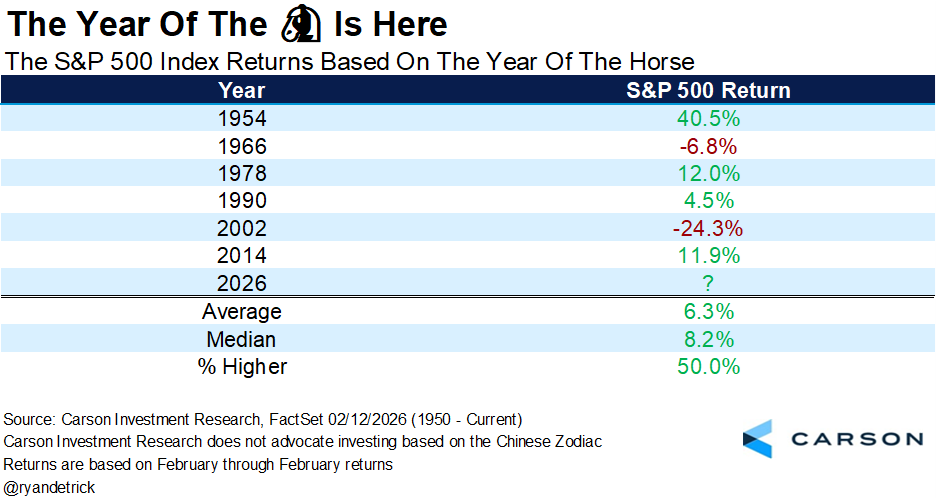

The Chinese New Year kicks off next Tuesday, and with it is the Year of the Horse. First things first, Sonu Varghese, our Chief Macro Strategist, and myself were both born in 1978, another Year of the Horse. So we are probably more excited about this year than most, even though we all know believing in Zodiac signs is spurious. Or is it 😉?

Oh, and as you could probably tell, Sonu is clearly the older one out of the two of us. He has me by five months!

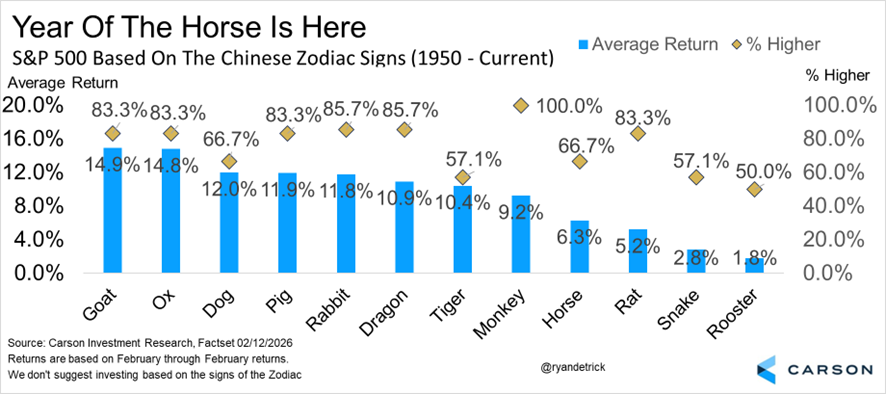

Last year was the Year of the Snake, which historically had been the worst of the 12 signs, yet stocks gained a very impressive 14.9% the past twelve months. Still, the Horse is one of the weaker Zodiac signs. 🐴🐎

Here’s what the Year of the Horse has done lately. And if you want to get particular about it, it’s the year of the Fire Horse, which last took place in 1966.

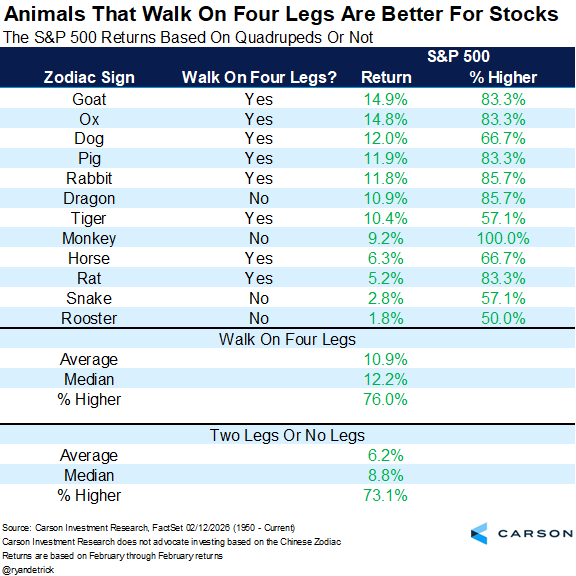

Lastly, you want spurious? Well, to paraphrase General Jessep, “You can’t handle the spurious” with this next one. I noticed that animals that don’t walk on four legs (the snake and rooster) were the two worst signs. Then I saw the top five signs all walked on four legs. Yep, that’s right, signs that are good old-fashioned quadrupeds are much better for the bulls! Yeah, I know, but if you’ve read this far, then you are fully invested in spurious correlations, sorry.

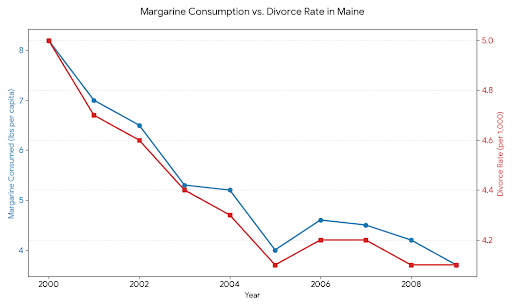

Oh, did you know that divorce rates in Maine are correlated with margarine consumption? Well, now you do.

Source: Gemini 02/12/2026

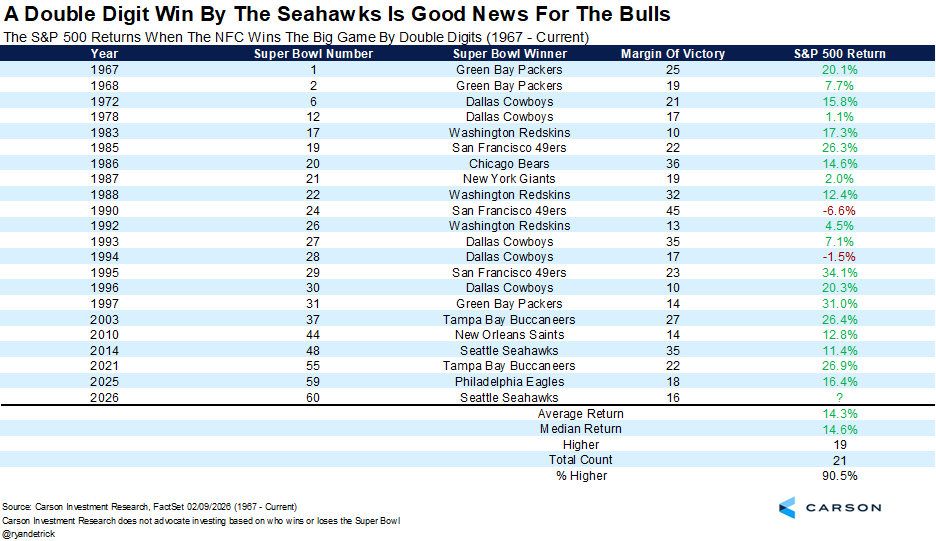

The Super Bowl Indicator

The Mona Lisa of spurious correlations and the stock market has to be the Super Bowl Indicator. We wrote about it all in Do Stocks Want the Patriots or Seahawks To Win? Nonetheless, I can’t stand the Pats, so I’m happy to report that in years the NFC has won by double digits (like this year) have been higher, an incredible 19 out of 21 times.

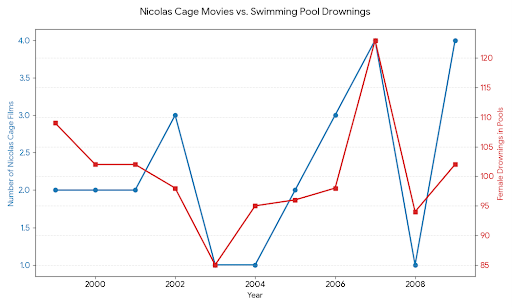

And no spurious correlations blog is complete without mentioning the striking correlation between Nick Cage movies and swimming pool drownings.

Source: Gemini 02/12/2026

So yes, there are many spurious correlations out there, and many aren’t nearly as obvious to spot. I mean, we have a new Federal Reserve Chairman coming in a couple of months who thought the size of the balance sheet was related to stock returns. We’ve pushed back against this for years, suggesting it was indeed corporate profits, along with fiscal and monetary policy, that drive stock prices.

Remember three years ago right now? You couldn’t watch financial media for an hour without being told a recession was coming because of the shape of the yield curve, ISM manufacturing under 45, Leading Economic Indicators (LEIs) negative, and the Sahm Rule triggering. All had ‘always predicted’ a recession in the past, but none of it played out of course, as markets have soared and the economy has been fine.

Our team will continue to have fun with spurious correlations (seriously, I’m happy to see an NFC win), but we will always focus on what really drives markets. And just as we did three years ago, if our data suggests going against the crowd, we will do it. Thanks for reading, and I hope everyone has a nice, long three-day President’s Day weekend. Oh, and be sure to buy a mattress. Is it spurious that those are cheaper this weekend?

For more of our thoughts on 2026, I was honored to join my friend Larry Sprung, Founder at Mitlin Financial, on The Mitlin Money Mindset podcast.

For more content by Ryan Detrick, Chief Market Strategist click here.

8773661.1. – 13FEB26A