“Plans are worthless, but planning is everything.” President Dwight D. Eisenhower

Another month and more strong gains. Make that five months in a row, the S&P 500 finished higher. The S&P 500 is now up close to 20% on the year, just like everyone predicted. 😉

We came into the year overweight stocks and remain there, so this run has been a lot of fun for us. But honestly, while we’ve been bullish, even we’ve been surprised by how strong markets have been.

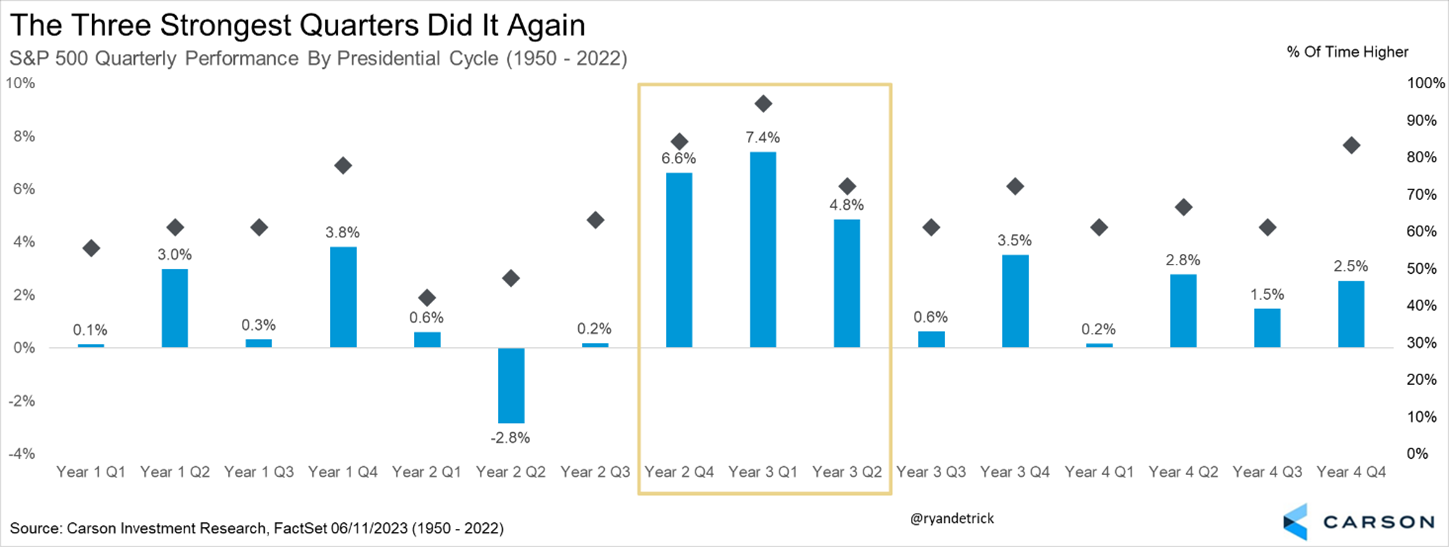

So let’s get the bad news out of the way. The odds are increasing that stocks could finally take some type of a break. Seasonality has worked out perfectly this year. Here’s a chart we shared many, many times, and it said that some of the very best quarters out of the entire four-year Presidential cycle were the three now just behind us. Sure enough, the fourth quarter last year and the first two quarters this year were spectacular for stocks, just like history suggested. Now seasonality is saying to be open to some type of weakness, or at least a break.

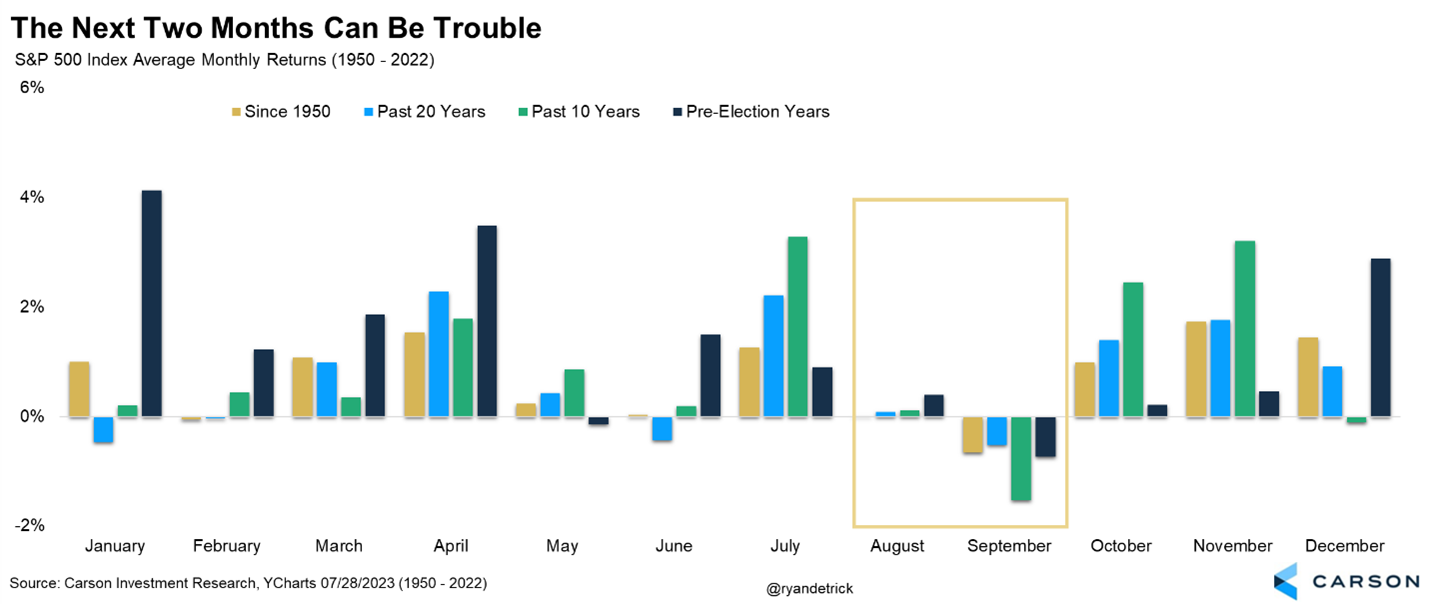

To be clear, we do not expect major weakness. But we believe a modest pullback of approximately 5% would be perfectly normal. The S&P 500 has closed higher for five consecutive months. And we’re now moving into the austere month of August. August has been a poor performer, ranking worse than only February and September since 1950 and trailing behind only September and December in the last ten years, although still averaging a positive return over both periods. Oh, and right behind August comes September, the weakest month seasonally. So, while the calendar was a tailwind, we believe it is now becoming a near-term headwind.

Taking another look at August, when stocks are up more than 17.5% for the year heading into this month, a breather is even more likely. We found 11 previous years (since 1950), this occurred, and August was higher only three times and down 1.1% on average. So the better the year, the worse August does, apparently.

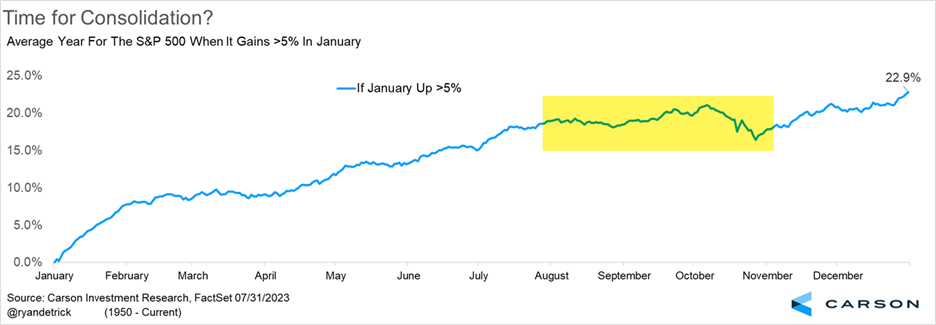

One of the reasons we were on record for a surprise summer rally was how stocks tended to do when they had a big first month of the year. When the S&P 500 gained more than 5% in January a summer rally tended to occur (check). But we take seasonal warnings as seriously as seasonal support, and now we are in a period of potential seasonal weakness, at least for the near term.

If stocks experience weakness over the coming months, investors may be surprised and even start projecting the catastrophe many had expected earlier in the year. But keep in mind a pullback in the next couple of months would be entirely normal seasonal behavior. In fact, it may present buying opportunities, or it may simply be a chance to stay the course and remind ourselves that most years see more than three separate 5% pullbacks. Even in a strong year, there will often be bouts of volatility, so we should be ready for it and avoid overreacting. As President Eisenhower said, start planning today.

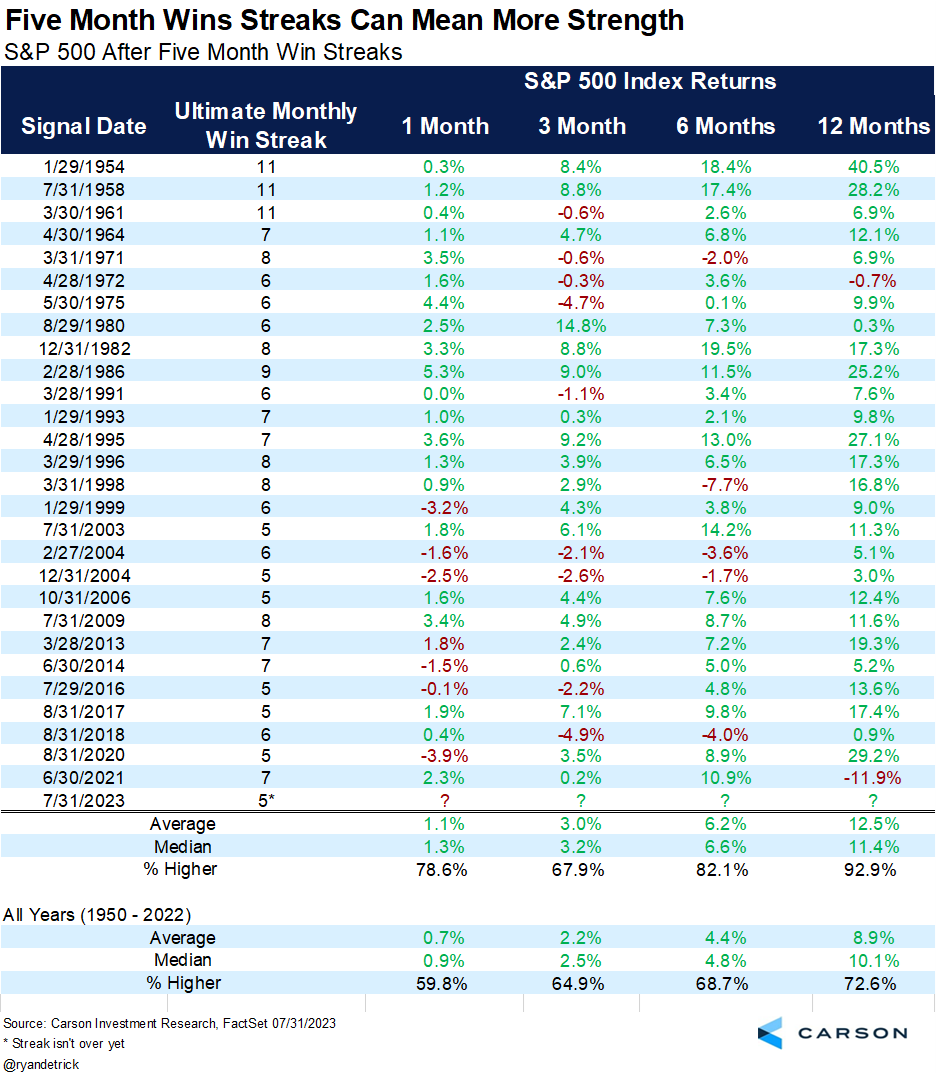

Lastly, the S&P 500 closed up five consecutive months yesterday. Historically, stocks have done quite well after similar streaks. In fact, the S&P 500 has been up a year later, 26 out of the past 28 times. However, the last time this happened was in June 2021, and that was followed by a drop of nearly 12%. Despite this recent example, the market’s historical strength is likely another indication of higher stock prices in the future.

All in all, the odds are increasing that stocks could see some seasonal weakness, but we don’t think it will be anything major. In fact, maybe a little breather could be just what the bulls need for an eventual strong end-of-year rally.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

01852381-0823-A