Technology investors are walking away with a smile from this earnings season. Many of the largest companies in S&P 500 traded higher after their earnings report, with the notable exception being Meta. The fundamental results produced by these companies were largely cheered by investors and fueled earnings expectations, as well as spending expectations, higher. And while Nvidia did not officially report earnings this week, news from their own technology conference helped fuel the company to close above a $5 trillion market cap for the first time.

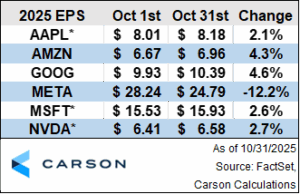

Four of the five ‘MegaCap’ technology companies that reported earnings this week saw their fundamental outlook improve as their earnings estimates moved higher, according to FactSet estimates. As shown in the table below, Alphabet stood out as this week’s largest winner. The company’s +4.6% increase to its 2025 FactSet consensus earnings per share is the highest for this group. Not far behind Alphabet is Amazon, whose estimated EPS has increased +4.3% since the start of the month. Both stocks have traded higher this month amidst these positive revisions, with Alphabet shares up nearly 16% in October, and Amazon gaining roughly 12% in October (FactSet data, as of midday 10/31/2025).

*Denotes fiscal year 2026 estimates due to off-calendar year-ends

Both Alphabet and Amazon demonstrated a balance between increasing AI-focused spending and demonstrating the benefit AI is producing in their respective businesses.

- Alphabet CEO Sundar Pichai: “Gemini [Google’s AI-focused LLM] now process 7 billion tokens per minute via direct API use by our customers. The Gemini app now has over 650 million monthly active users and queries increased by 3x from Q2.”

- Amazon CEO Andy Jassy: “Rufus [Amazon.com’s AI-powered shopping assistant] is on track to deliver over $10 billion in incremental annualized sales.”

On the other hand, companies unable to show a balanced approach to spending and growth, such as Meta, were punished by investors. Meta continues its aggressive spending habits in a goal to build “personalized superintelligence” according to CEO Mark Zuckerberg. In pursuit of this, Meta expects “capital expenditures dollar growth will be notably larger in 2026 than 2025. We also anticipate total expenses will grow at a significantly faster percentage rate in 2026 than 2025.” With shares of Meta stock trading roughly -11% lower the day after their report, investors may be unwilling to underwrite such aggressive spending plans without more tangible AI-driven benefits.

Much of Meta’s increased spending, as well spending from Amazon, Alphabet and Microsoft, may accrue to Nvidia’s revenue. And investors received further confirmation of Nvidia’s growth trajectory this week, despite the chip company not officially reporting earnings.

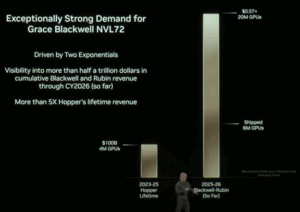

Nvidia hosted their GPU Technology Conference (‘GTC’) to showcase their latest innovations and product development pipelines…or so investors thought. The company unexpectedly provided a longer-term revenue opportunity for its chips to the tune of $500 billion of potential revenue total in 2025 and 2026 (as shown in the picture below). This projection was a surprise for investors, both on the clarity of time and magnitude. The company typically only offers quarter-by- quarter revenue guidance, so for investors to receive more than one-quarter-ahead potential revenue is more visibility than what’s been offered recently. And this $500 billion potential revenue figure was well above expectations, as FactSet consensus revenue for Nvidia’s 2025 and 2026 was roughly $440 billion before this announcement. Nvidia shares rallied roughly 10% on the week following this news (all FactSet data, as of midday 10/31/2025).

Picture courtesy of NVIDIA

Technology investors received a flurry of fundamentally good news this week, and the stocks of many of the companies in this sector traded higher. Four of the five ‘MegaCaps’ that reported earnings this week saw their EPS estimates climb. The companies that saw the highest EPS revisions are balancing increased spending with tangible monetization, though some companies are still earlier in potential product cycles. Much of this increased spending on AI is flowing to Nvidia, which revealed a higher-than-expected revenue opportunity for their new chips at their tech conference.

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here

8564324.1.-03NOV2025A