Technology stocks came roaring back in the second quarter of 2025. With stock prices now elevated, investors are setting a high bar for companies to clear in the upcoming earnings season. Unlike last earnings season – marred by fresh uncertainty stemming from newly announced tariffs – investors may be swifter to punish companies that fail to provide forward-looking guidance, as perceived uncertainty has been reduced. Encouragingly, the data tells a supportive story: last year’s AI-related spending may be evolving into AI-driven profits.

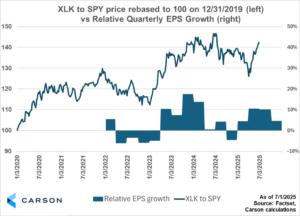

The technology sector, as proxied by XLK (the iShares Technology Select Sector Fund), has historically delivered earnings per share (“EPS”) growth that outpaces the broader S&P 500, tracked by SPY. As shown below, EPS growth outperformance for XLK peaked in the fourth quarter of 2023, when tech earnings grew 21.3% year over year compared to 3.7% for the S&P 500 – a notable 17.6% outperformance (FactSet data). Recent performance shows more in-line performance, with tech earnings largely growing at the same rate as the broader market for the last four quarters.

Forward estimates a potential breakout for tech fundamentals. For the coming earnings season, the tech sector is expected to outgrow the broader market by an impressive 12.9%. If achieved, this would mark the largest outperformance since the first quarter of 2024 and could signal a narrative shift. Specifically, tech companies that ramped up operating expenses over the past five quarters to accelerate AI product development (which reduced earnings) may now be positioned to convert those investments into accelerating earnings growth.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The market isn’t waiting for confirmation. Tech stocks are approaching relative highs compared to the SPY even before the reports begin. XLK outperformed SPY by a strong 11% during the calendar second quarter according to FactSet data. As shown below, this outperformance brings the XLK-to-SPY price ratio within striking distance of its all-time high set in July 2024. Said differently, tech stocks are nearly the most loved they’ve ever been relative to the broader market.

The chart also shows an important relationship between earnings outperformance and price outperformance – price performance of XLK to SPY often reflects relative earnings growth performance in advance. Tech’s strong run in 2023, which saw repeated new highs in this ratio, was underpinned by robust fundamentals. With tech earnings expected to outpace the broader market for the rest of the year, active investors may want to consider where this chart could be heading next.

As uncertainty has waned in the market over the last 3 months, investors will be looking for strong earnings reports this coming season. Tech earnings have largely grown in line with the S&P 500 over the last five quarters, but are expected to robustly outgrow the index this quarter. Investors have already bid up tech stocks in anticipation of this, but there could be confidence still to be gained. Clear, forward-looking commentary and guidance that supports elevated earnings expectations could give investors renewed confidence in the tech sector this earnings season.

8138072.1-07.03.25A

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here