“Even a broken clock is right twice a day.”

Some well-known bears are back in the news, with their usual dour predictions, from a recession coming soon to an outright 65% market crash. You can read more about their calls here, but we’ve been hearing these same things for years now and been pushing back the whole time. To be honest, I’m glad to see these permabears still pumping out the same old story, as I’d be much more worried if they looked at the data and come to a bullish conclusion.

We can talk all we want about the path of the economy, inflation, the election, geopolitics, or what the Fed should or shouldn’t do, but what matters at the end of the day is what markets do. Here are a few things I’ve noticed recently that continue to suggest this bull market is alive and well and a summer rally is still likely. For more on this, be sure to read Six Reasons This Bull Market is Alive and Well.

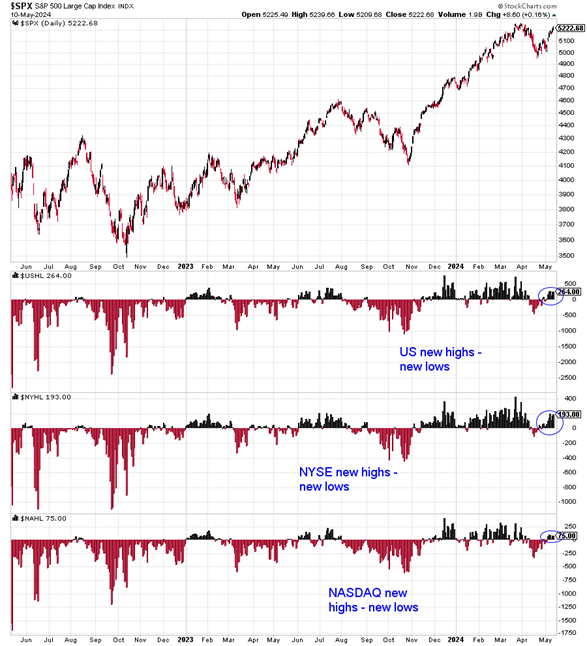

Breadth Is Strong

If more and more stocks are making 52-week highs, that’s a good thing. It suggests the foundation of the bullish move is healthy and likely sustainable. Below we show that is happening across the board.

One of my favorite technical indicators is advance/decline (A/D) lines. These are simply a daily look at how many stocks go up versus down each day on various exchanges. When A/D lines are breaking out to new highs, it could be a clue that overall price is about to follow. The same could be said for new lows in A/D lines, which means there’s weakness under the surface.

Last week saw new highs in these A/D lines: S&P 500, NYSE, and Midcaps. Small caps are close to a new 52-week high. To keep it very simple, this isn’t something you see in a bear market and it means this early spring rally likely has legs.

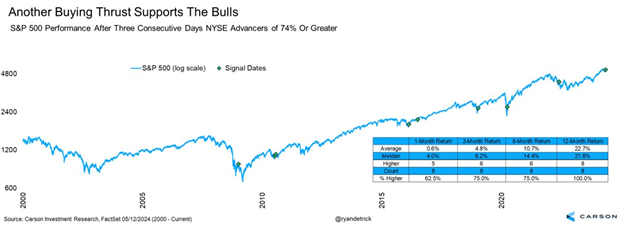

Lastly on breadth, there was a buying thrust on the NYSE that tends to be very rare, but quite bullish. For three days in a row more than 74% of the stocks on the NYSE were higher on the day. It is normal to see this for a day or two, but three days is very unusual and it suggests heavy buying pressure taking place. We found this happened only eight other times since 2000. A year later the S&P 500 was higher every time and up close to 23% on average.

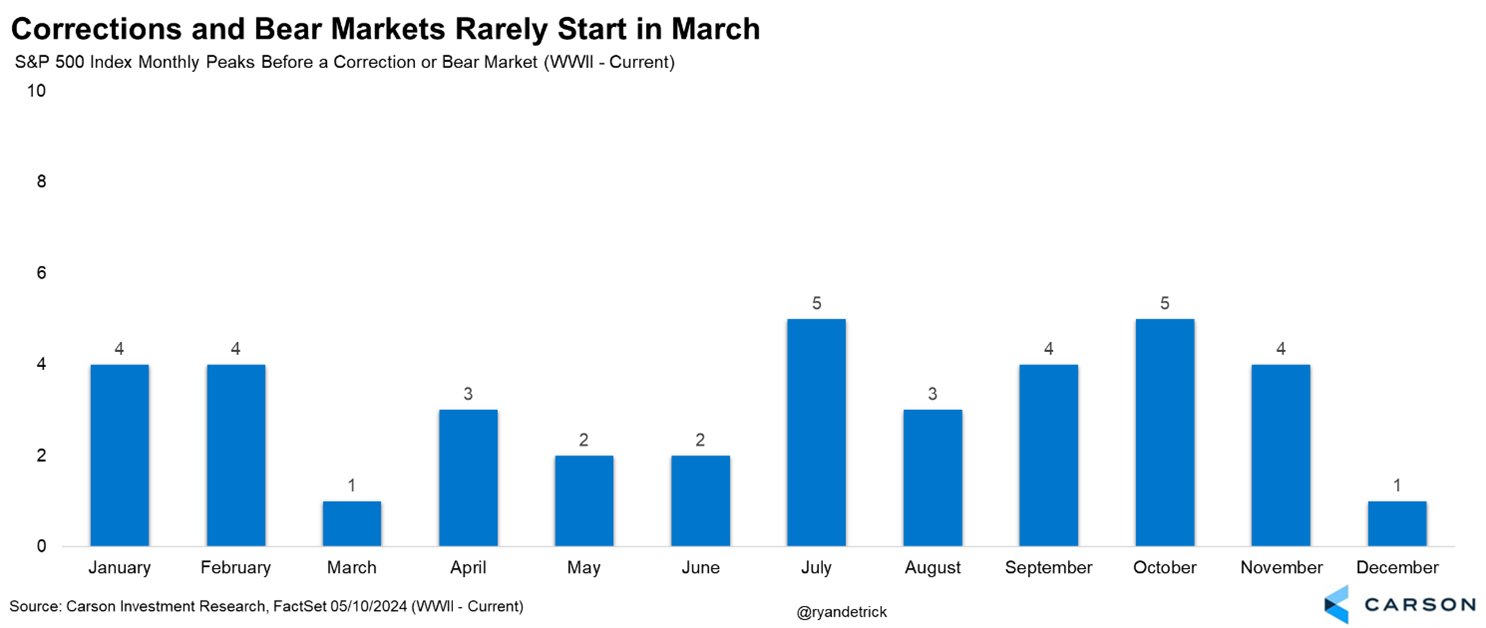

Stocks Don’t Peak in March

The last time the S&P 500 hit a new high was March 28, which lead to the 5.5% mild correction into mid-April. We were on record the whole time that it likely wouldn’t turn into a 10% correction (or worse) and with the big rally the past three weeks, that is looking accurate. I looked at the past 38 corrections and bear markets since World War II and I found that only once did one start in March. That of course was March 2000 when the tech bubble burst. But the bottom line is it’s quite rare to see stocks peak in March and this time doesn’t appear to be any different.

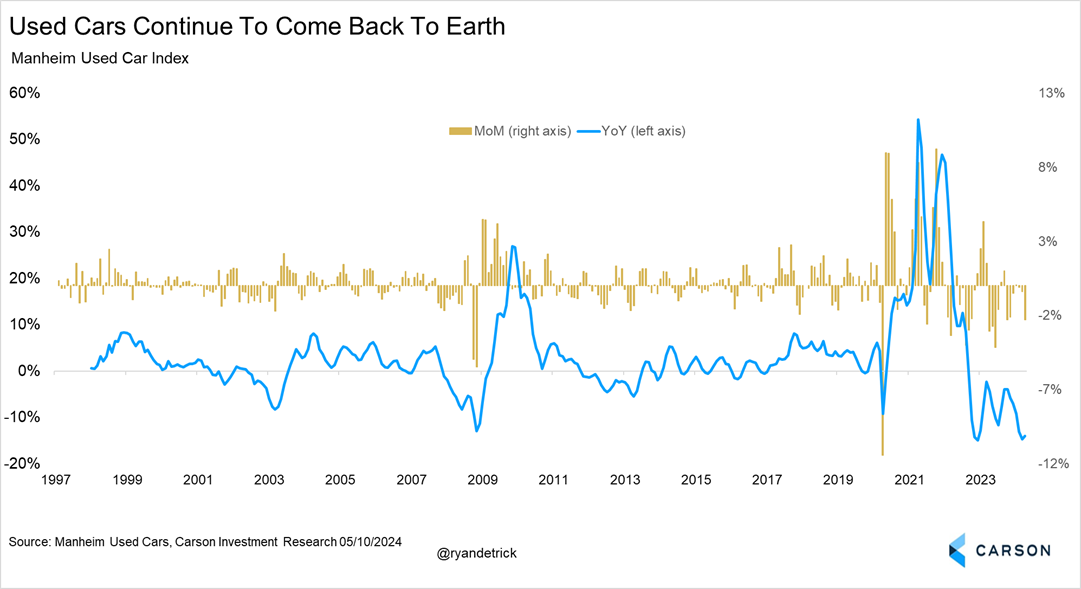

Better Inflation Data Coming

We’ve talked a lot about why the recent blip in inflation to start this year was probably nothing more than some pain after the large improvement in the past year and seasonal quirks (like higher auto insurance and higher financial services fees), and that we expect to see things like shelter drastically improve over the coming months. Here’s another interesting development that shows used car prices have outright tanked, even though the government’s data doesn’t show this yet.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Prices in the Manheim Used Car Index are down 14% year over year and lower six of the past seven months. Compare this with the government’s data showing used cars down about 1% the past year.

We’re actually pleased some of the bears are coming out of hibernation, or may have never left, as we think it actually is a positive for stocks. But we still always ask whether the arguments they are making are persuasive. At this point, we believe the preponderance of the evidence still says no. No doubt they’ll be right eventually, but many of these bears have been wrong through so many years of stock gains that the eventual bear victory dance will likely ring hollow. After all, even a broken clock is right twice a day.

Be sure to watch my CNBC Overtime discussion with Jon Fortt below. It was a bull and bear debate and I mentioned many of the same bullish concepts from this blog.

For more content by Ryan Detrick, Chief Market Strategist click here.

02238245-0524-A