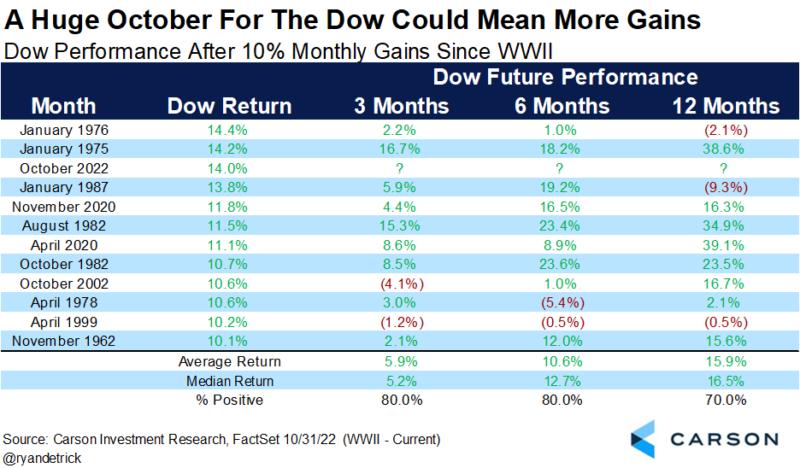

The Dow Jones Industrial Average began trading on May 26, 1896, and it just had the best October return ever, up 14.0%. This was the best month since January 1976 and third best month overall since World War II.

We noted many times over the past month why October was likely to see a bounce and potentially mark the end of the bear market. After the strong bounce in the second half of the month, we remain confident the bear market indeed likely ended last month.

First things first, what does the huge month mean for stocks? Looking at all the 10% monthly gains for the Dow going back to World War II showed that future strength is quite possible, if not likely. Up more than 10% on average six months later and up close to 16% a year later should comfort investors.

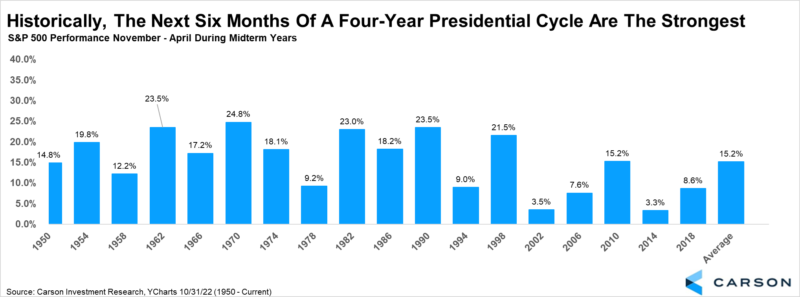

Couple this good news with the fact that these next six months in a midterm year have been higher 18 of the last 18 times, which is another feather in the cap of the bulls. We discussed this more here.

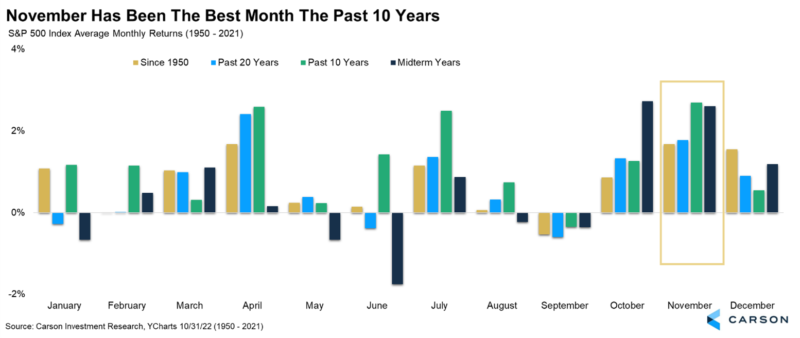

Turning to November, it has been a very solid month for stocks. Looking at the S&P 500, it has been the best month in the past 10 years, and it ranks as the second-best month in a midterm year. In fact, October is the best month in a midterm year, but November is second and December is third best. Talk about saving the best for last.

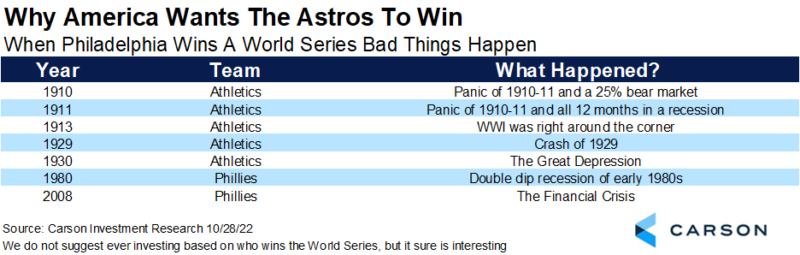

It isn’t all good news though, as the Phillies are in the World Series and when the City of Brotherly Love wins a World Series title, trouble is usually around the corner! Of course, this is more a joke and we would never suggest investing in this, but just to be safe, the Carson Investment Research team is pulling for the Astros.

Lastly, I joined Charles Payne on Fox Business last week to discuss many of these ideas, along with getting wished a Happy Birthday on national tv. You don’t see that every day!